Holders of EC World REIT units will receive a 2.2% year-on-year increase in DPU to 1.501 cents for 1QFY19. The 1Q19 DPU is derived from 100% of the distributable income for the period 1 Jan 2019 to 31 March 2019. |

Above: 1Q19 results briefing. It's nearly 3 years since the REIT listed at 81 cents in July 2016. Photo: Colin LumHolders of the REIT units can look forward to an uplift in returns under a proposed earnings-accretive acquisition, which will need unitholders’ approval soon.

Above: 1Q19 results briefing. It's nearly 3 years since the REIT listed at 81 cents in July 2016. Photo: Colin LumHolders of the REIT units can look forward to an uplift in returns under a proposed earnings-accretive acquisition, which will need unitholders’ approval soon.

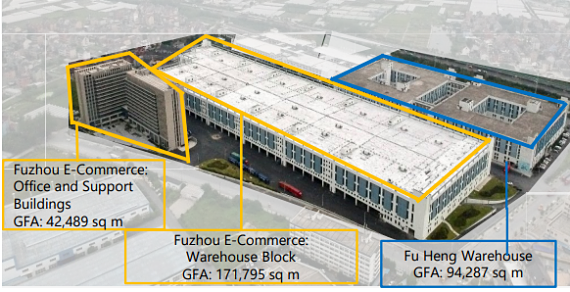

The target asset is Fuzhou E-Commerce, a 214,284 sqm integrated e-commerce logistics asset in Hangzhou, PRC.

It is located next to one of EC World REIT’s existing assets, Fu Heng Warehouse, which is also focused on e-commerce related fulfilment activities

The new acquisition will result in the enlarged portfolio having a heftier weightage on the specialised e-commerce logistics sector.

This rides on the supercharged e-commerce business in Hangzhou which expanded by 48% in 1Q19, according to management. Located in Hangzhou, the target property (214,284 sqm) comprises of a three-storey warehouse with a single-storey basement and two 14-storey office and support buildings which are primarily office spaces for auxiliary use for dormitory purposes.

Located in Hangzhou, the target property (214,284 sqm) comprises of a three-storey warehouse with a single-storey basement and two 14-storey office and support buildings which are primarily office spaces for auxiliary use for dormitory purposes.  CEO Goh Toh Sim. NextInsight photoThe property purchase price: RMB1,112.5 million (about S$223.6 million).

CEO Goh Toh Sim. NextInsight photoThe property purchase price: RMB1,112.5 million (about S$223.6 million).

If approved, the acquisition will, on a historical proforma basis, raise the following FY2018 metrics:

| ♦ DPU from 6.179 cents per unit to 6.278 cents, or 1.6%. ♦ Net Asset Value from 86.94 cents to 88.19 cents, or 1.4%. |

The asset comes with two master leases for warehouse and office components and a tenure of 5 + 5 years.

The rental escalation: 2.25% per annum.

Li Jinbo, Head of Investments, Asset Management and Investor Relations, gave an assurance that there will not be a rights issue or unit placement to fund this acquisition.  L-R: Johnnie Tng, CFO | Goh Toh Sim, CEO | Li Jinbo, Head of Investments, Asset Management and Investor Relations. Photo: GCP GlobalInstead, it will be funded 100% by debt, or mostly debt and a little cash, he said.

L-R: Johnnie Tng, CFO | Goh Toh Sim, CEO | Li Jinbo, Head of Investments, Asset Management and Investor Relations. Photo: GCP GlobalInstead, it will be funded 100% by debt, or mostly debt and a little cash, he said.

"If we offered equity as part of the consideration, we might not be able to meet the asking price. There were other bidders for this asset who were offering higher prices."

The REIT has a right of first refusal (ROFR) to acquire the Fu Zhou E-Commerce asset from the sponsor.

It is one of two ROFR properties, the other being Stage 2 of Bei Gang Logistics which the REIT declined as it would not immediately raise the DPU and there was a higher bidder.

"We hope to complete the acquisition by end of June or start of July," said Mr Li. This implies that the acquisition will start its DPU contribution from 3Q this year.

|

EC World REIT |

|

|

Analysts |

Target price |

|

DBS Vickers |

86 c |

|

RHB |

85 c |

|

Phillip Securities |

87.2 c |

|

SooChow CSSD Capital Markets |

93 c |

In another development, the REIT last week signed new master lease agreements for its existing assets.

That lifted the Weighted Average Lease Expiry (by gross revenue) of the REIT from 1.8 years as at 31 March 2019 to 4.7 years.

This enhances cash flow and income viability, ensuring stable and sustainable returns to unitholders. Built-in rental escalation is between 1% and 2% p.a.

For more, see the Powerpoint presentation materials here.

|

Previous stories: EC World REIT: Full-year 2018 DPU rose 2.6% to 6.179 centsEC World REIT: DBS initiates coverage with 86-c target

EC World REIT: Buy E-Commerce Logistics + 9% Yield; Initiate BUY |

For the latest 1Q19, the dpu of 1.501c has NO withholding tax involvement.

Hence, can we say that the ACTUAL dpu has DROPPED from 1.570c in 1Q18 to 1.501c in 1Q19 ?