| Pure play on higher oil prices |

- BUY Entry – 0.20 Target – 0.33 Stop Loss – 0.18

- Rex International Holding (Rex) is a pure-play oil & gas exploration and production company (Independent). It owns and operates an oil-producing field in Oman and has a portfolio of exploration licenses in Norway. This year, the company added the Brage oil field in Norway and was awarded two Production Sharing Contracts (PSCs) by Petroliam Nasional Berhad (PETRONAS), Malaysia’s national oil corporation.

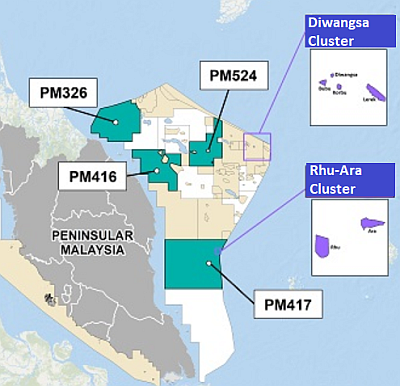

- Expanding into Asia. Early this month, Rex made its first foray into Asia. The company was awarded two PSCs by PETRONAS. The two PSCs are related to the development and production of the Rhu-Ara and Diwangsa Clusters located in offshore Peninsular Malaysia.

These previously discovered fields have a total estimated recoverables of 23.4 MMstb. The participating interests of Rex and Duta Marine Sdn Bhd (DMSB) are 95% and 5% respectively with Rex being the operator of the PSCs. Map: Petronas

Map: Petronas - Good start; even better second half. Rex International Holding (Rex) reported its highest semi-annual revenue since listing in 2013. Rex’s 1H2021 PATMI of US$24.0mn is a significant reversal from the US$20.1mn loss in 1H2020, driven by higher production and oil prices. We expect better performance ahead as the group grows organically and through acquisitions.

- Record free cash flows. Free cash flow generated by oil and gas companies are expected to break records this year with oil currently trading above US$70 per barrel. For Rex, the windfall will continue to strengthen its already strong balance sheet and give it opportunities to diversify.

- Increasing oil demand going into 2022. While OPEC recently trimmed its oil demand forecast for 4Q2021 due to the Delta variant, the organisation has increased its 2022 oil demand growth forecast to 4.15mn barrels of oil per day, compared to 3.28mn in the previous month’s report. This basically means that oil demand will exceed pre-pandemic levels next year.

- We have an Outperform recommendation and a DCF-backed target price to S$0.33.

Full report here.