"Dragon Descendant" contributed this article to NextInsight

| Share prices, as we all know, are influenced by many factors. Fundamentals, such as profit and financial health, are important factors affecting share price. Overall market conditions as well as the target prices that analysts set also play a part. |

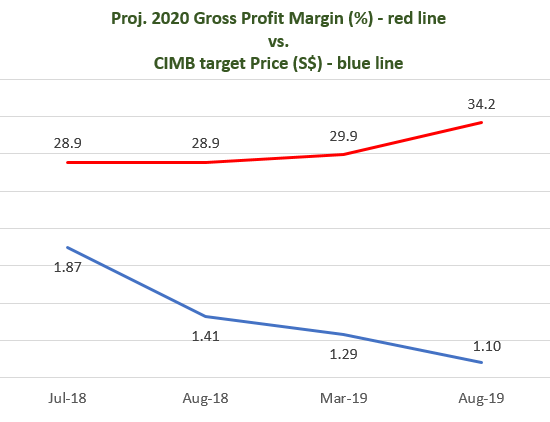

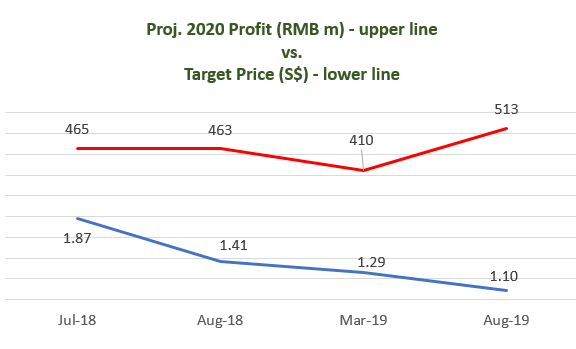

A CGS-CIMB analyst set $1.87 as the target price of Sunsine shares in a report dated 26 July 2018, but surprisingly slashed it to $1.41, just 12 days later.

The target price was further lowered to $1.29 on 1 March 19 and $1.10 on 7 Aug 19.

|

Report dated |

Target |

x times next |

Next year’s |

|

26 Jul 18 |

1.87 |

9.8 |

453 |

|

7 Aug 18 |

1.41 |

7.7 |

450 |

|

1 Mar 19 |

1.29 |

7.5 |

410 |

|

7 Aug 19 |

1.10 |

5.5 |

513 |

The latest $1.10 target price is pegged to 5.5 times 2020 projected profit.

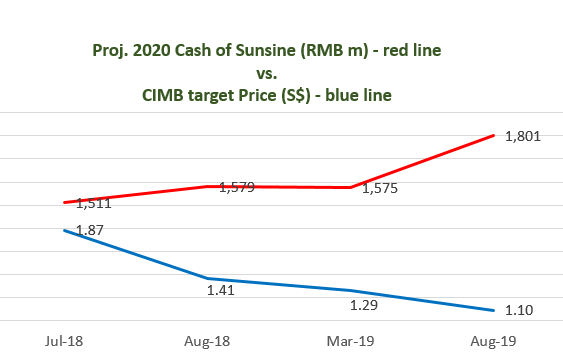

Let’s compare the target price and projected 2020 financial metrics (such as gross profit margin, profit, cash) in the four reports.

The divergence between rising projections of financial performance and declining target prices is striking.

|

“China Sunsine’s ROE in 2020 will be 21.3% on RMB 3,115m equity. |

The lowering of the target price to $1.10 in the most recent report, from $1.29 in the preceding one, is baffling when the projected 2020 profit of RMB 513m is very much higher than RMB 410m (2nd graph).

The 4.3 percentage point improvement in GPM in the Aug 19 report from the preceding one reflects strong pricing power and production efficiency.

The projected RMB 1,801m cash (with nil borrowing outstanding) by year 2020 translates into $0.72 per share, which is 65% of the $1.10 target price.

|

Thus, the lowering of the target price for China Sunsine share in the face of improving fundamentals is befuddling. |

||||||||||||||||||||