Company description

RPG (formerly known as Sky One Holdings Limited) was listed on SGX Catalist Board on 14 November 2014 via a reverse takeover. RPG is a mine owner and primarily engages in the business of coal mining and coal exploration operations in East Kalimantan, Indonesia. RPG also owns and provides coal mining facilities such as coal hauling road, coal stockpiles, coal crushers, coal conveyor system, jetty and barge loading facilities to third party mine owners. RPG is 54.67% controlled by Madrone Enterprises Limited, a company which is 100% owned by the family of Executive Chairman and CEO Mr Agus Sugiono.

Company developments to watch out for

Major catalyst – Potential award of the 2nd IPPKH permit

RPG currently has a “borrow-use” permit to mine 309 ha out of its total mining concession area of 1,933ha. In a 19 Jan 2015 press release, RPG said it has submitted an application to secure the “borrow-use” permit to mine the remaining 1,624 ha of total mining concession area. This, if approved, should have a positive impact on its reserves and future earnings. UOB Kayhian estimates that the award may be given to RPG by June 2015.

Cost reduction measures

In its 3QFY15 press release, RPG mentioned that it has commenced a cost reduction programme covering areas such as waste mining rates; heavy equipment requirements and fuel supply arrangements. In my opinion, as the rates with their waste mining operator, PT Cipta Kridatama (“CK”) were last adjusted and reduced in July 2013 (i.e. almost approaching two years), there is scope for reduction in 2015. It is noteworthy that waste mining costs comprised approximately 45% of the cost of goods sold. Source: Company (Year ends in Mar)Sales volume ramp up

Source: Company (Year ends in Mar)Sales volume ramp up

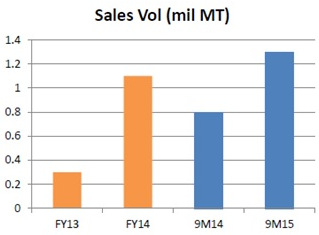

With reference to Chart 3 on the right, sales volume surged 59% from 0.82MT in 9MFY14 to 1.30MT in 9MFY15. It is likely that the company will further ramp up its sales volume in FY16F, albeit at a slower pace (on a percentage basis).

Contracts from coal logistics kicking in FY16F

According to the company, RPG leases its excess capacity in its coal logistics facilities, such as crushers, conveyors, stockpile, jetty etc to nearby concession owners. This business segment is lucrative and likely enjoys good margins.

RPG has signed contracts with five concession owners. RPG priced such contracts on a “use per basis” and by distance and tonnage. One concession owner already started to lease RPG’s logistics facilities which contributed to RPG’s 9MFY15 facility usage revenue of around US$1.7m. Barring unforeseen circumstances, it is likely that three other concession owners may start to lease RPG’s logistics facilities in FY16F.

Possibility of M&A

Besides organic growth, the company is also looking to accelerate growth through acquisitions, joint ventures and/or strategic alliances. Acquisitions are particularly interesting as the current depressed prices offer an opportunity to buy at attractive prices. The company is interested in projects that are located near their existing mine in order to achieve synergies and also for ease of management.

As of 9MFY15, RPG only has US$1.9m of debt. Thus, there seems to be scope for the company to take on more debt to finance inorganic growth.

*Some noteworthy points

Concentration risk

RPG has concentration risk in a couple of aspects. Firstly, it only has one mine, thus any problems in the mine will have an adverse impact on RPG. Secondly, due to its current small sales volume, it only has one customer, namely PT Anugerah Bara Kemilau (“ABK”). It is noteworthy that RPG signed the offtake agreement with ABK in Jun 2013 and this agreement will expire on Jun 2015. According to RPG, ABK has offered a 2 year extension at RPG’s option.

Notwithstanding the above, management is cognizant of the customer concentration risk and plans to diversify its customer base when they further ramp up their production.

Dependent on coal price

Any drop in coal price due to an increase in supply or a drop in demand may have an adverse impact on RPG’s operations.

Regulatory risks in Indonesia

RPG’s Rinjani mine is in Indonesia. Any adverse change in regulations may affect the approval for the “borrow-use” permit for the remaining 1,624 ha of mining concession area and their existing business.

*For the full range of risks, readers should download Skyone’s circular to its shareholders (available on SGX) and the UOB Kayhian analyst reports.

Conclusion

This is just a brief introduction on RPG. Readers should be cognizant of RPG’s volatile share price, concentration risk and its dependence on coal price. However, the bullish chart formation, and my view that most negatives have been priced into the share price, coupled with the aforementioned company developments, should make it an interesting stock to keep on the watchlist.

P.S. Readers should refer to the company website http://resourcesprima.com.sg/ for more information and email me at