Excerpts from UOB Kay Hian's report

STRATEGY: We have a year-end target of 3,660 for the FSSTI. Investors should adopt a selective approach on limited earnings visibility and external uncertainties such as rising interest rates in 2H15.

Upside is likely limited as the FSSTI’s 2015F PE of 14.7x is at a small 5% discount to the long-term mean valuation of 15.5x.

Investment themes we favour include: a) regional growth beneficiaries, b) regulatory changes, c) deep value stocks/strong recurrent earnings, and d) compelling business models.

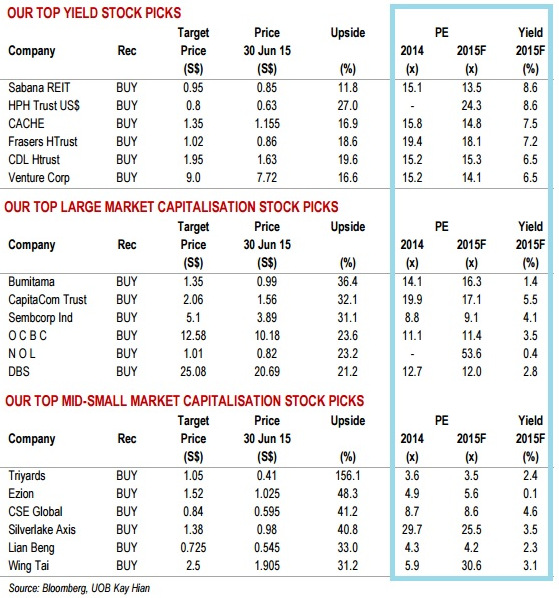

BUYs in the largecap space include DBS, OCBC, CapitaLand, CCT, SingTel, SATS, First Resources and Sembcorp Industries.

In the mid-cap space, we like Wing Tai and Ezion.

Our SELLs include SIA Engineering, StarHub, Nam Cheong and IHH.