Excerpts from analyst's report

|

|

Results Overview: Revenue fell by 9% year-on-year to S$93.7m in 2Q FY15, whilst gross margin fell to 17.6% due to cost adjustments at certain property development projects. Excluding these adjustments, we estimate that gross margin would have been about 23%. As a result, gross profit and PATMI fell by 46% and 43% year-on-year to S$16.5m and S$13.0m respectively. For 1H FY15, PATMI amounted to 78.5% of our previous forecast. As such, the 2Q results have already been factored into our outlook.

Our View: We see the slower performance in 2Q as reflective of Roxy’s strategy to remain cautious over the Singapore market during the past two years. We estimate that only about 24% of Roxy’s launched and uncompleted projects remain unsold, which we expect to be gradually sold over the next three years and are unlikely to attract additional qualifying certificate charges.

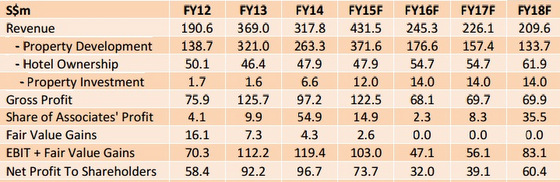

Near Term Outlook Intact: Based on Roxy’s pace of revenue recognition in 2Q and remaining progress billings of S$476.0m, we estimate that Roxy has the potential of achieving more than S$450m of revenue in 2015. Nonetheless, we avoid being excessively aggressive by estimating revenue of S$431.5m for FY15. FY15F PATMI has been revised lower by about 3% or S$2.1m to S$73.7m to reduce forecasting risk, even though we have already factored in lower margins at more recent projects.

Nonetheless, the net impact on our valuation is negligible and leads to an unchanged intrinsic value. Beyond FY15, Roxy has accumulated a land bank of properties in Malaysia and Australia to support performance in FY16 and FY17. Roxy has yet to unveil its plans for the sites at Selangor and North Fremantle. Potential upside for FY16 may arise from the early sale of these properties at the pre-development stage to unlock value. This year is looking strong but next year is expected to be less so. Source: Voyage Research.

This year is looking strong but next year is expected to be less so. Source: Voyage Research.

For the full report, click here.