Investors are sometimes lulled into a false sense of security thinking that stocks with high dividend yields are conservative bets. It is important to check that high dividend yields are not, in fact, reflecting market pricing for a weak business or for financial distress (share price denominator has been sold down).

One way to avoid the dividend trap is to invest in the Phillip SING Income ETF. This ETF replicates the Morningstar® Singapore Yield Focus Index, which selects and weights 30 constituent stocks using 12 factors associated with superior business quality, financial health, and dividend yield. The factors include trailing 12-month return on assets, earnings yield, sales yield, book value yield, equity volatility, maximum drawdown, total revenue, market cap, enterprise value, and average daily volume.

|

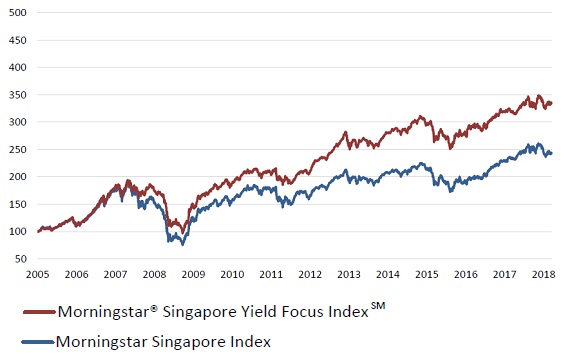

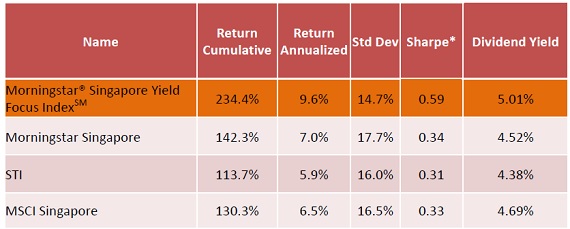

Data: Bloomberg, Phillip Capital Management estimates as at 31 August 2018

The table above shows that over the recent past 13 years, the ETF's underlying index was up a hefty 234%, outperforming the Straits Times Index by more than twofold. The Morningstar Singapore Yield Focus Index had a better risk-return profile compared to the Morningstar Singapore, STI, and MSCI Singapore baskets of blue chips.

Large cap liquid Singapore stocks are a good representation of high yield stocks as the Singapore market places great emphasis on dividends. The dividend yield of STI constituent stocks is higher than for equity market barometer indices for the developed stock markets in the U.S. and Japan as well as for ASEAN countries such as Malaysia, Indonesia, the Philippines, or Thailand.

|

Many of our clients who show up at the business trust or bondholders meetings are retirees. They are our old guards. It is our mission to provide something better for the pioneer generation. We think the Phillip SING Income ETF is the solution.

- Jeffrey Lee |

“The Phillip SING Income ETF is unique as the constituent securities of the initial portfolio of the index offer dividend yield in excess of 4% per annum, a significant yield advantage to long-term Singapore Government Bonds,” said Mr. Jeffrey Lee, Managing Director and Chief Investment Officer of Phillip Capital Management.

“The companies in the portfolio are familiar names that provide essential products and services such as supermarkets, healthcare, defense, real estate, banking, and telecommunication services.

“While the ETF aims to provide investors with regular dividend income, it does not sacrifice capital growth potential as its combined constituents have a good history of growing earnings.”

No need to constantly monitor No need to constantly monitor |

|

|