Portuser contributed this article to NextInsight

|

China Sunsine's full-year profit of RMB 341m in 2017 was an all-time high, surpassing the 2016 record of RMB 222m by 54%.

|

Crackdown on pollution

Besides making the environment more livable, the crackdown on pollution also achieves China's economic objectives, as stated in "China’s War On Air Pollution Causes Major Chemicals Shortages".

"The environmental campaign is in lock-step with wider economic reforms. Economically inefficient low value manufacturers that will hinder China’s attempt to escape its middle-income trap are often also heavy polluters. So shut them down and you kill two birds with one stone. Plus some of these companies are “zombie companies” as they are having to borrow more moneyto pay existing debts.So shutting them down helps China deal with its debt crisis."

Enforcement against industrial pollution, which started in 2015, was initially carried out by local authorities. In 2017, the central government joined the campaign.

Two articles, "China broadens campaign against overcapacity" and "China wages war on pollution" report that the anti-corruption watchdog was roped in to add teeth to the crackdown.

The second article states that the central government inspection teams included party officials who "can punish municipal and provincial officers for not taking their environmental tasks seriously". A water treatment facility in China Sunsine's plant in Weifang: The effluent is treated and then piped to a government central treatment site for further cleaning. NextInsight file photo.

A water treatment facility in China Sunsine's plant in Weifang: The effluent is treated and then piped to a government central treatment site for further cleaning. NextInsight file photo.

Rubber accelerators most affected by crackdown

The three main groups of rubber chemicals are rubber accelerators, insoluble sulphur and anti-oxidants. Rubber accelerators were affected the most by the crackdown because of the high amount of waste generated during production.

Sunsine is the world's biggest rubber accelerator producer with its 87,000-tonne capacity, accounting for 20% and 33% of global and China's output, respectively.

The two nearest rivals are both Chinese producers -- Tianjin Kemai (51,000 tonnes) and Yanggu Huatai (30,000 tonnes). These three producers account for two-fifths of global, and two-thirds of China's, rubber accelerator output.

Worried about not having enough rubber chemicals, some major Chinese tyre makers met several rubber chemical producers in Jan 2018 to seek assurance on stable supply. (Source)

Tight supply

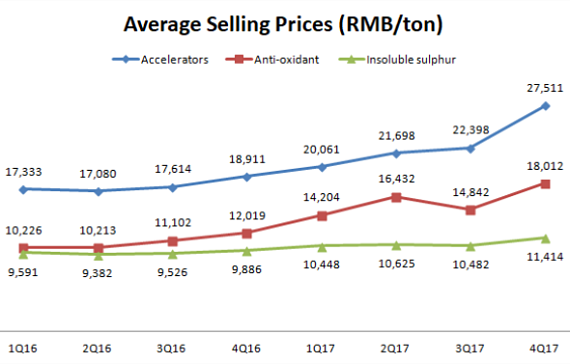

The following chart shows the rising trend of selling prices of Sunsine's products. In particular, the average selling price of rubber accelerators surged in 4Q17:

Tyre makers react to the shortage of rubber chemicals by stocking up.

They also pay as promptly as they can in the hope of getting a good share of the limited supplies.

In 2017, especially in the last quarter, Sunsine's customers were remarkably prompt in payment:

|

Time taken to pay invoice (days) |

|

|

1Q16 |

85 |

|

2Q16 |

84 |

|

3Q16 |

87 |

|

4Q16 |

83 |

|

1Q17 |

78 |

|

2Q17 |

70 |

|

3Q17 |

76 |

|

4Q17 |

60 |

|

Details in Annex A |

|

Sunsine's finished goods were also sold at a faster rate:

|

Finished goods turnover (days) |

|

|

2013 |

15 |

|

2014 |

19 |

|

2015 |

18 |

|

2016 |

10 |

|

2017 |

11 |

|

Details in Annex B |

|

The crackdown on pollution has reduced rubber accelerator production capacity that was previously in excess. To meet rising demand for replacement tyres by the growing global vehicle population, more rubber accelerators have to be produced.

|

Sunsine's expansion Sunsine planned for expansion early. With RMB 230m from an initial public offering on the Singapore Stock Exchange in 2007 and some bank loans, it introduced new products and increased its production capacity from 32,000 tonnes to 152,000 tonnes in 2014. |

Fund raising by Tianjin Kemai

Tianjin Kemai planned to raise RMB 890m from an IPO on the Shanghai Stock Exchange. Unfortunately, its application failed twice, in 2015 and 2017.

Even if alternative funding is found, new capacity will take three years to build.

Fund raising by Yanggu Huatai

Shenzhen-listed Yanggu Huatai is luckier. It secured RMB 604m recently, in Feb 18, after three attempts.

The first, in Nov 16, was to issue not more than 120m placement shares to raise RMB 1,175m for new capacity and relocation of an old production base.

But the Shenzhen Stock Exchange turned down the proposal as the number of placement shares exceeded 20% of 289m outstanding Yanggu shares.

Yanggu reduced the number of placement shares in Feb 17 but a subsequent decline of its share price (from around RMB 20 to around RMB 13) rendered the revised proposal infeasible.

Yanggu then turned to a rights issue and received approval in Nov 17 to raise a smaller sum of RMB 735m, making no provision for relocation costs.

Because of market conditions, Yanggu lowered the subscription price to raise a smaller sum of RMB 604m.

High casualties in the rubber accelerator sector

Sunsine entered the rubber accelerator business in 1994. In the IPO prospectus dated June 2007, it identified Tianjin No. 1 Organic Chemical and Zhenjiang Zhenbang Chemical as main rivals. These two are no longer around. Another rival, Dongbei Chemical, that emerged later was closed down for polluting the environment.

The exit of the three enabled Tianjin Kemai and Yanggu Huatai to find a foothold in the industry. But at this juncture, Kemai is still looking for money to grow; and Yanggu will take some time to add new capacity.

Annex A:

|

Local sales |

Local sales VAT |

Exports |

Sum |

Trade receivables |

Time taken to pay invoice |

|

|

RMB m |

RMB m |

RMB m |

RMB m |

RMB m |

days |

|

|

(A) |

(B) |

(C ) |

(A)+(B)+(C ) |

(E ) |

(E )/(D) x |

|

|

(D) |

no. of days in the quarter |

|||||

|

1Q16 |

269 |

46 |

175 |

490 |

461 |

85 |

|

2Q16 |

322 |

55 |

167 |

544 |

500 |

84 |

|

3Q16 |

338 |

57 |

209 |

604 |

570 |

87 |

|

4Q16 |

338 |

57 |

214 |

609 |

548 |

83 |

|

1Q17 |

372 |

63 |

200 |

635 |

550 |

78 |

|

2Q17 |

413 |

70 |

240 |

723 |

554 |

70 |

|

3Q17 |

398 |

68 |

235 |

701 |

579 |

76 |

|

4Q17 |

576 |

98 |

297 |

971 |

638 |

60 |

Notes

The 17% VAT of selling prices are levied on local sales and owed by tyre makers during the credit periods.

Exports are exempted from VAT.

Annex B:

|

4Q COGS |

Finished goods |

Finished goods turnover |

|

|

RMB m |

RMB m |

days |

|

|

(A) |

(B) |

(92*x B/A) |

|

|

2013 |

356.8 |

59.64 |

15 |

|

2014 |

356.4 |

74.64 |

19 |

|

2015 |

347.2 |

67.29 |

18 |

|

2016 |

402.9 |

45.86 |

10 |

|

2017 |

582.1 |

70.0 |

11 |

Notes

COGS: cost of goods sold

* 92 is the number of days in 4Q.