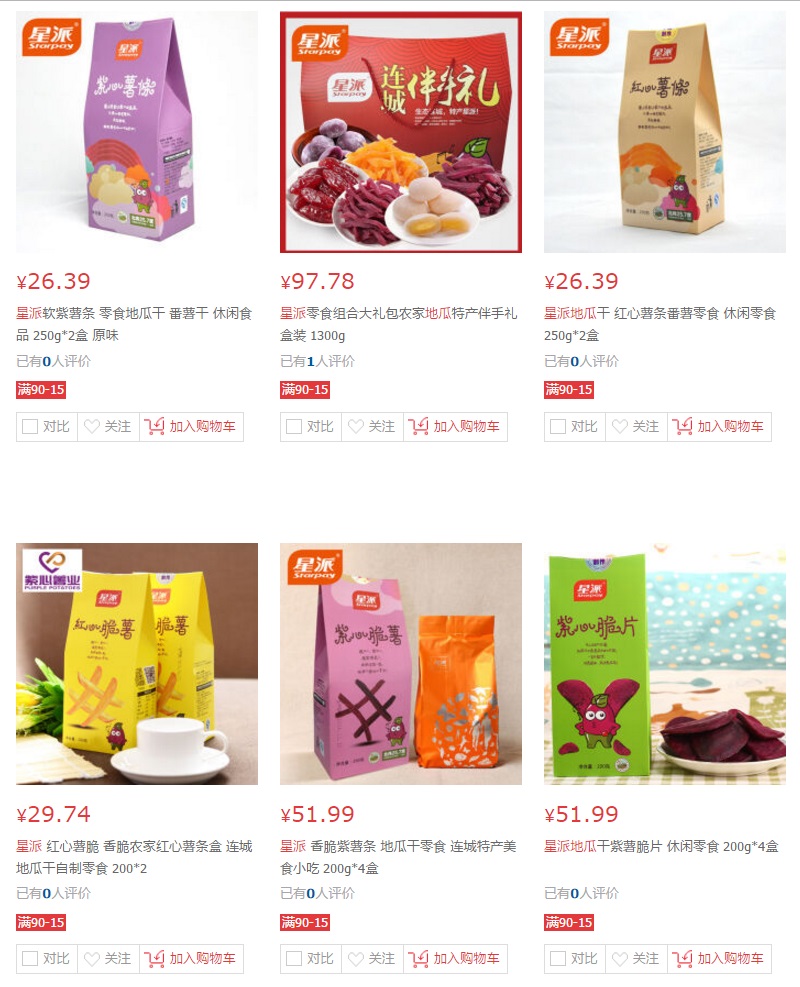

Results of a search for China Star Food's Starpie snacks on leading PRC e-commerce platform JD.com. (Image: JD.com) Results of a search for China Star Food's Starpie snacks on leading PRC e-commerce platform JD.com. (Image: JD.com)

CHINA STAR FOOD’s recent deal to distribute snacks through Wal-Mart Stores Inc (Walmart) stores is a two-pronged breakthrough. Not only has it penetrated the hypermarket segment, the leading producer of sweet potato health snacks also is riding on Walmart’s e-commerce strategy. |

E-commerce boom

China’s online market for fast moving consumer goods (FMCG) grew by 47% in the 12-month period that ended in June 2016, according to Kantar Worldpanel. The expert in shoppers’ behaviour expects online FMCG sales to grow from US$48 billion globally in 2016 to US$150 billion by 2025.

Last October, Walmart made two strategic investments to establish its foothold in China’s e-commerce market.

“Our breakthrough into a national hypermarket chain lays a solid foundation for expanding our footprint in other mega markets in China. |

Firstly, it doubled its stake in PRC online retailer JD.com to about 10%.

JD.com is China's second-largest e-commerce player by gross merchandise volume behind Alibaba.

The company is backed by Tencent, China's dominant social networking company and the owner of popular messaging platform WeChat.

Then, it invested US$50 million in New Dada, China’s largest local on-demand online logistics and grocery platform. New Dada has the capability for two-hour delivery service from Walmart stores.

Market experts view online shoppers as the driver behind the current phase of China’s growth story. They are young, urban, highly educated, and more willing to spend. This fits well with China Star Food’s main customer profile of health conscious and discerning consumers who are willing to pay for quality products.

Compared to brick-and-mortar retailing in China, e-commerce sales also enjoy the advantage of fewer licensing requirements and quicker customs clearance.

| Stock price | 18.8c |

| 52-week range | 17c - 45c |

| Market cap | S$44m |

| Price Earnings | - |

| Price-Book | 0.62x |

| Current ratio | 3.3x |

| Source: Company / Bloomberg | |

China Star Food places its products on Walmart shelves through a distributor that specializes in snack food distribution.

This distributor is familiar with the operational process of Walmart China, and uses a real-time system to monitor the inventory levels for Group’s stock keeping units at stores nationwide.

The system helps the distributor to assign its sales promoters to locations that need a push for sales, as well as timely replenishment of product shelves.

The management believes that its penetration into the hypermarket / supermarket segment allows it to tap into a wider customer base, and strengthens its leadership position in the sweet potato snack food industry.

For its media release on its 1HFY2017 financial results for the half-year ended 30 September 2016, click here.