Excerpts from analysts' reports

UOB Kay Hian analyst: Edison Chen

♦ Declout boasts an enviable track record of harvests. While incubating businesses involves levels of risk, Declout has performed two major harvests: a) Procurri, which was spun off and listed on the SGX mainboard, for 233% ROI and 79% IRR (over 3.25 years), and b) Acclivis, sold to CITIC, for 111% ROI and 71% IRR (over 4 years).  Vesmond Wong, executive chairman and CEO of DeClout. NextInsight file photo Since its IPO in 2012, Declout has ramped up its revenue from S$50m to S$300m and total assets from S$60m to S$320m with only S$140m raised (debt + equity).

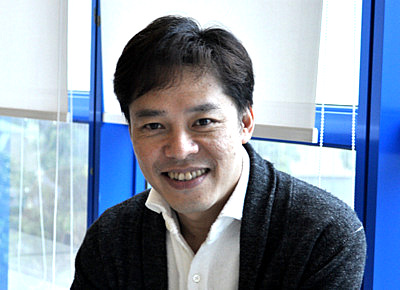

Vesmond Wong, executive chairman and CEO of DeClout. NextInsight file photo Since its IPO in 2012, Declout has ramped up its revenue from S$50m to S$300m and total assets from S$60m to S$320m with only S$140m raised (debt + equity).

♦ Beaqon could be next harvest target. Beaqon is one of the leading players in Southeast Asia to provide end-to-end technology and telco solutions with a future proof model ready for the Internet of Things and Smart Nations, riding on the increased demand for data centres. With profitability and size similar to Acclivis (sold for S$75m), Beaqon could be the next major harvest target after Procurri and Acclivis.

♦ Declout expects earnings to triple for first spin-off, Procurri, before 2019. While Procurri currently trades below IPO price, Declout remains bullish about its growth prospects, expecting triple earnings in the next two years through organic and inorganic growth. Just last year, Declout increased its stake of the data centre equipment IT distributor and lifecycle services provider from 46.5% to 47.3%.

|

|

♦ Remaining businesses are e-commerce and e-logistics provider. Other than the above-mentioned IT Infrastructure businesses, Declout also has two primary businesses operating in the vertical domain cloud (VDC):

a) Corous360, an O2O platform provider handling games content and distribution which includes the 1m-user PLAYe platform, and

b) vCargo Cloud, an e-logistics platform which provides trade, supply chain and efreight. There is already interest in Corous360 as its Shenzhen subsidiary is being sold.

♦ Remaining businesses implied to be available at only S$59.9m. Assuming that its 47.3% stake in Procurri is worth S$47.0m (based on current market cap), its remaining businesses are available at around S$59.9m. This mainly includes an IT infrastructure company with similar size and profitability to Acclivis and two VDCs incubations.

Full report here.

| Lim & Tan Research says ..... | ||||||||||||

|

Based on the recently published Annual Report 2016, Beaqon alone yields a net profit after tax of S$3.2m for FY2016, registering a 23% CAGR while EBITDA and revenue nets S$5.9m and S$72.8m respectively.

P/S: A total of 10 m shares have been acquired at an average price of 17.4 cents/share. The Chairman and CEO, Mr. Vesmond Wong, last purchased 9.0m shares at an average price of 20 cents/share on 17 October 2016. |