Republished from ThumbTackInvestor with permission

THIS IS A CONTINUATION OF MY EARLIER POST: Geo Energy Resources Investing Thesis – Part I

In Part I, I described the recent history of the company, its acquisitions and growth, and the recent positive developments for the company. I also analyzed its debt issue and potential cashflow requirements.

In the mid-term though, IMHO, the single most important factor that will determine how well the company does, is coal price.

That’s probably true of most commodity companies. Acquisitions and offtake agreements are great, but coal price is without doubt, the single biggest factor.

So let’s look into the macro factors for coal.

Coal Price Trend

Coal prices have not been kind to almost anyone in the entire supply chain. This chart gives a gauge of how Indonesian coal prices looked like in the past 6 years:

This widely used HBA marker is derived from the average of 4 coal price indices in Indonesia, all of which are of the high GAR value variety, NOT the GAR 4,200 coal that Geo Energy has, but the trends would be rather similar.

Specifically for Geo Energy’s 4,200 GAR coal, prices hit a multi-year bottom sometime in 1Q2016, and have been recovering strongly since then:

| 4,200 GAR value coal selling prices (US$/tonne) | |

| 2013 | $42.6 |

| 2014 | $54.3 |

| 2015 | $31.7 |

| 1Q2016 | $26.66 |

| 2Q2016 | $27.96 |

| August 2016 | $30.71 |

| September 2016 | $36.27 |

Based on 2Q2016 prices, Geo Energy’s cash profit increased to USD 4.50/tonne.

Since 2Q, the selling price has increased strongly, with costs likely to be roughly maintained. Hence, it is safe to predict that Geo Energy’s cash profit would’ve tracked the increase in coal prices just as strongly, to be significantly >USD 4.50/tonne.

Let’s bear in mind that there’s lag time between current coal prices, and the point when the results show up in the financials. This means that a current uptrend in selling prices will show up in improved profitability in the next financial statement, and improved cashflows for the next financial statement and perhaps even the one after that.

Supply & Demand

Global coal production, and consequently coal supply, dropped significantly in 2015:

China, in particular, has seen its coal production cut by 10% y-o-y, with coal imports making up for the shortfall. This coal production cut was deliberately done by the Chinese government, amidst concerns of excessive production during the sharp decline in 2015.

Chinese coal demand, on the other hand, has dropped only 5%, hence China has a sudden need to import coal to make up for the shortfall. The import volumes has risen dramatically since the end of Q1. This chart shows it nicely:

As China alone accounts for 50% of the total global coal production, any change in its coal production and/or coal demand has huge implications on global markets. Chinese power stations are also the “end-users” of Geo Energy’s coal, although the company is in the midst of negotiating with Indonesian power plants as well. More on this later.

With production falling off in 2016, global demand is likely to exceed supply for the 1st time in recent years. 2016 coal demand is forecast to be 862million tonnes, while supply is forecast to be 846million tonnes.

Aside from global and Chinese demand for coal, Indonesia is also fast becoming one of the major consumers of coal, with its consumption increasing by 15% in 2015, resulting in Indonesia being the 8th largest coal user in the world.

Adding to the near- to mid-term demand for coal is the Indonesian government’s 35GW power plan, released in May 2015. Basically, the government has determined that the country needs substantially more investment in power plants to meet the future electricity needs of the country.

Out of the 35GW planned, coal powered power plants will account for 20GW, with a corresponding increase in coal needs by 85mil tonnes/year.

Being situated in Indonesia, Geo Energy would be well-placed to capitalize on this. The company has already indicated that this is one aspect that they are considering.

In fact, they have gone as far as to say that they’re planning to supply coal via Perusahaan Listrik Negara, Indonesia (“PLN”), which is an Indonesian government-owned corporation.

While investors should keep this in mind, currently, I ascribe a value of absolutely zero to this development. This is because Indonesian infrastructure plans have typically proven to be problematic. In fact, there are some reports of delay and stuff regarding this electrification plan. I won’t describe it here, but delays are mainly due to getting the land rights to build the power plants.

To further illustrate my point about ascribing a value of 0 to this potential development, Geo Energy has previously, back in Feb 2015, announced a cooperative agreement with a Chinese SOE to construct, develop and manage power plants in Indonesia.

This was the announcement:

The agreement is non-exclusive, and has a validity of 2 years. All these details were repeated in the AR 2015. Since the agreement was inked in Feb 2015 though, there has been absolutely no further news/development.

I’d assume this expires in Feb 2017, which is a mere 4 months away, and from what I have found, this agreement has provided no economic benefits to Geo Energy. Except some initial bragging rights.

I can imagine the optimism it provided shareholders when it was first announced. This illustrates why I tend to be more cautious and unless the writing’s on the wall, I’m assuming it’s just noise.

Still, pursuing coal supply agreements with potential end-users in Indonesia (coal power plants) makes perfect sense for Geo Energy and I’m glad to see that management has already indicated that they’re pursuing this.

Being situated within the country itself, logistics such as transportation would be much cheaper. The company would also presumably have more local know-how and contacts to secure such deals.

It remains to be seen if they’d be successful. We have to keep in mind that there are many coal producers in Indonesia.

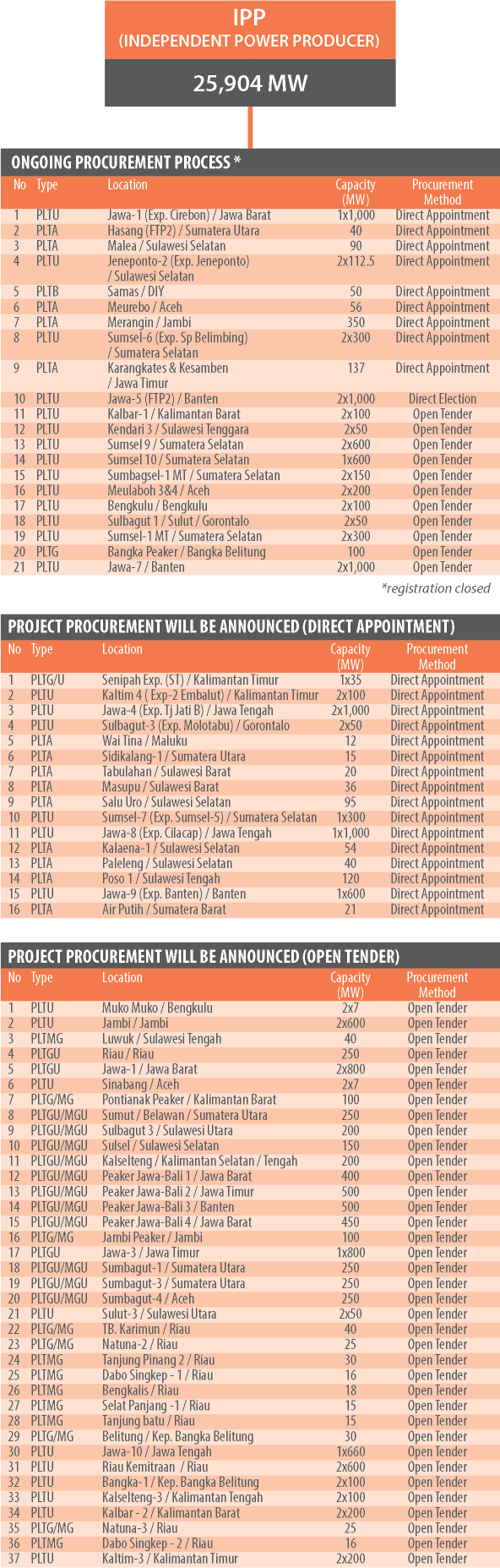

Here is a list of power plants coming up in various parts of Indonesia:

Some of the planned power plants such as No.11 (Kalimantan Barat) from the 1st slide, No.1 and 2 (Kalimantan Timur) from the 2nd slide and No.7,11, 33, 34 and 37 (Kalimantan Barat, Kalimantan Selatan) in the 3rd slide, are all situated within close proximity of the SDJ and TBR mines, which are situated in South Kalimantan.

These power plants are steam power plants or combined cycle power plants, both of which utilize coal to generate steam for electricity.

Just to recap: We have considered the coal supply and demand situation in China. We have also considered the potential demand from Indonesia.

Finally, let’s consider the coal situation in the US. Although the US does not have a direct impact on Geo Energy, being the 2nd largest coal producer after China, we do have to consider its current supply and demand trend, and the implications for the future.

Here are the latest stats/data I derived from the US Energy Information Agency (EIA):

For the week ended 1st Oct 2016, collectively, the US coal producers have produced 16.7mil tons of coal.

This is 6.5% higher than last week’s estimate, and 6.7% lower than the production estimate a year ago (in 2015)

Year to date, US has produced 540.5mil tons of coal, that’s a decrease of 21.9% compared to the same period in 2015.

U.S. coal production in August 2016 was 71mil tons, a 9% increase from the previous month but 14% decrease from August 2015.

In 2016, coal production is expected to decrease by 164 mil tons or 18%, which would be the largest decline in terms of both tons and percentage since at least 1949.

U.S domestic coal consumption in the electric power sector, which accounts for more than 90% of total U.S. coal consumption, is forecast to decline by 64 mil tons in 2016

So what does all this mean exactly? I’ll add in a caveat here by saying that it’s notoriously difficult to predict something as global macro as coal prices. (I’ve mentioned this in many articles. Global macro trends are just crazily difficult to predict with certainty.)

What I’ve done is to try to understand the historical coal suppliers (mainly China and US, the 2 largest players), tried to understand the immediate/short term supply and potential demand, and finally, tried to understand and predict longer term how coal will turn out.

|

Here are my thoughts/conclusions:

|

So how do the above conclusions affect my thoughts on Geo Energy?

Geo Energy’s share price has risen very very rapidly from the time I started writing part I of this investing thesis, tracking the rapid rise in coal prices. I am starting to get cautious. Things always swing to the other extreme.

In the near term (next few months, till end of 2016), I think coal prices would be more likely to stabilise or even dip, rather than continue on an upward trajectory.

Morgan Stanley seems to agree with me:

http://www.economiccalendar.com/2016/10/04/morgan-stanley-bets-coal-prices-peaked-but-thermal-coal-could-prove-resilient/

However, since the financials of Geo Energy are lagging behind coal prices, the current large increase in coal prices would be reflected in Geo Energy’s financials in 2016Q3 and probably Q4. Coupled with a projected increase in coal production, I am expecting a good set of results for Q3 and Q4, even if coal prices dip in the near term.

In the mid term, my guess is that power generation via coal in China and Indonesia will continue to hold up, and in the case of Indonesia, will probably increase substantially. Coal powered steam is one of the most cost effective ways to generate electricity quickly and cheaply, the major downside being pollution.

China has started to see that this is a problem, but changing all the coal powered plants will not be easy and definitely not fast. Indonesia has no choice but to stick to coal powered plants for now. They need the electricity pronto, who cares about pollution now. Just look at the list of power stations to be built or are being planned to be put up for tender (see above): A significant bulk are either coal powered or combined cycle power plants. (Combined cycle power plants use both steam and gas to generate electricity)

Longer term, utilisation rates of coal power plants globally will keep declining. This graph explains my point nicely:

I’m talking about broad, general trends, the impact of which is best seen over the course of multi years.

The implication though, is that barring dramatic changes to its operations, I don’t view Geo Energy Resources as an ultra long-term buy-and-hold investment.

In the short- to mid-term though, I think Geo Energy will continue to do well from supplying Chinese and, hopefully, Indonesian power plants.

Alright, thus far, I have devoted many pages, (in fact, the bulk of this post) to the supply and demand considerations. This is because as I mentioned earlier, being a commodity company, the one overriding consideration affecting Geo Energy’s fortunes is coal prices.

Competitive Moat

In the commodity business, I generally try not to base my entire investing thesis on macro factors. This is because macro factors affect all related companies, so if rising coal prices is the reason for favoring Geo Energy, how about other coal companies?

Instead, I’m looking for local factors or competitive advantages that the company has, that put it in a better position than rivals. Or it could be a situation where the company has been neglected by the markets, such that there’s a wide gap between its intrinsic value and the price that the company can be bought at.

I’ve previously mentioned some of the competitive advantages Geo Energy has. The offtake agreements, and the sub-con of the mining activities are good moves by the management.

Geo Energy’s SDJ and TBR mines are also situated near the coast, and this helps to save on transportation costs. This map shows the exact location of the mines. Their BEK mine is situated just north, within East Kalimantan, about an hour+ drive away.

On top of that, in October 2014, the Group’s subsidiary PT Sumber Bara Jaya signed a cooperation agreement with PT Bandar Laut Biru for the management and operation of a port terminal for a period of 15 years.

The port is located in close proximity to the PT Sungai Danau Jaya’s (“SDJ”) coal mine providing the Group with much logistic cost savings and flexibility in arranging shipping schedules.

In addition, I like the fact that both the SDJ and TBR mines have comparatively low strip ratios. That is, a lower amount of useless rock has to be removed to reach the coal.

All these are local competitive advantages that ultimately translate, one way or another, into lower operating costs. I am monitoring closely as I expect further synergies from the close proximity of SDJ and TBR mines, such that the operating costs should be kept relatively constant, while revenue increases dramatically.

Insider ownership and recent developments

Surprise, surprise.

I was trying to figure out who the major players in Geo Energy are. It’s not as easy as peering at the top 20 shareholders list, as many of the large players hold their stakes in nominee accounts.

I was surprised to find that in April 2015, the company issued 28,000,000 shares at $0.18 to Dektos Corp. My previous experience with Dektos is when they took a stake in Hock Lian Seng.

Perhaps I should meet Roland Thng some day, it seems our investments are “fated”.

Anyway, I noted that EVA Capital (fund managed by Dektos) started in the early 2015 with an initial capital of US$5mil. 28mil shares at $0.18 means a capital of about $5mil. (SGD of course). So basically Dektos seems to invest in an “all-in” manner.

I can’t find any news about Dektos divesting, so I assume they’re still holding on to the 28mil shares.

Aside from Dektos, Geo Energy has also utilised its shares as currency in the mine acquisitions. Shares have been issued at $0.15 (for the TBR mine) and $0.18 (for the SDJ mine) for the acquisition of the mines. Jim Rogers speaking with shareholders of Geo Energy after an AGM. NextInsight file photo.Other major players to note include the famed Jim Rogers who, as a non executive director, first bought 2 mil shares at $0.35, and in more recent times, bought another 1.7mil shares at $0.12 or so.

Jim Rogers speaking with shareholders of Geo Energy after an AGM. NextInsight file photo.Other major players to note include the famed Jim Rogers who, as a non executive director, first bought 2 mil shares at $0.35, and in more recent times, bought another 1.7mil shares at $0.12 or so.

When Mr Rogers bought his 2 mil shares 3 years ago at $0.35, the share price jumped as many “investors” decided that hey, if it’s good enough for this guy, it’s good enough for me. These investors would’ve suffered and are still suffering now. Goes to show that one should always do your own DD. At the very least, the mistake would’ve been yours and yours only.

In 2015, various members of the management team also bought in at prices largely below $0.14.

Now, my interest in monitoring insider purchases is NOT to follow them. Rather, I’m trying to avoid a scenario whereby these guys unload their shares, and I unwittingly buy from them.

I have had my fair share of situations where I hold large stakes. Exiting can sometimes be a problem. I’d also want to know how much of a margin of safety I have, compared to these guys. In addition, the shares issued are new shares. (Jim Roger’s 2mil shares at $0.35 are due to exercising call options that he was granted). Thus, it's good to know if these new shares are dilutive at the current share price. (They weren’t when I started writing part I, but now are!)

|

My Thoughts

Geo Energy is a company that I’ve been monitoring since the divestments of my long-held stakes in Hock Lian Seng and Metro Holdings. It has been incredibly frustrating as I was in the midst of doing due diligence when the share price started rising rapidly.

|