Excerpts from analyst's report

|

KSH Holdings: To ride on firm public construction outlook

OCBC Investment Research analyst: Eli Lee (above)

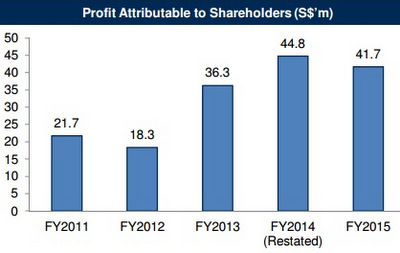

KSH reported that PATMI for FY15 (ending Mar 2015) decreased 7.0% to S$41.7m versus S$44.8m in FY14. This was mainly due to reduced contributions from both the construction and development businesses, lower fair value gains on investment assets and higher personnel expenses, but partially offset by higher interest income.

We judge these results to be broadly within expectations. Management indicates that the construction sector continues to face headwinds in the form of rising costs and, in addition to private construction projects, the group will maintain a dual focus on tendering for public projects for which demand is anticipated to stay strong due to government infrastructure initiatives.

As at end FY15, the group’s construction order book stands at a respectable level of around S$420m.

A final cash dividend of 1.50 S-cents was proposed, which brings the total dividend distribution for FY15 to 2.75 S-cents per share. Maintain BUY with an unchanged fair value estimate of S$0.71.

|

KSH's FY2015 corporate presentation materials can be downloaded here.

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors