'Wei' contributed this article to NextInsight. He is a full-time investor and hopes to join the fund management industry in the future. Besides investing, he enjoys nature walks and karaoke -- and is still looking for a girlfriend.

|

The joy of having multi-bagger stocks in my CPF investment account

|

UMS was purchased before year 2014 at various stock prices.

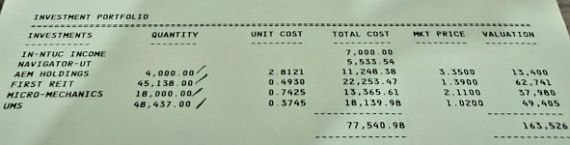

As of this week, all four stocks have increased in value by at least 67% from their original purchase prices.

AEM Holdings, in particular, has shot up further this month (Jan), closing at $4.70 this week, up from $3.35 at end-2017. My purchase price was $2.81.

As of end-2017, as shown in the screenshot of my bank statement, the total paper profit was $98,518 (excluding dividends) from a total investment cost of $65,007.

My views on Revamping CPF Investment Scheme

An investor, Peter Lin, wrote a good article on the potential revamp of the CPF Investment Scheme: https://blog.moneysmart.sg/opinion/heres-singaporeans-know-revamped-cpf-investment-scheme/.

I agree with him that there should be an option to opt out of the proposed Lifetime Retirement Investment Scheme. One way to opt out could be by taking a qualifying test similar to Capital Markets and Financial Advisory Services (CMFAS) Examinations.

Those who pass should be allowed to invest a greater amount in stocks (at least 60% of investable CPF savings from the current 35% limit). This will allow them to build up their nest egg for retirement and housing needs at a faster pace.

There are a substantial number of CPF members who are self-reliant and capable of investing in stocks and generating much higher returns than the average fund.

On the NextInsight portal, readers like Rock, Mr Issac Chin and Ms Sandy Chin had written about how they have generated substantial returns in their stock investment portfolios using cash, SRS or CPF savings.

|

See: ROCK: My $84K SRS Contribution Has Grown To $286,000 in 8 Years INVESTOR: How My Stocks Bought With CPF Savings Have Done (2014)Isaac Chin: How I did in 2015 and my outlook for 2016 |

Wei's previous contribution: "5 Reasons I Invest in CEI CONTRACT MANUFACTURING"