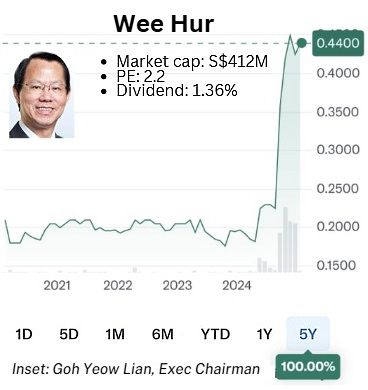

• Looking for stock ideas to kick off the year? For many of us, balance is key. A mix of high-beta stocks and dividend-paying ones can help us ride market waves while keeping our portfolio steady. • High-beta stocks, like tech innovators, are exciting, and can deliver big gains (or losses). Know your risk tolerance. On the flip side, dividend stocks are your steady earners. They’re like comfort food—reliable and satisfying. Phillip Securities's report today has such a balanced portfolio recommendation, comprising 10 stocks.  • In that portfolio, Wee Hur Holdings stands out with the highest upside potential (48%), despite achieving ~100% gain already in the past 5 months.  The 100% gain over a 5-year period happened in the last few months!Wee Hur has been off investors' radar for a long time, as can be seen in its staid stock movement in the past few years (see chart). The 100% gain over a 5-year period happened in the last few months!Wee Hur has been off investors' radar for a long time, as can be seen in its staid stock movement in the past few years (see chart). The stock sprang to life recently on news of its large divestment of accomodation assets in Australia. Phillip Securities is now the first to initiate coverage of the stock. Wee Hur operates across diverse sectors, including construction, property development, and investment. Its workers' dormitories are increasingly a cash cow as day rates go up. Read more about Wee Hur below .... |

Excerpts from Phillips Securities report

Analyst: Paul Chew, Head of Research

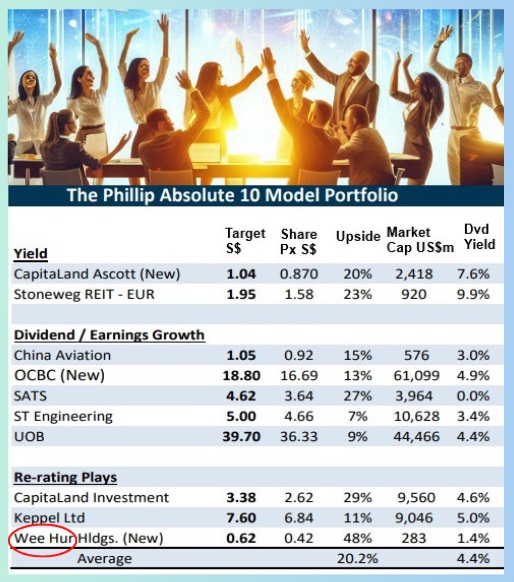

| RECOMMENDATIONS FOR PHILLIP ABSOLUTE 10 The strategy of the portfolio is to generate alpha or absolute returns in a balanced portfolio.  Paul ChewUsing 10 stocks for a portfolio is highly concentrated. Paul ChewUsing 10 stocks for a portfolio is highly concentrated. We add lower beta yield names to avoid excessive volatility in our model portfolio. In our 2025 model portfolio, which is reviewed every quarter, the top 10 picks - The Phillip Absolute 10 - by category are: |

a) Dividend yields: Such stocks anchor the portfolio with less volatility and attractive dividend income.

We find the dividend yield of CapitaLand Ascott and Stoneweg REIT attractive.

Hospitality remains a growth segment, albeit at a slower pace. Valuations are attractive with the REIT trading at 0.8 price to book and 7% yield. Ascott has a history of selling assets at a significant premium to book.

Both REITs benefit from declining interest rates in developed markets, especially Europe.

Stoneweg portfolio occupancy and rents have been resilient despite the multiple economic challenges in Europe.

b) Dividend/Earnings growth: These are stocks with growth in dividends and/or earnings. We added OCBC due to an upside surprise in dividends.

China Aviation is expected to report healthy earning growth in 2025.

An upside surprise will come from a rise in their dividend payout ratio. SATS and ST Engineering will ride on continued improvement in freight and passenger travel volumes.

c) Re-rating: Companies that we expect to enjoy higher valuations due to certain share price catalysts.

CapitaLand Investment is building an asset-light fund management platform that warrants premium valuations.

We expect growth to return as REIT performance improves from lower interest rates and China asset prices stabilise.

Wee Hur will enjoy a windfall from the disposal of its student accommodation portfolio in Australia.

| Wee Hur -- Unlocking value from PBSA sale |

| Analyst: Ben Yik ▪ Worker dormitory segment as a key growth driver. Pioneer Lodge, the Group’s second purpose-built dormitory (PBD) with 10,500 beds, is expected to be partially operational by 1Q25 and fully operational by the end of FY25.

Higher rental rates in 2024 resulted in a 67.9% YoY increase in revenue for the workers’ dormitory segment in 1H24. |

||||

▪ Wee Hur recently secured an A$1.6bn exit from its PBSA (Purpose Built Student Accommodation) portfolio, potentially bringing in net proceeds of S$320mn. The transaction could result in a one-off gain from sale of S$36mn.

Ben Yik, analystThe transaction could also enhance the Group’s financial position, improving from current net debt of S$60.6mn to net cash of S$259.3mn.

Ben Yik, analystThe transaction could also enhance the Group’s financial position, improving from current net debt of S$60.6mn to net cash of S$259.3mn.

Given the Group’s track record of declaring special dividends during strong financial performance, we believe there is a strong likelihood that special dividends may be announced.

Notably, in FY12, the Group reported a S$90mn gain from sale from the completion of the Harvest@Woodlands industrial development project and subsequently distributed c.S$15.9mn in special dividends.

| ▪ Wee Hur’s stock is trading significantly below book value per share. The Group’s sale of its PBSA portfolio will result in a 10.6% increase in its revised net tangible assets (NTA) per share from S$0.66 to S$0.73. Based on the average 0.9x P/B of the Group’s comparables, this represents a c.56% upside in valuations based on current stock prices. Given the successful agreement to realize value from its PBSA portfolio, we believe the Group is well-positioned to leverage its expertise and experience to maximize the potential of its remaining tangible assets. |

Full report here