Helipad on offshore oilrig (Photo from Rex annual report) Helipad on offshore oilrig (Photo from Rex annual report)

Rex International’s oil discoveries in Oman and Norway in the last 3 years has led it to focus on its oil concessions there. These concessions include 6 offshore assets in Norwegian waters and the Block 50 license in Oman. Petroleum consultancy Gaffney, Cline & Associates recently assessed the Group’s concession at Edvard Grieg South (Rolvsnes or EGS) in the North Sea to have a gross contingent resource (3C high estimate) of up to 77.9 million barrels of oil. |

Oil was discovered at the EGS concession in December 2015, the first time that the Group’s Rex Virtual Drilling technology was applied to an unconventional weathered and fractured basement reservoir. The Group expects test production from its EGS concession to start in 2019.

“Our aim is to prove up adjacent fields in the mid to long term to grow our pool of resources, on top of achieving production in EGS in the short term.” |

Exploration in Norway benefits from long-term political stability and an exploration friendly tax structure.

“Accredited pre-qualified petroleum companies such as Lime Norway are eligible for tax rebates of 78% of their upfront exploration costs,” said CEO Måns Lidgren.

Lime Petroleum Norway (Lime Norway) is an exploration company that is 87.84% owned by the Group.

The EGS concession illustrates the Group’s technology and infrastructure-led strategy in Norway, according to the CEO.

“We have used our Rex Virtual Drilling technology to select and build a cluster of investments in this oil prolific area that already has pipeline infrastructure in place.

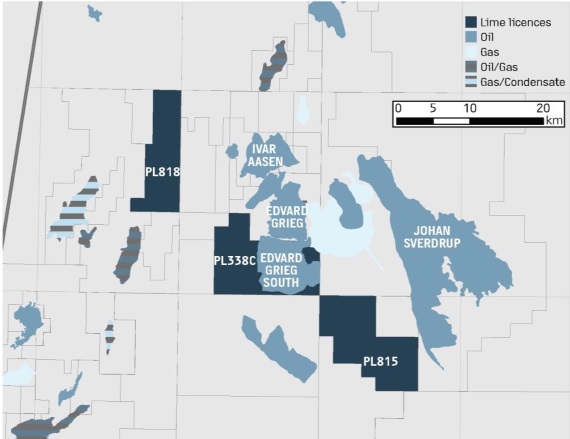

“This gives us a fast-track path to potential commercialisation and return on investment when we make more oil discoveries,” he said. Lime Petroleum oil exploration concession area in the North Sea: PL338C, PL815, PC818. (Map: Company)

Lime Petroleum oil exploration concession area in the North Sea: PL338C, PL815, PC818. (Map: Company)

Oil was discovered at the EGS concession near to Johan Sverdrup, one of the five largest oil fields on the Norwegian continental shelf with expected resources of between 1.9 to 3.0 billion barrels of oil.

| Stock price | 5.9c |

| 52-week range | 4.4c - 11.2c |

| Market cap | S$80.5m |

| Price-Book | 0.448 x |

| Source: SGX StockFacts | |

It is adjacent to the producing Edvard Grieg and Ivar Aasen fields, which have estimated combined reserves of some 400 million barrels of oil.

Lime Norway is also evaluating several farm-in opportunities that are already oil producing. Acquiring interests in producing concessions owned by other operators has financial and tax benefits in addition to reducing overall business risk.

Lime Norway secured a two-year extension of a credit facility of NOK 400 million (about US$46 million) in December 2016.

Rex International narrowed its net loss from US$56.9 million in FY2015 to US$31.7 million in FY2016.

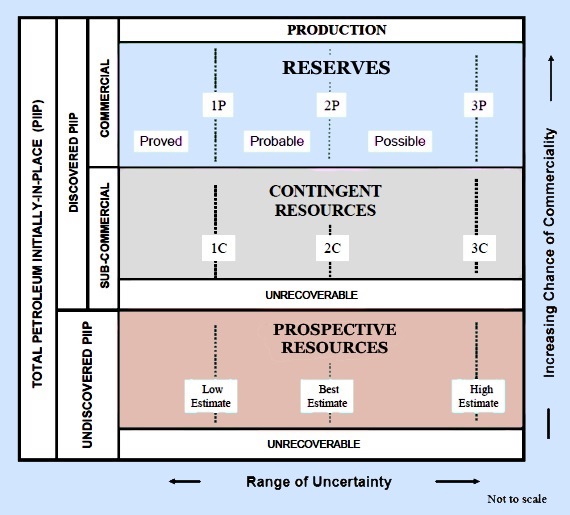

| ♦ 'Contingent' vs 'Reserves' |

The oilfield asset at EGS was classified in Gaffney, Cline & Associates’ independent qualified person's report as ‘contingent’. The ‘contingent’ classification means that the recoverable volumes are estimated from known hydrocarbon accumulations that have been proven through drilling and are associated with a development plan. ‘Reserves’ may only be so classified if the oil has been assessed to be commercially recoverable with the following conditions:

|