Excerpts from analysts' report

|

|

Ausgroup – Transformative acquisition; earnings to double

What it does. Operating mainly in Australia, Ausgroup (AUSG SP, mkt cap: S$151.8m, ADT: S$0.6m) provides fabrication, construction and maintenance services for the downstream oil & gas as well as mining sectors. Once viewed as the beneficiary of the Australia LNG boom, Ausgroup’s expected tidal wave of orders did not materialise. Instead, the mega-LNG projects contracted out fabrication of modular works to cost-competitive Southeast Asian fabrication yards.

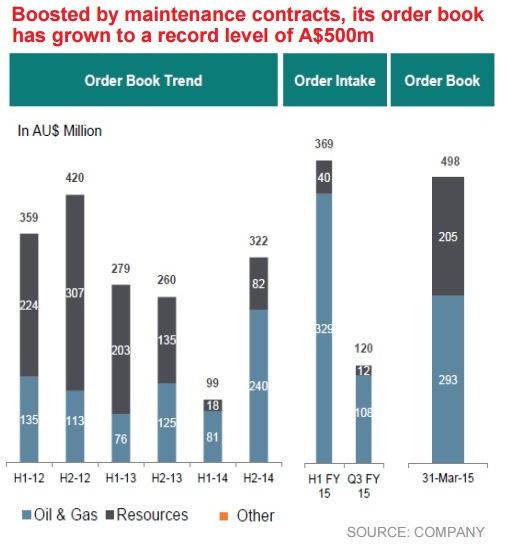

Every dog has its day. With the mega-LNG projects at the tail-end of construction, there is now a need for maintenance programmes. Maintenance requires on-the-ground presence and cannot be outsourced. So, this is the time for local companies. Indeed, Ausgroup recently clinched a 5-year maintenance contract from Chevron worth c.A$300m. We also like that maintenance carries less execution risks vs. construction.

Transformative acquisition. Aside from this, what really excites us is the transformative acquisition of Port Melville, located in Australia’s Northern Territory. Recall that Ausgroup acquired Port Melville from Ezion through the issuance of 92.2m new shares @ S$0.4449/share at end-2014 (total value of S$41m).

With a 17.8% stake, Ezion is now the largest shareholder of Ausgroup. The facilities of Port Melville – the 228m jetty, the lay-down area, the accommodation facilities and the tank farms – are more or less slated to be completed by July 2015. The port is expected to support activities of the nearby Ichthys LNG as well as potential projects, such as Prelude, Sunrise and Banyu Urip. The jewel in the crown is the tank farm with capacity of 30ml (million litres).  Gerard Hutchinson, CEO and MD of AusGroup.Essentially, Port Melville will be in the best proximity to re-fuel vessels that are in no man’s land. There is no oil price exposure for the tank farm as Ausgroup will simply earn a spread of c.10 US cts/l for the bunker fuel it sells to the vessels. It will share half of that spread with the fuel supplier, a US oil major.

Gerard Hutchinson, CEO and MD of AusGroup.Essentially, Port Melville will be in the best proximity to re-fuel vessels that are in no man’s land. There is no oil price exposure for the tank farm as Ausgroup will simply earn a spread of c.10 US cts/l for the bunker fuel it sells to the vessels. It will share half of that spread with the fuel supplier, a US oil major.

Based on Ausgroup’s market research, it expects to achieve 3.5 turns for the tank farm in its first year of operations. This translates into c.US$5m or c.A$6.5m profits (3.5 turns x 30ml x US$0.1/l x 50% profit-share).

Additionally, the jetty is estimated to earn c.US$2m p.a. net profit (A$2.6m) as it supports the export of wood chips (providing ship handling, unloading and loading of cargoes, etc.). Lastly, Ausgroup recently refinanced its ~13.5% US$20m mezzanine debt with a ~6.5% DBS term loan, which could translate into c.A$1m in interest cost savings.

Visible earnings drivers. Bringing it all together, we estimate Ausgroup to add A$10m net profit (tank farm + export of wood chips + interest cost savings) to its incumbent business, which is expected to deliver steady A$8m profits p.a. in FY16 (based on annualised 9MFY15 numbers).

By our estimates, Ausgroup is trading at 8x FY16 P/E, with longer-term growth as the tank farm is envisioned to achieve 10-12 turns in its fourth year of operations. The stock is also trading at 0.6x P/BV. CEO Mr Gerard Hutchison presented at our conference.

Full CIMB report here.