Buying a life insurance policy expecting it to generate good investment returns for you is like expecting your goalkeeper to score goals for you in football. It rarely happens. |

How often do you chat with a friend, spoken to a relative or even engaged in a discussion with an insurance agent about the importance of buying a life insurance policy?

If you are a working adult with dependants who are reliant on your income, and have yet to consider this question, we suggest for you to read up more in our archive of life insurance articles on DollarsAndSense.sg to first familiarise yourself on its importance. Or to speak to a trusted agent about it.

|

“Many people make the fundamental error of thinking a life insurance policy is an investment plan just because it projects some returns in the benefit illustration. It’s not.” |

The main reason behind buying a life insurance policy is to ensure that those who are reliant on your income are taken care of financially in the event that you are no longer around to provide for them.

However there are many Singaporeans who buy life insurance policies expecting that it will generate a return for them. Here’s why such an approach isn’t a good idea.

Cash Value Component

Whole life insurance policies usually come with a cash value component attached to them. Some people prefer these, instead of cheaper term insurance policies, since there is cash value within the policy. In addition, coverage is for life (or till 99), rather than for a period of time.

Obviously, the cash value component of the insurance policy comes at a cost. As policyholders, you will be paying for it through higher premiums. Part of these premiums will be used to pay for insurance coverage while the remaining is used to build up cash value in the policy. This is usually through putting the money into a participating fund under the insurance company.

If you hold your whole life insurance policy for a long enough time (e.g. 30 or more years), the cash value in the policy will start to generate returns which may even cover the insurance cost that you paid for in your earlier years.

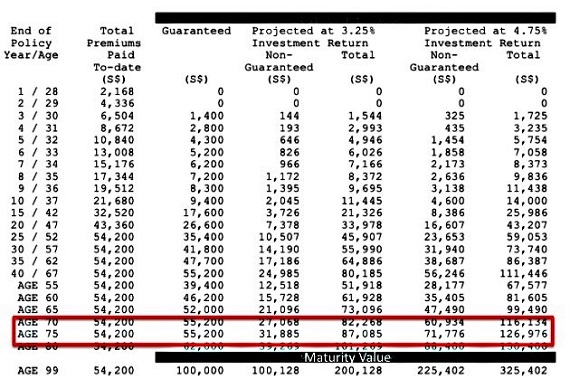

For example, in the benefit illustration above, a policyholder would receive a total guaranteed return of $55,200 if he surrenders the policy at age 75, or at the 47th year of the policy. This is slightly more than the premiums that he would have paid in total ($54,200).

If the participating fund generates an annual return of 3.25%, the policyholder will receive an additional $31,885. This part of the benefit illustration is not guaranteed.

What Happens If The Policyholder Passes On Instead At Age 75?

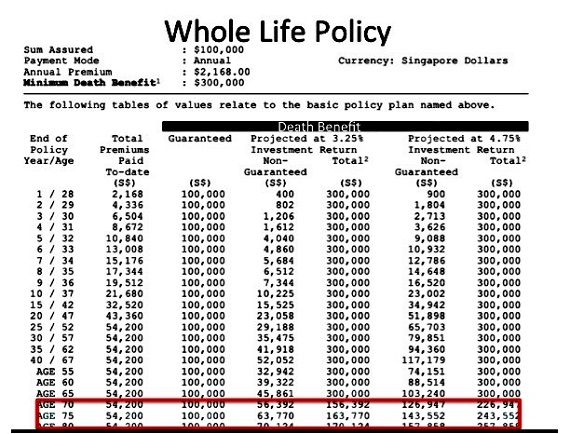

If instead of surrendering the policy, the policyholder passes on at age 75, the death benefit payout will be higher.

The death benefit payout at age 75 is guaranteed at $100,000. If the participating fund generates a return of 3.25% per annum, there is an additional death benefits payout of $63,770.

You can see that death benefit payout is much higher than surrender value. Simply put, you get more from your life insurance policy when you pass away instead of surrendering it.

|

Premiums Paid |

Guaranteed |

Return of 3.75% |

Total |

|

|

Surrender Value |

$54,200 |

$55,200 |

$31,885 |

$ 87,085 |

|

Death Benefit |

$ 54,200 |

$100,000 |

$63,770 |

$163,770 |

A Life Insurance Policy Is NOT An Investment Plan

A life insurance policy is exactly what its name suggests, a policy that you buy to provide your dependants with insurance payout should an insured event occurs. This payout will help them tide over the difficult period where they may face financial difficulties having lost a breadwinner in the family.

Many people make the fundamental error of thinking a life insurance policy is an investment plan just because it projects some returns in the benefit illustration. It’s not.

|

“Expecting that your life insurance plan, even one that comes with a cash value component, will magically transform into an investment and retirement plan during your old age is an unreasonable expectation.” |

Expecting that your life insurance plan, even one that comes with a cash value component, will magically transform into an investment and retirement plan during your old age is an unreasonable expectation.

There have been cases in the past where policyholders (or their dependants) are unhappy with the investment returns (or lack of) from their policy despite having bought into what was a life insurance policy.

A life insurance policy is best seen as a goalkeeper in football. It keeps goals (i.e. adverse circumstances happening) from being scored on you. But you cannot expect it to be scoring goals (i.e. generating high returns) for you. If you do, you will be disappointed.

This article is republished with permission from Dollars and Sense.