Excerpts from analyst's report

RHB Research analyst: Jarick Seet

|

Trek’s 2Q15 results were slightly on the low-end, but its strong revenue growth of 57.8% YoY was very encouraging. Maintain BUY as we expect a stronger 2H15 with increased contribution from the USD50m Rely/Mattel deal. |

|

Trek 2000 |

|

|

Share price: |

Target: |

• Revenue surge encouraging. Trek 2000 International’s (Trek) 2Q15 revenue grew 57.8% YoY to USD41.8m, mainly led by an increase in sales of Flucard and Wifi memory modules to new and existing customers, which grew 60% YoY to USD39.3m. 2Q15 PATMI grew to USD1.2m, but below our FY15 NPAT estimate.

This was partially due to higher admin and R&D costs coupled with lower margins of its thumbdrive and Flucard segment in an effort to retain market share.

• OSIM – a strategic partner. Trek did a new equity placement of 26m shares recently with the majority given to a new strategic partner – OSIM International (OSIM SP, BUY, TP: SGD1.78). We believe both companies will work together to develop new products (eg a new medical chair), especially in the wellness and healthy lifestyle sector. They will also be working together on the commercial application of Trek’s patents and technology for products in the wellness and healthy lifestyle sector.

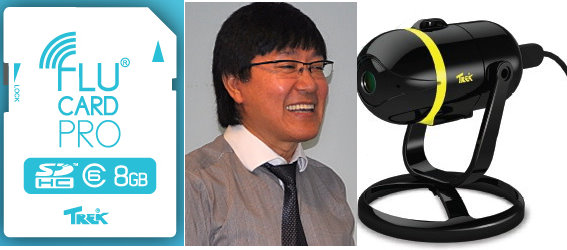

• Potential acquisition target. We continue to think that Trek could also be considered as a potentially favourable acquisition target by its larger peers due to its database of valuable patents, which has grown steadily to 436 as of 2Q15. • Potential acquisition target. We continue to think that Trek could also be considered as a potentially favourable acquisition target by its larger peers due to its database of valuable patents, which has grown steadily to 436 as of 2Q15.-- Jarick Seet (photo), RHB analyst |

• Stronger 2H15 ahead; maintain BUY as we expect increased contribution from the USD50m Rely/Mattel deal secured in Apr 2015. In addition, Trek traditionally performs much better in the latter part of the year.

Together with a strong surge in 2Q15 revenue, we expect a stronger 2H15. However, due to higher R&D costs and lower margins, we lower our FY15 NPAT estimate by 36% to USD5.96m which, coupled with the dilution from 26m new shares issued recently, results in our TP falling to SGD0.52, pegged to 20x FY15 P/E. Maintain BUY.

Full report here.