Excerpts from CGS-CIMB report

Analyst: Ong Khang Chuen, CFA

Riverstone Holdings

| Solid execution ■ 1Q NP of RM109m (-2% qoq) slightly above expectations, showing RSTON’s earnings resiliency vs. peers, amid declining healthcare glove ASPs.

■ RSTON continues to prioritise customised offerings in both the cleanroom and healthcare segments to improve stickiness in ASPs. Reiterate Add. |

||||

Source: DBS Research, Bloomberg

Source: DBS Research, Bloomberg

Solid set of 1Q22 results

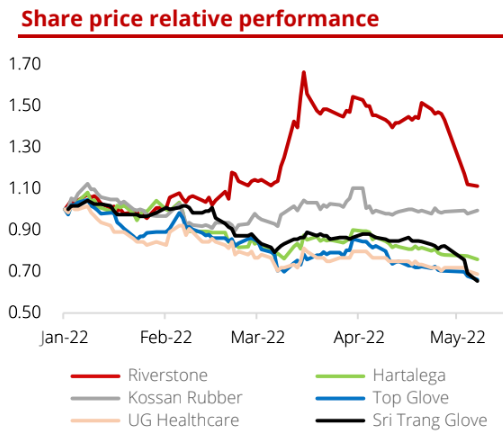

Riverstone Holdings (RSTON) reported a 1Q22 NP of RM108.7m (-1.8% qoq, -79.2% yoy); the qoq flattish NP showed its stronger earnings resiliency vs. peers amid the continued decline in healthcare glove ASPs.

1Q22 NP was slightly above expectations, at 32%/31% of our/consensus’ FY22F estimates. 1Q22 revenue of RM402.3m was stable on a qoq basis (-1.9% qoq, -61% yoy), as weaker healthcare ASPs were offset by higher volumes; cleanroom segment’s ASP and volumes remained firm in 1Q22.

Due to lower input costs and higher utilisation rates during the quarter, margins were stable qoq.

Cleanroom outlook remains firm

Cleanroom segment remains the key earnings contributor, accounting for 60% of RSTON’s gross profit in 1Q22.

Demand for cleanroom gloves remains strong, and management expects the segment volume to grow 10% yoy in FY22F (back-loaded due to 1H festive seasons and ongoing capacity expansion).

Cleanroom glove pricing remains high at US$100-US$110/carton in 2Q22F, and we expect it to remain sticky with quarterly/semi-annual pricing reviews.

Healthcare ASPs likely bottomed in 2Q22F

While healthcare glove ASPs continued on a normalisation trend in early-CY22 to c.US$25/carton in Apr (1Q22: c.US$30-US$32), we understand that the recent increase in industry operating costs (higher labour costs due to minimum wage hike in Malaysia, higher utility costs due to rising electricity and natural gas tariffs) have enabled RSTON to raise prices in May by c.4%.

RSTON continues to work with distributors on customised products that offer higher ASPs and margins, and we expect its healthcare segment GPM to remain healthy at 22% in 2Q22F supported by price hikes and the recent US$appreciation against RM.

RSTON notes that order demand remains healthy and believes that production capacity utilisation can remain at c.80% for the rest of FY22F (with the labour shortage currently being the key bottleneck for further recovery).

Reiterate Add and TP of S$1.10 Ong Khang Chuen, CFA, analystReiterate Add, as we believe RSTON’s earnings are relatively resilient vs. Malaysian listed peers, given its sustained performance in the cleanroom segment. Ong Khang Chuen, CFA, analystReiterate Add, as we believe RSTON’s earnings are relatively resilient vs. Malaysian listed peers, given its sustained performance in the cleanroom segment. Valuation is attractive at 7.8x CY23F ex-cash P/E. We make no changes to our FY22-24F EPS forecasts; our TP is also kept at S$1.10, still based on 17x CY23F P/E (RSTON’s 5-year mean). Re-rating catalyst include a continued uptrend in selling prices; downside risks include stronger-than-expected cost pressures negatively impacting margins. |

Full report here.

DBS Research as a 82-cent target price while UOB KH, 80 cents. Read UOB KH's report here.