|

|

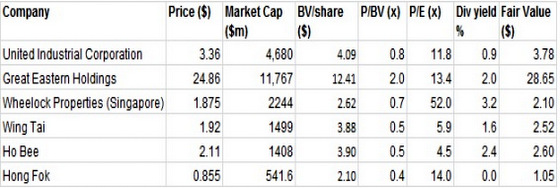

1. United Industrial Corporation (UIC) – It may happen this year, next year or some point in the future. But we think it will happen. In recent years, UOL Group has steadily tightened its grip on UIC, amassing a 44% stake in UIC. Haw Par, which is affiliated with the Wee family, holds another 5%. We think UOL is likely to eventually raise its stake in UIC above 50% through further open market purchases and/or buying over Haw Par’s 5% stake. This will then trigger a general offer for UIC and if the price is enticing enough, it may even persuade the other major shareholder of UIC, JG Summit, to part with its 37% stake. UOL will get to consolidate UIC’s SGD7bn of property assets, many of them investment grade commercial properties and hotels, into its books. This will swell UOL’s asset base to over SGD10bn, making the Wee family’s property flagship one of the largest real estate company in the region. UIC currently trades at 0.8x P/BV.

2. Great Eastern Holdings (GE) – OCBC’s acquisition of Wing Hang probably delayed the timetable for any potential privatisation move on its 87%-owned life insurance arm. Recall that OCBC had made two previous attempts to privatise GEH, the first attempt in 2004 and the second in 2006. GE has since grow its life insurance franchise in Singapore and Malaysia steadily, maintaining its market leadership in these two countries. In the last six years, embedded value compounded at 10% p.a. Despite a re-rating in the stock price, valuation for the stock remains undemanding at 1.1x P/EV. We have a TP of SGD28.65 based on a P/EV of 1.3x, suggesting an upside of 15%.

3. Wheelock Properties (Singapore) – Since the passing of former CEO David Lawrence in 2012, Wheelock has pretty much operated without a CEO. Wheelock is focused on the development of luxury properties, and has a cashrich balance sheet due to handsome profits generated from past projects such as Scotts Square and Ardmore Park.

In recent years, however, the company has been caught wrong-footed on several occasions. The group bought a mass market residential site in Ang Mo Kio in January 2013, on the eve of a new round of property cooling measures that were announced the next day. It also recently took a write-down for a site it bought in Fuyang, China 3 years ago and another write-down for its Scotts Square retail mall, which is experiencing a drop in occupancy due to a sub-optimal tenant mix. Wheelock Singapore is 76% owned by its parent Wheelock & Company (0020 HK), which has a growing property business in China. We think it may privatise Wheelock Singapore and redeploy the excess cash to fund the rapidly growing China business. Based on a 20% discount to its NAV, we think the stock could trade up to a fair value of SGD2.10.

4. Wing Tai – Wing Tai makes the list due to an advantage that it would enjoy as an unlisted, locally owned company: avoiding Qualifying Certificate penalties on its luxury unsold projects such as Le Nouvel Ardmore and Nouvel 18. However, the group has a robust balance sheet with net gearing below 0.2x, and has a diversified property business, both geographically and sector-wise. Major shareholder, the Cheung family, made a successful partial offer in 2012, at SGD1.39 per share, to bring its stake above 50%. With the stock trading at a deep discount of 55% to its latest book value of SGD3.90, the company has been doing active share buybacks and the Cheung family may yet pounce again in a second privatisation attempt.

5. Ho Bee Land – We featured Ho Bee Land in our last issue. The attraction of the stock is its steady, recurring income stream from its portfolio of investment properties in Singapore and London, coupled with management’s proven track record in execution. While its Sentosa projects are currently slow-moving, exposure is limited and the group has earlier made some provisions to writedown its landbank. We see capital upside potential for its real estate, which will further drive NAV/share growth. Major shareholder Chua Thian Poh owns more than 70% of the stock, and could take the company private if the stock continues to trade at depressed levels.

6. Hong Fok Corporation -- Hong Fok owns two prime commercial properties, the International Building at Orchard and The Concourse at Beach Road. Asset enhancement works done and in the pipeline for these 2 assets have steadily driven up net asset value. Hong Fok’s latest NAV was SGD2.10, with the stock price trading at a 60% discount. We recognise investors’ concerns with management’s past corporate governance practices, but in recent years, it has generally improved. It has dished out a maiden cash dividend, and has committed to continue paying dividends and engaging investors more proactively. We like the value-creation from the asset enhancement initiatives implemented by management, and value the stock at SGD1.05 based on a 50% discount to NAV.

Full report here.