| Is the recent 32% share price decline justified? Riverstone recently caught my attention. It has tumbled approximately 32% from an intraday high of $4.90 on 7 Aug 2020 to close $3.33 on 11 Sep 2020. One client even thought that Riverstone has already undergone a bonus issue! The recent weakness is likely attributed to its co-founder selling 15.5m shares at $3.95; the possibility of a vaccine resulting in demand for gloves and consequently their average selling price (“ASP”) falling off the cliff; and some Malaysian investors selling shares to raise cash, as their moratorium on loan repayment ends (click HERE for the article) |

CEO Wong Teek Son.

CEO Wong Teek Son.

NextInsight file photo.Granted that there is some merit to the above. However, is the 32% fall justified given that it is cheaper than its industry average based on FY21F PE?

For this write-up, besides sourcing information from the usual sources, such as analyst reports; news articles etc, I have the fortune of speaking with Mr Wong Teek Son, Executive Chairman, Co-founder, and CEO of Riverstone for a 1-1 discussion last Thurs.

Insights from discussion with Mr Wong are in italics.

1. Average analyst target $5.45; implies 64% potential upside

Four analysts cover Riverstone and have target prices ranging $4.73 – $6.00. Average analyst target is at $5.45, implying a hefty 64% potential capital upside (if the analysts are correct).

Readers can refer to the website HERE for Riverstone’s analyst reports.

2. Demand is still in favour of glove makers

According to US-based Allied Market Research, global disposable gloves market may soar almost 3x from US$6.8b in 2019 to US$18.8 b by 2027.

Furthermore, based on an article on CNA dated 4 Sep 2020, Top Glove mentioned that demand continues to be strong with order backlog stretching to nearly 600 days, compared with a normal delivery time of 30 to 40 days.

3. ASPs continue to rise across the board

In a UOB Kayhian research report on Top Glove dated 4 Sep 2020, the analyst believes that Top Glove's ASPs may increase 30% month on month (“mom”) from Sep to Oct (as opposed to 10% mom), followed by an additional 5-10% mom till year- end.

For Riverstone, based on my understanding, it has raised the ASP for its healthcare gloves 10% every month from June to Oct 2020 (both months included).

Given such increments, it is likely that the ASP for its healthcare glove segment may increase by around 50% quarter on quarter in 3QFY20F.

This is more than what was reported in a CGS-CIMB Research report dated Aug 2020 where Riverstone's ASP for its healthcare glove segment was projected to increase by around 25% quarter on quarter in 3QFY20F.

Furthermore, it is likely that ASPs should continue to remain elevated till at least 1QFY21.

For cleanroom gloves, Riverstone has hiked its ASP in Jul 2020 and hiked it again in Sep 2020 by a greater magnitude than July.

This is due to an increase in demand for cleanroom gloves as some cleanroom glove makers switch their lines to manufacture healthcare gloves.

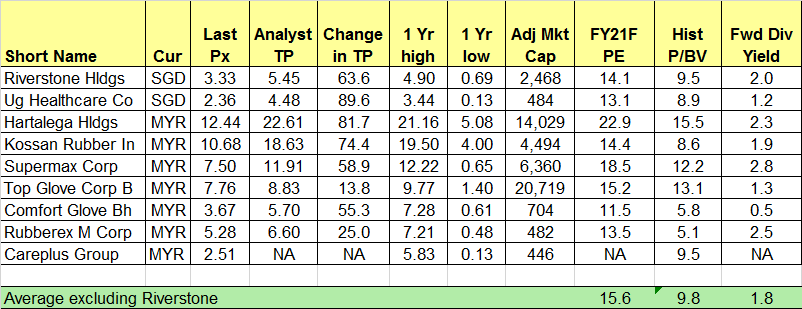

4. Attractive valuations relative to industry average

Based on Table 1 below, Riverstone trades at an attractive 14.1x FY21F PE as compared to its peers which are trading at an average 15.6x FY21F PE. Source: Bloomberg 11 Sep 20

Source: Bloomberg 11 Sep 20

5. Bonus and dividend in the near term

Riverstone has a couple of events in the near term. Firstly, it is going to ex-div MYR0.04 / share on 18 Sep 20.

Secondly, on 18 Aug 20, Riverstone announced that it is proposing a 1:1 bonus share with the aim of increasing the accessibility of investing in the Company to more investors, thereby encouraging trading liquidity and greater participation by investors and broadening the shareholder base of the Company.

This bonus issue is pending the approval of Shareholders at an extraordinary general meeting (“EGM”) to be convened and the approval from SGX. A circular for the EGM will be sent out to eligible shareholders in due course.

6. Expansion on track

Based on my understanding, one single line has already been commissioned in Jul 20 with one double line being commissioned every month from Aug to Dec 2020. This will raise Riverstone’s annual capacity to 10.4b pieces by end 2020.

Construction for Phase 7 of the Group’s expansion plans has started, and will add capacity of up to 1.4b pieces of gloves per annum by FY21F. Based on my understanding, the first line for Phase 7 is likely to start commissioning in Apr 21.

|

7. 2H should be much stronger than 1H

|

8. Strong cash flow generation bodes well for dividends and balance sheet strength

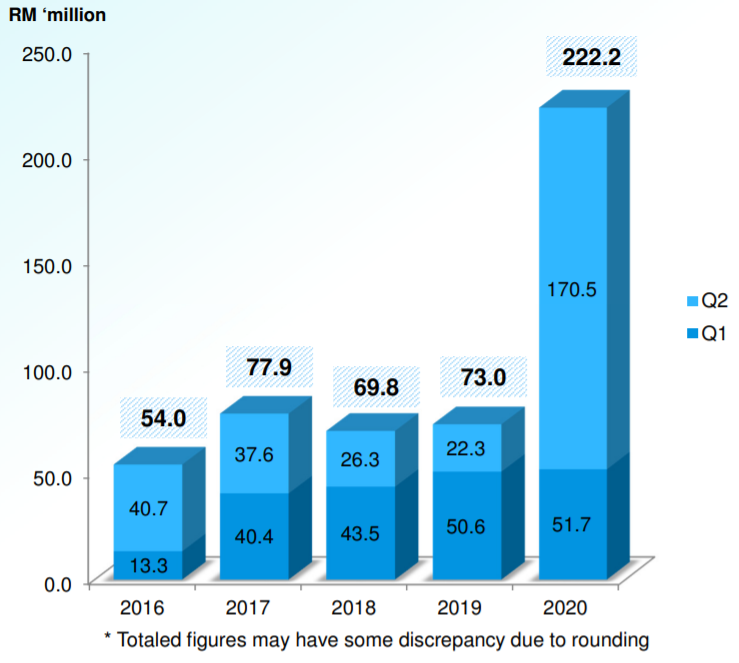

Based on Table 2 below, Riverstone’s operating cash flow is very strong with robust positive operating cash flows of MYR222.2m for 1HFY2020. There are two noteworthy points on this aspect.

|

a) Riverstone’s cash balance and net cash position are likely to be even stronger in 2HFY20F. This is because its operating cash flow is likely to be stronger in 2HFY20F amid higher sales volumes and higher ASPs. As at 1HFY20, Riverstone has a net cash position of MYR264.2m with only a mere MYR10m of short- and long-term loans and borrowings. A case in point: As at 1HFY20, Top Glove has cash and investment securities amounting to MYR348m and MYR1.45b respectively. It is not a net cash company with MYR1.52b of short- and long-term loans and borrowings. |

Table 2: Strong operating cashflow; likely stronger in 2HFY20F

Source: Company

Since FY07 to FY19, Riverstone’s dividend payout ratio has ranged from 36% - 56%.

Given an estimated payout ratio of around 45% (ratio is likely to be higher than the average 40% as cash flow is likely to be very strong given potentially good results in the next two quarters), an estimated dividend for the full year (inclusive of the MYR0.04 / share announced in 1HFY20) is likely to be around SGD0.084.

That translates to an annualised dividend yield of 2.5%. (I used average consensus net profit from CGS-CIMB, DBS and UOB and a SGD-MYR exchange rate 3.045)

9. Wind fall tax unlikely in the near term

A CGS-CIMB Research report on the glove sector dated 18 Aug 20 said that after their checks with Malaysian Rubber Glove Manufacturers Association (MARGMA), there has been no discussion with the government on the topic of windfall tax. Hence it may not be likely that a windfall tax may be imposed on the glovemakers in the near term.

|

Risks Almost all investments carry risks. I have listed some noteworthy risks but do note that it is not an exhaustive list. 1. Competition As the glove industry continues to enjoy supernormal profits, it is reasonable to assume that competition is likely to intensify either via incumbents increasing their production capacities at a faster pace, or new entrants coming into the industry. Competition may erode Riverstone's margins, and reduce its ability to hike ASPs and reduce its market share.

5. Vaccine may affect both sentiment and eventually demand for gloves The discovery of a successful vaccine may affect the glove makers (not necessarily only Riverstone) in at least two ways. |

Conclusion

In view of the above points, I believe the recent 32% fall in Riverstone is not justified.

Nevertheless, it may take some time for the market to digest the recent placement; shaky market conditions etc.

Readers should be cognisant of the pros and cons in owning Riverstone shares and should exercise due diligence and independent judgement.

P.S: I have previously informed my clients on Riverstone. I am vested. Readers please visit Riverstone’s website HERE and do your own due diligence. Investments carry risk and its best to be familiar and comfortable in what you invest in.

Disclaimer

Please refer to the disclaimer HERE

This article was originally published on Ernest Lim's blog