Excerpts from CGS-CIMB report

Analysts: Kenneth Tan & Ong Khang Chuen, CFA

Jiutian Chemical Group Ltd

A high-octane performance

■ Juitian posted a record core net profit of Rmb430m (+148% yoy) in FY21, above our expectations on stronger-than-expected DMF and MA ASPs.

■ We expect 1.1Scts DPS for FY22F (13% yield), front-loaded with May’s 1Q22 results announcement. Net cash is now 90% of market cap. Reiterate Add. |

||||

FY21 core net profit at a record high on surging ASPs

Reversing a one-off loan impairment to an associate of Rmb126m (as flagged in Jiutian’s Nov 2021 announcement), 4Q21 core net profit surged to a record Rmb213m (+274% qoq, +147% yoy).

FY21 core net profit was boosted to Rmb430m (+148% yoy), helped by stronger profit spreads as ASPs of both methylamine (MA, +103% yoy) and dimethylformamide (DMF, +57% yoy) continued to trend higher, especially in 4Q21.

FY21 core net profit was above expectations, at 124% of our forecast.

More dividends likely to be declared in May 2022

We understand that the dividends declared by Jiutian in FY21 are for profits made by its Chinese subsidiary in FY20 (representing c.24% dividend payout). As with last year’s practice, we expect an interim dividend to be declared in May 2022, alongside 1Q22F results announcement (given the need for its China OpCo to first approve and distribute dividends to SG listco in its AGM). Based on 20% dividend payout assumption, we expect 1.1Scts dividend to be declared for FY22F, implying c.13% yield. |

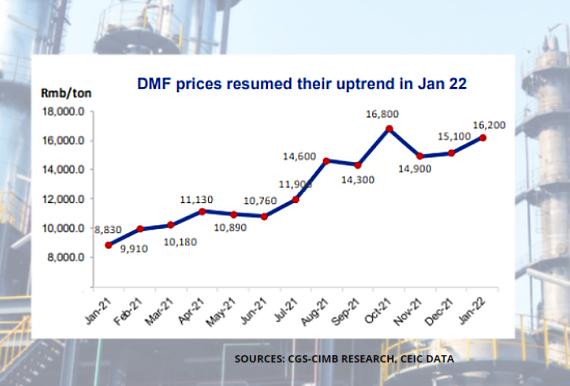

DMF prices remains firm in 1Q22F

While DMF ASPs eased slightly in Nov-Dec 21, prices have since resumed their uptrend in Jan 2022 on the back of strong downstream demand and tight supply, in our view.

According to 100ppi.com, DMF prices remain elevated at Rmb16k/ton as of 27 Feb 22 (vs. c.Rmb10k/ton in Feb 21). We expect DMF prices to remain elevated, as new industry capacity additions are likely to only be introduced in 2H22F.

We raise our FY22F EPS by 8% due to higher ASP assumptions. While production volumes in 1Q22F were slightly impacted by Covid-related disruptions and Chinese New Year holidays, we expect net profit for the quarter to show continued yoy growth.

Net cash now at c.90% of market cap; Reiterate Add

Jiutian’s FY21 net cash of Rmb694m forms c.90% of its current market cap.

Combined with strong FCF generation, we expect strong dividends in FY22F as the group continues to benefit from the favourable industry cycle in 1H22F.

Reiterate Add and TP of S$0.15, still pegged to 5.7x CY23F P/E (a 20% discount to SGX-listed peer China Sunsine).

Potential re-rating catalysts include stronger DMF ASPs and a higher dividend payout in May.

Downside risks include production disruptions and a sharp correction in DMF prices.

Full report here.