Excerpts from analysts' report

RHB Research analyts: Ong Kian Lin and the Singapore Research Team

|

|

Banks, commodities and the oil and gas (O&G) sectorsare the most affected, routed by contagion effects over the health of the Chinese economy and sentiment on forex risk in China-dependent economies (MYR and IDR down 2.7% and 2.1% over USD respectively), weakening the asset prices in commodities and further tumbling of oil prices, with the US oil benchmark settling at its lowest level in more than six years (USD43.08 a barrel at one point).

Representatives from each segment and their downside over two days (2D) include DBS (2D: -8.3%, DBS SP, BUY, TP: SGD23.30), Noble (2D: -12.9%, NOBL SP, NR) and Nam Cheong (2D: -9.0%, NCL SP, BUY, TP: SGD0.40) as per Figure 3.  Large Singapore (SG) companies with China exposure. Selectively, DBS has more than one-third of its gross loans from Greater China and Hong Kong.

Large Singapore (SG) companies with China exposure. Selectively, DBS has more than one-third of its gross loans from Greater China and Hong Kong.

On the property front, CapitaLand (CAPL SP, BUY, TP: SGD4.22) and Global Logistic Properties (GLP SP, NR) has 41.4% and ~40% of total assets in China respectively, with both companies maintaining a natural hedge by borrowing in local currencies.

Others with majority of their assets and income contribution from China include Yangzijiang Shipbuilding (YZJSGD SP, BUY, TP: SGD1.68), China Everbright International (257 HK, NR), SIIC Environment (SIIC SP, NR), and CapitaLand Retail China Trust (CRCT SP, NR), among others (see Figures 1-2).

Brace for further near-term onslaught. China devalued the CNY for the second day running, sparking fears that the world’s second-largest economy is in worse shape than investors estimated. It set the CNY daily midpoint even weaker than in Tuesday’s devaluation.

We believe China’s currency move will decrease the appetite for risky assets in Singapore in the near term. Downside risk includes other central banks being forced to follow suit, which may trigger a fresh round of currency weakening in the emerging economies. We urge investors to stay cautious on forex exposed companies for now. Amongst our coverage, we favour stocks that rely solely on domestic demand (all SGD-denominated) or generate revenue/lock-in contracts in the USD (or currencies pegged to the USD). Stay defensive in this climate.

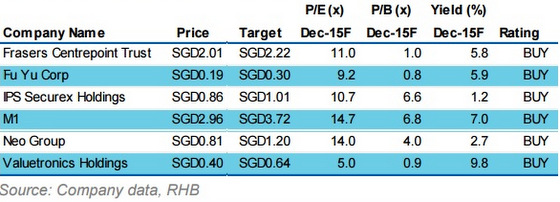

Our BUY calls are listed in the table below.

For the full report, click here.