Highlights of Foreign Family Empires Listed on SGX

| SGX lists 16 companies and eight trusts associated with five foreign family empires - three Indonesian, one Thai, and one British - which have a combined market capitalisation of more than S$220 billion. The Indonesian business empires are associated with the Widjaja, Riady and Salim families, while Thai corporate ownership is represented by the Sirivadhanabhakdis, and the Jardine Group of companies is owned by the Scottish/British Keswick tai-pans. These 16 companies and eight trusts are involved in businesses ranging from real estate development and investment, including REITs, to food and beverage manufacturing and processing, agriculture, hospitality, commodities, utilities, and healthcare. |

The tables below detail the five foreign family empires and their individual companies listed on SGX, with executives who are on their respective boards.

Widjaja Family

| ♦ Franky Widjaja is a son of Eka Tjipta Widjaja, founder of one of Indonesia's largest conglomerates, the Sinar Mas Group. ♦ The senior Widjaja, who passed away at the age of 98 in January this year, was ranked by Forbes as the third-richest person in Indonesia in 2018, with an estimated net worth of US$8.6 billion. A former immigrant from China, he founded Sinar Mas in 1962 and built it into a conglomerate with interests in the paper, agribusiness, real estate, financial services and telecoms industries.  Golden Energy & Resources: Jetty for transferring coal to barges. Golden Energy & Resources: Jetty for transferring coal to barges. NextInsight file photo. ♦ The Widjaja family owns stakes in SGX-listed Golden Energy and Resources, Golden Agri-Resources and Sinarmas Land through various vehicles, including the Widjaja Family Master Trust, Ascent Wealth Investment, Massingham International and Flambo International, recent annual reports of these companies showed. ♦ The Widjaja family members also hold various positions on the boards of these companies - Fuganto Widjaja and Muktar Widjaja are Franky's nephew and brother respectively, while Margaretha Widjaja is Muktar's daughter. |

Riady Family

| ♦ Stephen Riady is a son of Mochtar Riady, founder of the Lippo Group with estimated US$8 billion in annual revenues. Mochtar Riady was ranked by Forbes as the 12th-richest person in Indonesia last year with a net worth of US$2.3 billion. Today, Lippo Group's interests include real estate, retail, healthcare, media and education. ♦ Through various vehicles, the Riady family owns interests in SGX-listed OUE Ltd, OUE Lippo Healthcare, Lippo Malls Indonesia Retail Trust, OUE Commercial REIT, OUE Hospitality Trust and First REIT. These vehicles include PT Lippo Karawaci, Lippo Capital, Golden Concord Asia, Bridgewater International, and Pacific Landmark, according to shareholding data from the respective company annual reports. ♦ Stephen Riady and his son Brian hold board positions in OUE Lippo Healthcare and OUE Ltd. |

Salim Family

| ♦ Anthoni Salim controls the Salim Group, a family-run holding company with investments in the food, banking, automotive, and real estate sectors. He is the youngest son of Liem Sioe Liong, who immigrated to Indonesia from China in the 1930s and adopted the Indonesian name Sudono Salim. ♦ The Jakarta-based group owns stakes in businesses ranging from SGX-listed Indofood Agri Resources and Hong Kong-listed First Pacific Company to Indonesia's largest instant noodle-maker Indofood Sukses Makmur, and the country's biggest bank by market value, Bank Central Asia. The Salim family was ranked by Forbes as the fifth-richest in Indonesia in 2018, with a net worth of US$5.3 billion.  In Vietnam, Food Empire has successfully marketed its Cafe Pho. Photo: Company♦ Apart from their family-run companies, the Salims have also acquired stakes in other SGX-listed firms, such as Food Empire, Moya Holdings and QAF. According to Food Empire and Moya's most recent annual reports, Anthoni Salim holds a deemed interest of 24.72% in the food and beverage manufacturer, and a deemed interest of 72.84% in the Indonesia-based water treatment company. Anthoni's brother, Andree Halim, also has a deemed interest of 60.28% in SGX-listed QAF, according to the company's most recent annual report. In Vietnam, Food Empire has successfully marketed its Cafe Pho. Photo: Company♦ Apart from their family-run companies, the Salims have also acquired stakes in other SGX-listed firms, such as Food Empire, Moya Holdings and QAF. According to Food Empire and Moya's most recent annual reports, Anthoni Salim holds a deemed interest of 24.72% in the food and beverage manufacturer, and a deemed interest of 72.84% in the Indonesia-based water treatment company. Anthoni's brother, Andree Halim, also has a deemed interest of 60.28% in SGX-listed QAF, according to the company's most recent annual report.♦ Anthoni's son, Axton, is the Non-Executive Director of IndoFood Agri-Resouces. Note that Salim-controlled PT IndoFood Sukses Makmur last month unveiled a cash offer to buy out Indofood Agri and take it private. |

Sirivadhanabhakdi Family

| ♦ Charoen Sirivadhanabhakdi is the founder and chairman of TCC Group, a Thai beverage and real estate conglomerate. He was ranked by Forbes as Thailand's fourth-richest man in 2018, with a net worth of US$17.4 billion. ♦ A number of privately held companies - including Sriwana Company and MM Group - in which Charoen and his wife Khunying Wanna jointly hold stakes, are substantial shareholders in various SGX-listed companies - Thai Beverage PCL, Fraser and Neave, and Frasers Logistics & Industrial Trust, Frasers Centrepoint Trust, Frasers Commercial Trust, Frasers Hospitality Trust, and Frasers Property. Units of Charoen's TCC Group, including TCC Assets and TCC Group Investments, also hold stakes in these SGX-listed firms. ♦ Charoen's sons - Thapana and Panote Sirivadhanabhakdi - also own deemed stakes in these companies, according to shareholding data from their most recent annual reports. |

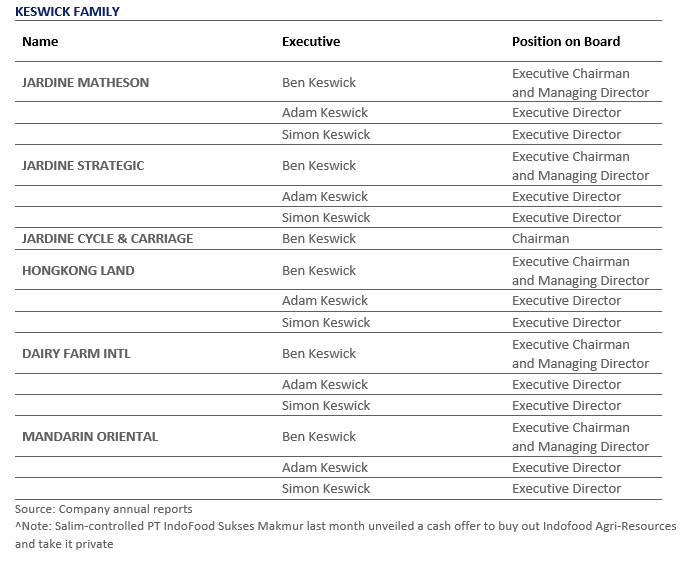

Keswick Family

| ♦ Simon Keswick is the fourth-generation descendant of William Keswick, who founded the Keswick family dynasty that was linked to the Jardines Group by marriage. Of Scottish origin, the Keswick dynasty has been associated with the Far East since the 1850s, while Jardine, Matheson & Co was founded in China, in the 1830s by Scotsmen William Jardine and James Matheson. ♦ Jardine Matheson is a British conglomerate incorporated in Bermuda and headquartered in Hong Kong, with its primary listing on the London Stock Exchange and secondary listings on SGX and the Bermuda Stock Exchange. The group's portfolio of businesses across Asia Pacific includes engineering, construction, auto dealerships, insurance services, property, hospitality, consumer goods. ♦ Simon Keswick, together with his son Ben, and nephew Adam, hold various board positions in Hongkong Land, Mandarin Oriental, Dairy Farm and Jardine Matheson, which are secondary listed on SGX. For primary-listed automotive distributor Jardine Cycle & Carriage, Ben Keswick holds the position of Chairman on its board. ♦ Jardine Strategic Holdings is a substantial shareholder in Jardine Cycle & Carriage, Hongkong Land, Mandarin Oriental, Dairy Farm and Jardine Matheson. The latter in turn is a major shareholder of Jardine Strategic. ♦ Jardine Matheson, Jardine Strategic, Jardine C&C and Hongkong Land are constituents of Singapore's benchmark Straits Times Index (STI). |

The table below details the companies and trusts associated with the five foreign family empires that are listed on SGX, sorted by market capitalisation.

Republished from SGX website with permission