'Wei' contributed this article to NextInsight.

He works in the IT data mining field. He has benefited from the bull market, achieving consistent profit in the last 3 years. Wei's investing focus is on high dividend stocks, particularly those in niche, high growth industries such as medical and lab equipment, life sciences and healthcare. Besides investing, he enjoys nature walks and karaoke -- and is still looking for a girlfriend. CEI (10.5 cents recently) has a market cap of S$36.4 million and a trailing PE of 9.2X. For 1H2014, its revenue grew 4.3% to $56.5 m. Net profit grew 16.1% to $2.36 m. Chart: Bloomberg

CEI (10.5 cents recently) has a market cap of S$36.4 million and a trailing PE of 9.2X. For 1H2014, its revenue grew 4.3% to $56.5 m. Net profit grew 16.1% to $2.36 m. Chart: Bloomberg

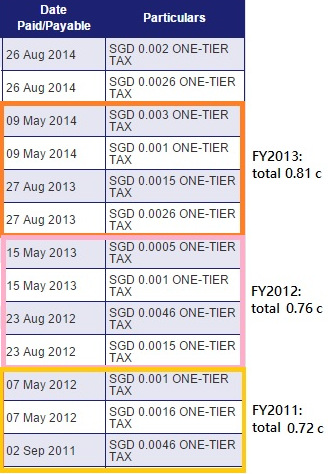

CEI's dividend track record.

CEI's dividend track record.

Source: SGX website.1) Consistently high dividend yield

CEI has consistently paid out good dividends.

For the last 3 financial years, the dividend yield ranged from 7.0% to 7.9%.

For FY13, it was 7.9% and the dividend payout ratio was 77%.

2) Strong management team

CEI has quite a strong management team, led by Mr Tien Sing Cheong and Mr Tan Ka Huat, both veterans in the electronics industry. An interesting story on Mr Tien is available here

As of the FY2013 annual report, Temasek Holdings owned 18.09% of this micro-cap company but has subsequently disposed 9.04% to Singapore-listed private equity fund TIH in Oct 2014.

3) Strong strategic partnership and research

» Machine Vision System in partnership with Ultratech

CEI partnered Ultratech, a renowned US original equipment manufacturer of photolithography and laser processing equipment, to establish full turnkey manufacturing capability of Machine Vision System (MVS). Source: here

Tien Sing Cheong, executive chairman of CEI.

Tien Sing Cheong, executive chairman of CEI.

» Optical metrology instruments for Zygo

CEI was one of the few manufacturers qualified to produce highly sophisticated opto-mechanical instruments for Zygo - a world-renowned supplier of optical metrology instruments. Source: here.

» Member of the A*STAR-led consortium in clean energy

A*STAR formed a strategic partnership with four companies, namely, Rolls Royce, Vestas, SP PowerGrid and CEI Contract Manufacturing, to develop smart grid and distributed energy solutions for Singapore. Source: here

4) Serves the growing industrial equipment sector

CEI Contract Manufacturing provides contract manufacturing services to industrial equipment market in the United States, Europe, and Asia Pacific. It also designs and manufactures its own brand of proprietary equipment for the semiconductor industry.

Tan Ka Huat, MD. NextInsight photo.The company offers its services for electroluminescence displays used in industrial, transportation, and medical applications; medical and health care equipment; office equipment, such as digital photocopiers; analytical instruments comprising gas and liquid chromatographs, and measurement instruments; industrial safety controllers and environmental sensors; and front and back end semiconductor equipment and SMT equipment.

Tan Ka Huat, MD. NextInsight photo.The company offers its services for electroluminescence displays used in industrial, transportation, and medical applications; medical and health care equipment; office equipment, such as digital photocopiers; analytical instruments comprising gas and liquid chromatographs, and measurement instruments; industrial safety controllers and environmental sensors; and front and back end semiconductor equipment and SMT equipment.

5) Beneficiary of rising US dollar and growing US economy

CEI customers are predominantly US companies and sales are mostly denominated in US dollars. The rising US dollar and growing economy may lead to higher sales and foreign exchange gains. Source: here.

As at 30 June 2014, CEI had orders on hand worth $58.2 million, a 23% increase compared to a year earlier. Gross profit margin had also increased to 22.8% (HY 2014) from 22% in Year 2013.

Main risks in investing in CEI are a downturn in the industrial equipment market in the US and a sharp fall in the US dollar.

I was expecting 1 cent dividend for the whole year, turns out to be 1.02 cents. Net profit for the year was also above my expectation.