DECLOUT is speeding towards the IPO of a subsidiary on the mainboard of the Singapore Exchange.

The listing of Procurri will result in a windfall of about S$50 million for DeClout, according to NRA Capital (see: DECLOUT: Shocking S$50m windfall if spinoff succeeds).

How did DeClout, listed in 2012, speedily arrive at its present level of success?

It has grown substantially through M&As, reporting S$5.0 million in net profit attribuable to shareholders for 2015 on S$279.5 million in revenue.

DeClout operates in the IT industry, not exactly a familiar one to many investors. To learn more, view Channel NewsAsia's programme on DeClout just last Friday (May 20).

In that show, DeClout executive chairman Vesmond Wong gave his quick take on the opportunities and risks of his business, as follows:

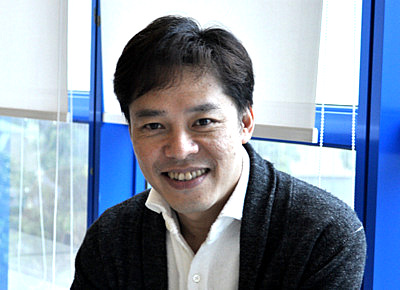

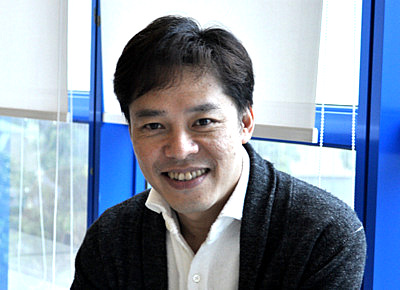

DeClout executive chairman and CEO Vesmond Wong. NextInsight file photo.We are in a very fast paced technology arena. Because of the speed, what we do today will become obsolescent. My fear is we become irrelevant to the market, we lose sight of the landscape, we are not focusing on the customer and that's not what our customers wants anymore.

DeClout executive chairman and CEO Vesmond Wong. NextInsight file photo.We are in a very fast paced technology arena. Because of the speed, what we do today will become obsolescent. My fear is we become irrelevant to the market, we lose sight of the landscape, we are not focusing on the customer and that's not what our customers wants anymore.

So this is really the fear that we have. All we need to do is look at the tech giants of the past. In a change of landscape all these giants just disappeared.

We are a small company compared to them and we will face the same fate if we are actually not alert.

The advantage we have is we are small, nimble, agile. However if we cannot focus on all this, we will also be wiped out in the same manner and all our hard work will be gone in a flash.

Kow Ya (right), an executive director of DeClout, said in the show: "One of the most important qualities of a successful business is to always stay paranoid.

Kow Ya (right), an executive director of DeClout, said in the show: "One of the most important qualities of a successful business is to always stay paranoid. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors