Below are excerpts from Rex Holdings' FAQ published on its website relating to its 90% subsidiary, Lime Petroleum AS' intended acquisition of an interest in an oil field. See earlier story: REX INT'L: Makes US$43 m acquisition of North Sea oil interest for recurring revenue

|

|

QUESTIONS & ANSWERS

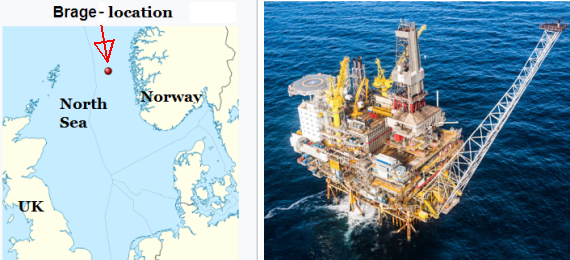

What is the rationale for Lime Petroleum buying 33.84% of the Brage Field?

Although Brage is a mature field, the Group believes the economics from its current reserve base are robust and that there is further upside. A drilling programme to ramp-up production will commence later in 2021.

| a. Present reserves and resources in Brage will add to the Group's existing inventory of reserves (producing assets) and contingent resources (discovery assets). b. Brage is producing and will add production and cash-flow with effect from 1 January 2021, upon completion of the Acquisition. |

The price of US$42.6 million seems high?

The Group believes that the transaction is beneficialfor the Rex Group:

|

a. The effective date is 1 January 2021, which means payment for all production will be received by Lime Petroleum retrospectively, from the effective date up and until completion. This will be offset against the final cash amount to be paid at completion. d. The transaction allows for Rex to diversify and to have two producing units - Oman and Norway.

f. The Target Assets' unaudited pro forma net profit before tax for FY2020 of approximately US$21 million. |

What about capex and investment in drillings in Brage?

The transaction is based on the premise that capex will be paid for by existing production and future development

Lime Petroleum is doing a bond of US$60 million. Aren't you taking on a lot of risks?

To clarify, the bond is issued at the Lime Petroleum level and ring-fenced, thus shielding Rex from any obligations:

| a. Placement of the bond is possible due to Brage's production profile, cash flow generation and quality in the security provided. b. The bond issue is used towards the purchase price and refinancing of an existing revolving exploration facility. c. The expected maturity date of bond is in 2.5 years. |

Will interest rates be high?

a. Interest costs are deductible costs for tax purposes in Norway, reducing the effective interest rate.

Is it very risky to take on decommissioning costs with a "late-life" asset?

To clarify, the seller will retain an obligation to finance 95% of the decommissioning costs and guaranteed by the Seller's parent company.

|

a. The proposed letter of credit relating to the 1.69% of the full decommissioning costs of the current Brage Field infrastructure would come from Lime Petroleum. |

Is Rex going to do a rights issue to finance the Acquisition?

No.