|

RESOURCES PRIMA GROUP (“RPG”) has been on the restricted “online list” of a few brokerages such as CIMB Securities, OCBC Securities and UOB Kayhian (i.e. clients are not able to trade online but have to call their broker to execute trades for this stock). This restriction is typically for more speculative stocks. So what attracted me to take a closer look and do a writeup? |

First glance - What attracts me…

1. Chart formation seems positive

I have pointed out in my article dated 23 Mar 2015 “Selective stocks may have some small near term technical rebound” that RPG seemed to be building a base. RPG closed at $0.083 on 20 Mar, Fri and was trading around $0.082 – 0.084 on 23 Mar, Mon. It closed at $0.082 on 23 Mar.

Since 23 Mar, RPG has jumped 23% to close at $0.101 on volume expansion. Based on Chart 1 below, RPG surged 11% & 10% with 10.7m & 14.6m shares traded on 26 Mar & 27 Mar respectively. The volumes transacted were significantly above its 30D & 100D average volume of 3.6m & 12.8m shares.

Based on my personal observation, RPG’s has completed its base formation and it seems to be on the verge of a new uptrend. 21D exponential moving average (“EMA”) has turned up. Indicators such as RSI and MACD have formed bullish divergences and they seem to be strengthening. Although the RSI was a 15 month high (RSI closed at 57.7 last Fri), it is not overbought yet. Near term supports and resistances are at $0.097 / 0.094 / $0.090 and $0.109 – 0.111 / 0.122 / 0.136. The “bullish feel” of this chart will be negated if RPG falls below $0.090 on a sustained basis.

Resources Prima (11.4 cents) is loss-making and has a market cap of S$207 million.

Resources Prima (11.4 cents) is loss-making and has a market cap of S$207 million.

Chart: Yahoo!

2. Negatives seem to have been largely priced in

Firstly, the price for thermal coal has slipped to a six-year low. According to a Bloomberg article dated 24 Mar 2015, prices for a coal-supply deal between Glencore Plc and Japanese utilities may be set at a six-year low. The low coal prices have already prompted Glencore to plan to reduce its Australian output by 15m tons in 2015, equivalent to about one fifth of its production from Australia. Glencore also plans to trim output by shutting some mines in South Africa.

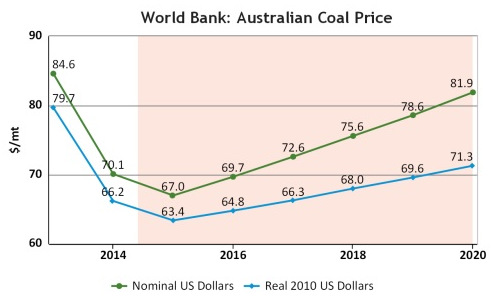

Notwithstanding the fallen coal prices, the World Bank forecasts that coal prices are likely to hit bottom in 2015 and rebound thereafter (See Chart 2). Other institutions such as the IMF and Economist Intelligence Unit also predict that 2015 is likely to be the bottom for coal prices.

Secondly, the massive 70% RPG’s share price drop from an intraday high of $0.265 on 4 Dec 2014 to $0.079 on 18 Mar 2015, coupled with a three week long base formation should have exhausted the selling.

Coupled with the online trading curbs by brokerages and the current bearish news on coal, it should be quite safe to assume that most sellers have already exited. It is likely to be an “under owned” stock for both retailers and institutions / funds. UOB Kayhian is the only house which is covering RPG, and it has a target price of $0.295.

Thirdly, RPG has incurred a few one-off expenses in 9MFY15 results such as:

a) Professional fees of US$1m under Admin Fees in 3QFY15 incurred in relation to completion of the reverse takeover;

b) The immediate recognition of the entire historical depreciation costs of US$11m which should otherwise have been amortised over a few years;

c) Arranger fee of US$15.7m & goodwill of US$45.9m written off in 3QFY15F in relation to the reverse takeover;

According to management, the above are not expected to be incurred in future. In other words, going forward, ceteris paribas, RPG’s financials are likely to be better without the above non-recurring expenses.