"Rock" contributed this article, which builds on his earlier forum post, to NextInsight

Tourists at Singapore Flyer. NextInsight file photo When the news emerged in 2014 of Straco Corp buying over Singapore Flyer, Straco shares were sold down from 83.5 cents to as low as 72 cents.

Tourists at Singapore Flyer. NextInsight file photo When the news emerged in 2014 of Straco Corp buying over Singapore Flyer, Straco shares were sold down from 83.5 cents to as low as 72 cents.

The question on many shareholders' mind: Will Singapore Flyer be profitable or be a liability to the company?

Time has proved that buying Singapore Flyer was a wise move.

Mr Wu Hsioh Kwang, Straco's founder and executive chairman and his team, through years of experience have developed plans and calculated all the risks in order to land this spectacular deal.

Straco has turned around Singapore Flyer and made it profitable from day one.

|

|

||||||||||||||||||||||||||||||||

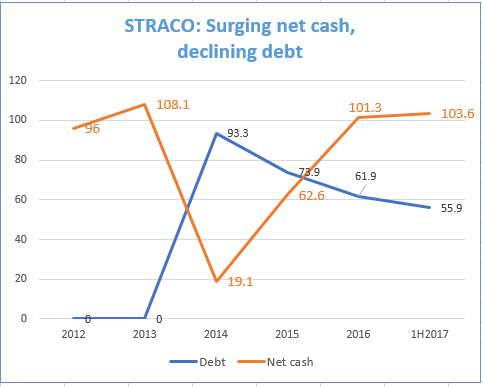

With so much cash in hand, Straco is capable of doing another fruitful M&A deal.

Straco has proven to be truly a cash-generating machine and I will be holding on to this stock for as long as the company continues to generate rich cash.