Henry Tiong says he is an average Singaporean in his early 30s, has a full-time job, is happily married and caught within the sandwich class. He lives in an executive condominium with a "mountain-like mortgage". He says: "My goal is to achieve financial freedom as early as I can. My target is 45 years old. I don't mind working but I hope to provide my wife an option not to work." The following article was recently published on his site Valuestocks.sg and is republished with permission.

|

|

Hmm...if we look deeper into the income statement, we see that the main contributor to the bottom line is the share of associates' results of $64M.

Where did that come from and is that sustainable? It is not common to see associates contributing more to the bottom line than the mother ship. Indeed, the $64M is due to negative goodwill - an accounting concept.

In substance, what happened was that Metro acquired a stake in Top Spring International on 1 July 2014. Top Spring is a property play. If we compare the acquisition price that Metro paid with the fair value of all the net assets on Top Spring's books, it turns out that Metro got a good bargain. The difference is $64M for the stake that Metro bought into. This is one time and non-recurring.

If we exclude the results from associates & joint ventures, Metro's core operating results were poor. Q2FY15 would be an operating loss of $14.6M. We have shrinking gross profits that put $2.2M on the table (a 42% decrease compared to corresponding period in FY14). Poor market sentiment culminated in a $10.3 M impairment on available for sale instruments (shares).

And you would have thought that management would at least keep cost under control. No. Slap on another $9.5M in General & Admin Expenses to sink the results into a deeper red.

What does it mean for investors? We are now at the halfway mark of FY15 earnings which stand at $70.8M or 8.6 cents per share. Given the significant one-time contributors to the bottom line, there is no chance of us just doing a plain extrapolation to estimate full year earnings.

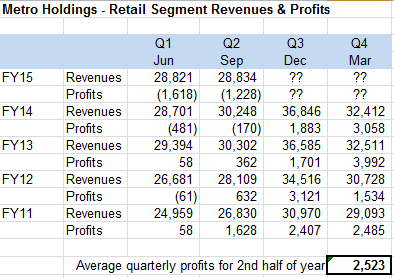

So how should we proceed? One way is to break up the analysis into Metro's business segments - Property and Retail.  Metro's retail business typically brings in relatively small profits (or even losses) in 1H (April -Sept) of its FY but the 2H (Oct-March) brings in about S$5 m in profits. Photo: Company

Metro's retail business typically brings in relatively small profits (or even losses) in 1H (April -Sept) of its FY but the 2H (Oct-March) brings in about S$5 m in profits. Photo: Company

For Property, the main contribution for Q3 and Q4 would come from rental income arising from the five investment properties - GIE Tower, Frontier Koishikawa, Metro City, Metro Tower, EC Mall. There should be contribution from sales of Nanchang Project. Overall, it is not too aggressive to expect a $5M to the bottom line for the second half.  If we look back at historical quarterly results for Metro, we would note that for Retail, the last two quarters are definitely the main contributors to the full year results. In fact, on average, the second half of the year brings in about $5M profits (from $66M revenues) - see table on the right.

If we look back at historical quarterly results for Metro, we would note that for Retail, the last two quarters are definitely the main contributors to the full year results. In fact, on average, the second half of the year brings in about $5M profits (from $66M revenues) - see table on the right.

For stocks that trade below book value, their stock prices can continute to languish due to lack of catalysts till there is some unlocking of asset values - perhaps through divestment of assets / businesses. Another possible catalyst would be improvement in earnings.

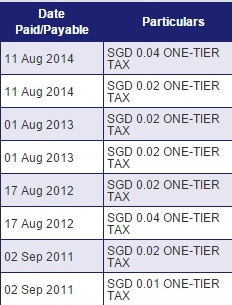

Can Metro continue to pay out 6 cents dividends? That amounts to nearly $50 million. Metro definitely has the cash hoard to fund this dividend, at least for a couple of years.

However, if we look into the cash flow statements - current and past, we can see that Metro's core operations are not spewing out cash. A lot of the cash inflows historically came from investing activities - they sell associates, and / or dividend income from their investments (including associates and joint ventures). Makes sense to look at that space.

Disclosure: Henry is not vested in Metro Holdings (M01.SI).

Previous article by Henry Tiong: MARCO POLO MARINE: Should I cut loss or continue to hold?