Excerpts from analyst's report

UOB Kay Hian analyst: Nicholas Leow

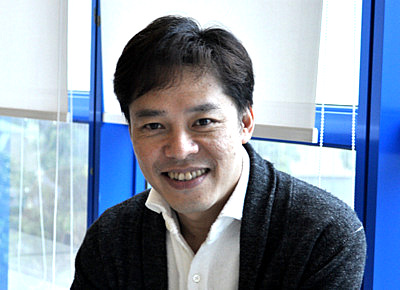

Vesmond Wong, chairman of DeClout. Vesmond Wong, chairman of DeClout. NextInsight file photo.DECLOUT LTD (DLL SP): Cloud Nine On The Horizon VALUATION • Declout is trading at a trailing 17.9x FY15 PE and a trailing 1.3x FY15 PB which is about 30% below its historical 3-year average PB ratio. |

INVESTMENT HIGHLIGHTS

• Management update. This note highlights our key takeaways following our recent management meeting.

• Declout is a global builder of next-generation cloud, data, e-commerce and marketplace companies. The company invests in, incubates and scales companies to be market leaders in their industries. Since its IPO, Declout has grown from an 80 man team to a company of 544 employees today.

• Identifying disruptive trends. Declout’s business is focused on identifying and building on disruptive technology. First, Declout identifies disruptive trends to create growth platforms and then incubates the businesses concerned. Second, Declout uses its existing network and in-house expertise to scale the companies. Finally, in the harvesting stage, the portfolio companies are usually spun-off in 3 to 5 years to reward shareholders.

• Procurri is ready for harvesting. Procurri is an IT asset recovery and independent maintenance services subsidiary of Declout. Declout aims to spin-off Procurri by the end of 2016 on the mainboard of SGX-ST. Procurri contributed about S$120m or 44% of total group FY15 revenue with a net profit after tax of S$8.8m. In a span of two years, Declout has turned Procurri into a profitable business.

| ♦ Next in line for harvesting |

| "Acclivis has experienced exponential revenue growth, recording a CAGR of about 210% from FY13-15. The company turned profitable in FY14 and registered 60% growth in net profit in FY15. "We reckon that once the Procurri business has been spun off, Acclivis will be the next in line to be harvested." -- Nicholas Leow |

• Acclivis waiting on the wings. Acclivis is an end-to-end regional information and communications technology (ICT) provider, engaged in cloud solutions. The company currently has four data centres across the region. In order to gain greater market share in the internet services space, Acclivis acquired internet service provider Pacnet’s (ISP) assets and business in Singapore and Thailand in Nov 15.

• A beneficiary of enhanced M&A schemes announced in Singapore’s Budget 2016. Declout’s growth can be attributed to a combination of prudent acquisitions and a strong operational team which has allowed the group to grow both organically and inorganically. The M&A scheme was first introduced in 2010 to encourage companies to consider M&As as a strategy for growth and internationalisation.

In the Budget 2016, the M&A scheme was enhanced to support more M&As with a tax allowance of 25% to be granted for up to S$40m (up from S$20m) of consideration paid for qualifying M&A deals per year of assessment. We believe that Declout will be a direct beneficiary of the scheme as the company continues to scour the region for disruptive technology to compliment the existing portfolio.

Full report here.