|

|

Rubber accelerators @ Sunsine's plant. NextInsight file photoAs background, the three groups of rubber chemicals that Sunsine produces -- rubber accelerators, anti-oxidants and insoluble sulphur -- are essential to tyre manufacturing. Sunsine is the world's largest rubber accelerator producer,

Rubber accelerators @ Sunsine's plant. NextInsight file photoAs background, the three groups of rubber chemicals that Sunsine produces -- rubber accelerators, anti-oxidants and insoluble sulphur -- are essential to tyre manufacturing. Sunsine is the world's largest rubber accelerator producer, with a 17% market share. It is also China's largest insoluble sulphur producer.

Sunsine started producing rubber accelerators in Shanxian County in 1994. Foreseeing that the authorities would eventually weed out factories that cause harm to the environment, it opted for green, though costlier, production methods.

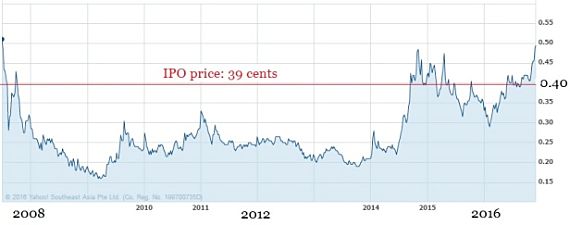

Sunsine’s IPO netted $52m (or RMB 260m) for it to expand its production capacity of rubber accelerators by 10,000 additional tonnes, and insoluble sulphur and TMQ, a low-grade anti-oxidant, by 5,000 tonnes each.

Further capacity expansion

As its strategy is to grow sales volume and market share to achieve better economies of scale, Sunsine expanded further in subsequent years, setting up two new bases and adding another 100,000 tonnes of capacity (see table):

| Capacity (tonnes) | |||

|

Before IPO

|

Immediately after IPO | Thereafter and up to end-2015 | |

| Rubber accelerators | 32,000 | 42,000 | 87,000 |

| Insoluble sulphur | nil | 5,000 | 20,000 |

|

Anti-oxidants

|

|||

| i) TMQ | nil | 5,000 | 10,000 |

| ii) 5PPD | nil | nil | 5,000 |

| iii) 6PPD | nil | nil | 30,000 |

| Total | 32,000 | 52,000 | 152,000 |

Sunsine has also built a plant to supply steam for use by its Shanxian factories as well as other factories nearby.

The projects implemented after IPO cost a total of RMB 1,000m. Moreover, as sales quadrupled to RMB 1,859m in 2015 from RMB 475m before IPO, working capital for inventories and trade receivables rose correspondingly to RMB 638m from RMB 158m.

Notably, Sunsine did not resort to raising funds through a share placement or rights issue. Instead, it relied on retained earnings and loans.

Uninterrupted dividend payment

The high capital outlay and bank loans, which peaked at RMB367 m at end-Sep 14, did not deter the company from paying dividends to shareholders for nine consecutive years after IPO. Moreover, the dividend of 1 cent a share was raised to 1.5 cents in 2015 and 2016. All in, Sunsine's shareholders have received RMB 229m.

| Year of purchase | No. of shares | Average price | |

| 2008 | 7,253,000 | 19.51 c | |

| 2009 | 7,084,000 | 18.82 c | |

| 2011 | 1,216,000 | 24.74 c | |

| Early 2012 | 10,592,000 | 25.87 c | |

Share buyback

Sunsine bought back its shares in 2008, 2009, 2011 and 2012 at prices that were very much lower than the IPO price. There were four years when the share buyback was suspended as Sunsine increased its borrowings from banks.

When Sunsine ceased buying back its shares, the company was viewed by some shareholders as being over-cautious. They opined that Sunsine had always managed to stay liquid. When its bank loans peaked at RMB 367m at end-Sep 14, the company had RMB 149m in cash and RMB 206m in promissory notes that could be encashed at the issuing banks. Thus, its loan default risk was negligible. The opportunity of buying back shares on the cheap to enhance shareholders' value was missed.

Bank loans

With good cash flows, largely from Sunsine’s mainstay product of rubber accelerators, bank loans dwindled very quickly, to RMB 214m by end-2014 and RMB 145m a year later.

The outstanding loan of RMB 83m at end-Sep 16 was out-matched by RMB 312m in cash and RMB 189m in promissory notes.

| Period | Number of shares bought back | Average price |

| 30 May - 1 June 16 | 490,000 | 38.67 c |

| 29 Nov - 12 Dec 16 | 873,200 | 47.31 c |

Its strong financial muscles enable Sunsine to resume its share buyback at much higher prices than before (see table).

Sunsine’s cash level, which stood at RMB 312m at end-Sep 16, is set to rise even higher because further capacity addition will not cost much.

New capacity on the horizon

Because of its track record in the rubber accelerator industry, Sunsine has managed to sell all it can produce.

Sunsine has set up a new base dedicated to the production of TTBS, a high-grade rubber accelerator. The first 10,000-tonne line will be ready for commercial production next year. Production lines for another 20,000 tonnes will be installed next year. By then, its TBBS capacity will be 55,000 tonnes, almost half of its rubber accelerator capacity of 117,000 tonnes.

The capital cost for the new base is around RMB 90m. By end-Sep 16, around RMB 50m had been paid, leaving a small balance of RMB 40m.

With regards to the other product, insoluble sulphur, sales were slow initially, but by 2015 the capacity utilisation reached 75%. In the second and third quarters of this year, production exceeded capacity. Insoluble sulphur is now being produced in Shaxian and the new base at Dingtao, each with a 10,000-tonne capacity. As the infrastructure at Dingtao was built for an output of 30,000 tonnes, adding a new line will not cost much.

The technology for making insoluble sulphur is more demanding, and tyre factories in China are very reliant on imports.

Sunsine is unlikely to expand its anti-oxidant segment (capacity 45,000 tonnes) for now as there is still considerable spare capacity, though it is diminishing quite quickly with a pickup in sales (see table). The utilisation rate was 48% in 2015 but may hit 70% this year, with the 47% output increase in the first nine months of this year.

The main product in the anti-oxidant segment is 6PPD, which started sales only in 2012. Sunsine invested RMB 200m for 30,000-tonne capacity (those of TMQ and 5PPD are 10,000 tonnes and 5,000 tonnes, respectively).

| tonnes | ||

| 2012 | 5,183 | |

| 2013 | 12,281 | |

| 2014 | 19,903 | |

| 2015 | 21,640 | |

| 9m15 | 16,240 | |

| 9m16 | 23,942 | |

Acceptance of Sunsine's 6PPD is rising judging from recent sales figures of anti-oxidants (see table).

|

2016 profit to exceed record 2014 profit?

Sunsine earned RMB 82.6m in the first half of this year. 3Q 16 profit of RMB 72.8m was unexpectedly strong, on higher sales volume.

The RMB 260m IPO money had enabled Sunsine to kickstart its expansion plan. Without it and without careful cashflow management, Sunsine would not be able to spend a total of RMB 1,737 m and still had net cash of RMB 196m at end-Dec 15 (see table). |