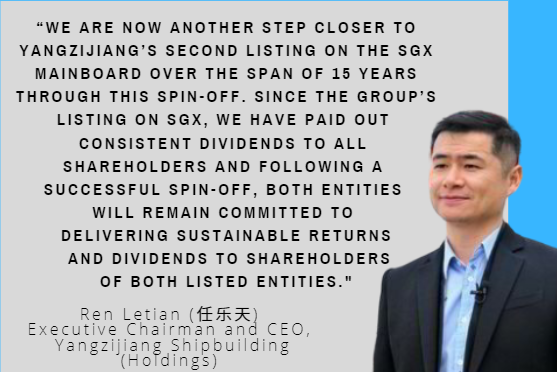

Yangzijiang Shipbuilding has received an eligibility-to-list from the Singapore Exchange for the shares of its investment arm, Yangzijiang Financial Holding Ltd (YZJFH).

As part of the Group’s restructuring exercise carried out for the proposed listing of YZJFH, the company had, on 25 March 2022, carried out a capital injection into YZJFH.

YZJFH will have an estimated initial net tangible asset of S$4.26 billion with a total number of shares of 3,950,589,220. All shareholders of the Group will be entitled to a dividend-in-specie on a one-to-one basis. Below are excerpts of a DBS report on the development:

Excerpts from DBS report

Analyst: Pei Hwa HO

|

What’s New • Scaling up YZJFH’s corporate governance with a Board of Directors comprising senior management from MAS, SGX, legal and asset management firms

• YZJFH will broaden its asset class and geographical footprint with growing sector focus on ESG, new economy, healthcare, etc. |

||||

Financial arms boosts “E” and “G” metrics

Investment Thesis:

Spin-off of investment arm improves corporate governance. The separate listing of Yangzijiang Financial Holdings (YZJFH) offers greater transparency and flexibility for investors. The appointment of senior management from MAS, SGX and law firm as directors of YZJFH could contribute to improving corporate

governance practices as well.

Set to re-rate as pure proxy to shipbuilding and shipping upcycles. Post spin-off of YZJFH, Yangzijiang’s shipbuilding business deserves a re-rate from the currently implied 0.8x PB and 6x PE (assumes YZJFH at a 0.7x PB) towards 1.5x PB and 12x PE on the back of a 13% ROE, 4%-5% dividend yield, and ~20%

earnings CAGR.

Potential upside to earnings growth and dividend yield. A record high order backlog of US$8.5bn as of end-2021 will keep Yangzijiang’s yards full through to 2024. We are hopeful of Yangzijiang delivering stronger-than-expected shipbuilding margins for its mainstream containership orders (~80% of orderbook).

The dividend payout ratio could also be raised with every 10ppt increase, translating to a 1.5ppt higher dividend yield from the base case of 4%.

| Valuation: Our TP of S$ 2.15 is based on a sum-of-the-parts (SOTP) valuation, pegged to a 9x PE on shipbuilding earnings, 0.7x P/BV for investments, and 1.0x P/BV for its marked-down bulk carrier/tanker fleets.  Pei Hwa Ho, analystThis translates to a 1.09x P/BV (0.5SD above its five-year mean of 0.9x). Pei Hwa Ho, analystThis translates to a 1.09x P/BV (0.5SD above its five-year mean of 0.9x).The stock is unwarrantedly undervalued, trading at a 0.7x P/BV and 7x PE against a 10% ROE and two-year core EPS CAGR of 13%. |

Where we differ:

The market has over-penalised Yangzijiang for its debt investments, most of which are backed by collateral of 1.5-2.5x.

Key Risks to Our View:

Revenue is denominated mainly in US dollars. Assuming the net exposure of ~50% is unhedged, every 1% depreciation in the USD could lead to a 1.5% decline in earnings.

Every 1% rise in steel cost, which accounts for about 20% of cost of goods sold (COGS), could result in a 0.8% drop in earnings.