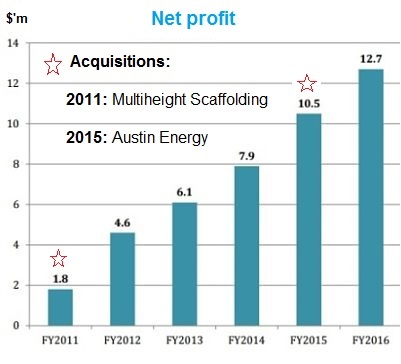

Nordic has been upping its net profit by roughly $2 million a year, thanks to two acquisitions that helped offset the impact of the global shipbuilding downturn on one of its business segments. At its full-year results briefing in March 2017, Nordic Group's chairman said senior management is "committed to putting in place pillars and building blocks to try to grow at 20% a year." Nordic has been upping its net profit by roughly $2 million a year, thanks to two acquisitions that helped offset the impact of the global shipbuilding downturn on one of its business segments. At its full-year results briefing in March 2017, Nordic Group's chairman said senior management is "committed to putting in place pillars and building blocks to try to grow at 20% a year." Last week, Nordic delivered again. Its 1Q17 net profit came in at S$2.8 million, up 21% y-o-y. But it was not without a struggle and a positive outcome from an opportunistic move. |

|

S$’m |

1QFY17 |

1QFY16 |

Change |

|

Revenue |

19.9 |

19.8 |

1% |

|

Gross profit |

6.1 |

6.3 |

-3% |

|

Gross profit margin |

30.6% |

31.7% |

-2.1 ppts |

|

Operating expenses |

(2.3) |

(3.2) |

29% |

|

Net profit after tax |

2.8 |

2.3 |

21% |

In 1Q17, Nordic cut its operating expenses by 29% y-o-y (or S$932,000) as it downsized its staff strength in China where its systems integration business continued to be challenged by the shipbuilding industry downturn.

The topline contribution from Nordic's operating businesses slipped but this was offset by $1.4 million in revenue from a one-off transaction. It also led to a substantial profit contribution.

This was Nordic's first (and opportunistic) investment in a financial instrument in China's nascent carbon trading market. Nordic has outstanding similar investments whose results will be apparent in the near future.

|

Nordic's record order book* |

|

|

As at end-1Q2017 |

$20.9 m |

|

New contract post-1Q2017 (as of May 11) |

$3.9 m |

|

Ensure Engineering |

$14.8 m |

|

New petrochem client |

$35.0 m |

|

Total |

$74.6 m |

|

* Orderbook doesn’t include maintenance contracts as they are contracted at unit rates and do not have an upfront contract value. |

|

Two new contributors will figure strongly in Nordic's fortunes going forward: Ensure Engineering and an unnamed petrochemical MNC.

They have boosted Nordic's orderbook to a record high of about $74 million, which is roughly 2x the ongoing orderbook of Nordic in past years.

The table shows the recent orderbook totalling $74.6 million but it is actually slightly lower now because the end-1Q17 orderbook of $20.9 million has been partially fulfilled since.

The new petrochem client has awarded Nordic a $35-million project contract to be fulfilled over three years. The work involves scaffolding, insulation and coating.

| On 28 April 2017, Nordic acquired 100% of Ensure -- its third acquisition since 2011 which is set to lift Nordic's profit to a markedly higher level. That may not be apparent from Ensure's reported profit for 2016 of S$1.3 million. It was much lower than its past earnings, noted Mr Chang Yeh Hong, executive chairman of Nordic, at its 1Q17 briefing. Reasons: Ensure's earnings were beset by certain events in 2016 -- including long-running internal shareholder disputes which led to a court hearing, and the deferment by a major petrochem client of a turnaround project. If Ensure's profit reflates to its historical levels, it will lift Nordic's bottomline significantly. This will be partly offset by finance costs from bank borrowings by Nordic to finance the acquisition.  Chang Yeh Hong, executive chairman of Nordic Group. NextInsight file photo What Nordic got from buying Ensure: Assets including three industrial properties valued at about $16 million and $14.6 million in cash. Chang Yeh Hong, executive chairman of Nordic Group. NextInsight file photo What Nordic got from buying Ensure: Assets including three industrial properties valued at about $16 million and $14.6 million in cash. Ensure came with an order book of $14.8 million, excluding maintenance contracts which do not have an upfront value but are worth several million dollars a year. On the liabilities side, Nordic has assumed, among other things, Ensure's $28 million of long-term borrowings. The cash consideration for Nordic's purchase of Ensure is S$18 million of which $10 million is in cash and $8 million in deferred cash payment to the vendors over 4 years, subject to profit targets being met (See terms). Ensure's business is complementary to Nordic Group's. According to Mr Chang, Ensure, which currently provides its mechanical services in industries such as waterworks and waste incineration in Singapore, will open doors for Nordic to bundle its services (electrical, instrumentation and automation) to serve Ensure's clients. For more on Ensure, visit its website. For Nordic's 1Q presentation materials, click here. |