Yangzijiang is becoming a serious player in the large vessel space. Above: Its first 10k TEU vessel delivered from Xinfu Yard. Photo: Company

Yangzijiang is becoming a serious player in the large vessel space. Above: Its first 10k TEU vessel delivered from Xinfu Yard. Photo: CompanyExcerpts from analysts' report

Analysts: Somesh Kumar Agarwal and Justin Chiam (Macquarie)

|

YANGZIJIANG SHIPBUILDING was a surprise outperformer in the Singapore industrials sector in 2014 (up 2% vs peers down 20-30% each) on the back of strong order inflows and better-than-expected margin performance.

» Has 6 large outstanding options which could convert into new orders: These options comprises 2 x 36,500 dwt bulk carriers, 2 x 10,000 TEU and 2 x 2,700 TEU containerships and estimated to be about US$300m. » We estimate US$1.6bn of new orders in 2015: YZJ will continue making inroads into the very large vessel segment, in our view. We estimate 28 bulk carriers and 5 containership orders in 2015. |

YZJ’s dependence on offshore rigs orders is declining which works to its favour given the current oil climate. We think YZJ could beat consensus with better than expected shipbuilding orders at higher prices. At 8x 2015E P/E and 1.0x 2015E P/B with 13-14% ROEs, the stock looks attractively priced in our view.

» Price have bottomed out in 2013, rebound backed by fundamentals

» Demand for both bulk and container trade continues to grow, post-2008 dip.

» While supply has yet to catch on: orders for bulkers to be delivered in 2017 not yet filled, and containerships for 2016 and 2017 delivery barely filled.

» Lower value post-2008 contract options that were exercised will result in falling margins for the next few years

» We expect gross margins to be in the region of 26% for 2014 and 24% for 2015

Becoming a serious player in the very large vessel space

» Secured 7 very large bulker orders (>200,000 dwt), 4 are the first of its kind on its order book; the 260,000 dwt bulk carriers

» Secured 6 new 10,000 TEU containership orders with an additional outstanding option for 2 more after having successfully delivered 6 of these ships

» Management also intends to offer the larger 16,000 TEU and 18,000 TEU vessel types to bolster their capabilities

» Focus on shipbuilding and move from offshore has paid off given the current oil climate

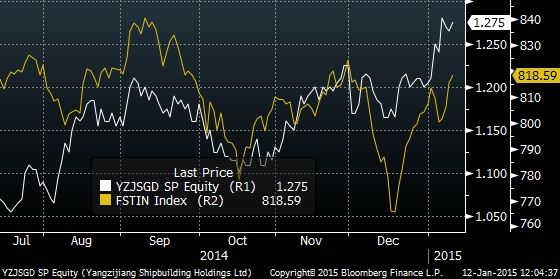

Yangzijiang's stock price has outperformed the Straits Times Industrial Index over the past two months. Bloomberg data

Yangzijiang's stock price has outperformed the Straits Times Industrial Index over the past two months. Bloomberg data» YZJ trades at 1.0x 2015E P/B and 7.8x 2015E P/E, which we think is attractively priced

» Our target price of S$1.55 implies a valuation of 1.3x 2015E P/B and 10.0x 2015E P/E, which we think is fair