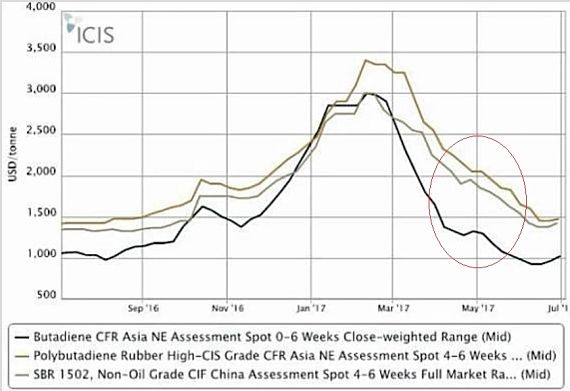

Riverstone Holdings' 2Q17 profit was affected by higher contracted prices for a key raw material, butadiene. Wong Teek Son, executive chairman and CEO, Riverstone Holdings. NextInsight file photoBut Riverstone's stock price has stayed stable following the 2Q17 results release -- despite a negative report by UOB Kay Hian. Wong Teek Son, executive chairman and CEO, Riverstone Holdings. NextInsight file photoBut Riverstone's stock price has stayed stable following the 2Q17 results release -- despite a negative report by UOB Kay Hian.The reason is the market price of butadiene has normalised since June and Riverstone's contracted prices for butadiene for delivery in June 2017 has come down. The price has continued to stay low so far in 3Q17. Riverstone keeps about two weeks worth of raw materials, according to CEO Wong Teek Son.  Butadiene surged to US$3,000 a tonne in Feb 2017 -- a five-year high -- likely owing to temporary production plant shutdown in various places and a spike in demand from China. But it has since fallen to around US$1,000 a tonne. Butadiene surged to US$3,000 a tonne in Feb 2017 -- a five-year high -- likely owing to temporary production plant shutdown in various places and a spike in demand from China. But it has since fallen to around US$1,000 a tonne. |

The day after its 2Q results release on 3 Aug, Riverstone's stock price dipped only 1.5 cents to $1.05, which is a shade below its 52-week high of $1.10. It closed last Friday at $1.06.

|

Target prices |

|

|

UOB Kay Hian |

96 c |

|

CIMB |

$1.20 |

UOB Kay Hian analyst Edison Chen, in a report on 4 Aug, was disappointed with the 2Q results, saying they were "lacklustre and below our expectations."

While revenue rose 36.1%, net profit dipped 0.8% to RM27.1 million. Gross margin shrank 3.9 percentage points y-o-y to 20.5% on higher raw material costs.

|

Stock price |

$1.05 |

|

52-week range |

81.5 c – $1.10 |

|

PE (ttm) |

19 |

|

Market cap |

S$778 m |

|

Shares outstanding |

741 million |

|

Dividend |

1.98% |

|

Year-to-date return |

19% |

|

Source: Bloomberg |

|

But with raw material prices dropping sharply from their highs, Riverstone's gross margins are recovering.

Riverstone negotiates selling prices of its healthcare gloves with purchasers every month. It's half-yearly - or longer -- for cleanroom gloves.

Thus, the current 3Q should see a rebound in gross margins.

(By volume, Riverstone's production is split 80-20 between healthcare and cleanroom gloves).

|

Year |

Added capacity |

Final Capacity |

|

|

2013 |

-- |

3.1 billion |

|

|

2014 |

+1.1 billion |

4.2 billion |

|

|

2015 |

+1 billion |

5.2 billion |

|

|

2016 |

+1 billion |

6.2 billion |

|

|

2017 |

+1.4 billion |

7.6 billion |

|

|

2018F |

+1.4 billion |

9.0 billion |

|

|

2019F |

+1.4 billion |

10.4 billion |

A critical metric for Riverstone is the capacity utilisation rate, which has been maintained at 90%, even after it raised its production capacity by 1 billion gloves in 2016.

The capacity expansion continues this year with the first production line to be commissioned this month (Aug).

Riverstone has just surprised the market with news that it would raise the target new capacity for 2017 from 1.0 billion to 1.4 billion. Thus, by end-2017, Riverstone's total capacity would be 7.6 billion.

The extra capacity has attracted committed buyers already.

CIMB has lifted its FY17-19F earnings per share by 8.4-19.0% to factor in the new capacity expansion plan.

Currently, the planned expansion stretches out until 2019 (see table).

Watch video of our visit to Riverstone's factory in 2016 -->

For CIMB's report, click here.

For UOB KH's report, click here.