XMH HOLDINGS had a stronger-than-expected 3QFY15 and appears to be on a recovery track after being negatively affected by its Indonesian business in the past year or so.

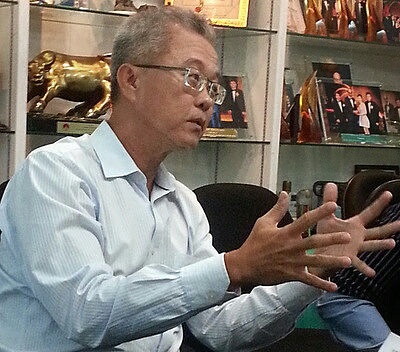

The senior management sounded upbeat on the business outlook at the 3QFY15 (ended Jan 2015) results briefing last week. Alphonsus Chia, Deputy CEO of XMH Holdings. (He was Deputy CEO of IE Singapore in 2004-2007).

Alphonsus Chia, Deputy CEO of XMH Holdings. (He was Deputy CEO of IE Singapore in 2004-2007).

Photo by Leong Chan TeikSome key takeaways:

» Gross margin: XMH reported a sharp 4.6 percentage point rise year-on-year in gross margin in 3QFY15 to 31.7% due mainly to better margins across all its business segments.

Reasons:

1) Mech-Power, the subsidiary that produces standby gen-sets for clients such as data centres in Singapore, has seen margins improve because of bigger projects, compared to previously, said Mr Alphonsus Chia, the deputy CEO of XMH Holdings.

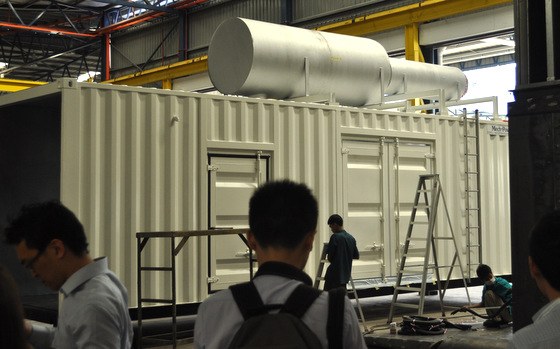

Mech-Power is likely able to sustain its margin going forward, said Ms Jessie Koh, the finance director of XMH Holdings.  A standby gen-set being produced in Mech-Power's factory in Johor. NextInsight file photoThat's because Mech-Power has been more selective in its tendering for projects and has achieved better pricing from its suppliers for key components (engines, alternators and radiators).

A standby gen-set being produced in Mech-Power's factory in Johor. NextInsight file photoThat's because Mech-Power has been more selective in its tendering for projects and has achieved better pricing from its suppliers for key components (engines, alternators and radiators).

2) Xin Ming Hua -- the distribution subsidiary that largely derives revenue from Indonesia -- has been able to get more favourable terms from its key principal, Mitsubishi, especially in targeting the vast Vietnam market where XMH has appointed more dealers recently and is gaining sales traction.

(The Vietnamese government has taken steps to grow and upgrade the country's fishing fleet and Coast Guard vessels. See: Vietnam to spend $750 mil upgrading Coast Guard and fishing fleet)

3) Due to some over-reporting of the cost of goods sold in two prior years, a one-off adjustment was made in 3QFY15. A similar adjustment will be made in 4QFY15.

» Indonesia revenue: In 3QFY15, customers took delivery of more vessel engines they have ordered. The faster take-up pace is expected to continue into 4QFY15, said Mr Chia.

With a slowdown in the construction of coal-transporting vessels, Xin Ming Hua is targeting other vessel types such as fishing vessels and larger vessels.  Jessie Koh, finance director of XMH Holdings.» Z-Power Automation's accretive earnings: XMH completed the acquisition of an 80% stake in Z-Power early this month (March) and will consolidate nearly two months of its results in 4QFY2015.

Jessie Koh, finance director of XMH Holdings.» Z-Power Automation's accretive earnings: XMH completed the acquisition of an 80% stake in Z-Power early this month (March) and will consolidate nearly two months of its results in 4QFY2015.

For an idea of the size of the contribution, Z-Power achieved $1.9 million net profit on revenue of S$21.4 million in calendar year 2013.

And for perspective, for 9MFY15, XMH's revenue came in at $68.1 million, of which $32.9 million was contributed by Xin Ming Hua and the rest (S$35.2 m) by Mech-Power.

» M&A: For now, XMH will focus on integrating the businesses of Xin Ming Hua, Mech Power (acquired in Sept 2013) and Z-Power -- and derive synergies from them.

Xin Ming Hua could cross-sell Mech-Power's gen-sets to its engine-buying customers in Indonesia, for example, said Mr Chia.

Physically, all these subsidiaries will come under one roof when they move to a new HQ building in Tuas some time this year.

XMH's cash balance has come off with the completion of the $12.8 million Z-Power purchase as well as payments for the construction of the new HQ building. But it will be replenished over time if the group continues to be profitable.

|

Still, XMH is not ruling out any M&A action if an attractive deal comes along, since XMH can easily turn to bank borrrowings, said Mr Chia.

» Forex: Xin Ming Hua orders Mitsubishi engines in yen and sells in yen. Mech-Power buys engines and other parts in either euro or USD.

Given its greater exposure to the euro, the recent fall in the euro-SGD rate has contributed to a positive forex gain of $885,000 in 3QFY15 and $306,00 in 9MFY15.

The Powerpoint slides for the 3QFY15 briefing are here.