By Lim & Tan Research (28 July 2022)

We initiate a BUY rating on KSH Holdings with a SOTP-based target price of S$0.46, representing a 31.4% upside.

We see good earnings visibility over the next 2 years with >99% sales of its Singapore developments and completion of Gaobeidian Phase 1 Stage 1 project. Supported by a strong net cash position and dividend yield of 5.8%, KSH continues to trade at an undemanding 0.58x P/B compared to its 5-year historical mean P/B of 0.83x. |

||||||||||||||||||

Return of construction up-cycle and a robust order book. KSH’s healthy construction order book in Singapore of more than S$530mln (2 years’ worth of revenues) represents a 5y CAGR of 9.3%.

The order book is split 57:43 between private and public sectors, providing them with counter cyclical options during down-cycles and up-cycles.

The recovery of construction sector is expected to drive growth with the BCA upgrading its construction demand forecast for 2022 to an optimistic S$27bln-S$32bln, from S$29.9bln and S$21.0bln in 2021 and 2020 respectively.

Visible pipeline of developmental earnings. KSH’s attributable share of progress billings of more than S$212.0mln to be recognized as sales revenue provides good earnings visibility over the next 2 years.  KSH co-founder, executive chairman and MD Choo Chee Onn. Photo: CompanyIts 4 development properties in Singapore - Affinity @Serangoon, Riverfront Residences, Park Colonial and Rezi 24, are almost fully sold and we project unrecognized profits of S$17.3mln of developmental earnings distributed over the next 2 years.

KSH co-founder, executive chairman and MD Choo Chee Onn. Photo: CompanyIts 4 development properties in Singapore - Affinity @Serangoon, Riverfront Residences, Park Colonial and Rezi 24, are almost fully sold and we project unrecognized profits of S$17.3mln of developmental earnings distributed over the next 2 years.

The recent Dec’21 enbloc acquisition of Peace Centre/Peace Mansion into a mixed-use commercial and residential development helps to replenish KSH’s future land bank of development projects in Singapore.

| Huge potential from Gaobeidian project in China. The mega township project, Gaobeidian New Town, is expected to complete construction of Phase 1 Stage 1 in FY23. KSH’s 22.5% stake in GBD project has so far sold more than 596 units out of the 812 residential units launched with average selling price expected to earn a positive profi t margin. We estimate profits of about S$6.0mln out of the units sold so far and earnings to be recognized in FY23. KSH is well-positioned to benefit from future launches involving 14,368 units in subsequent Gaobeidian phases over the next 10 years. |

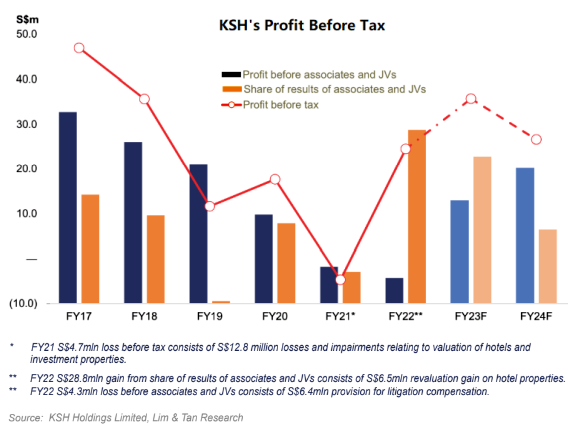

Hospitality exposure to provide positive surprise. KSH’s losses and impairments of its hotels and investment properties contributed significantly to its FY21 net loss of S$3.8mln. Excluding these provisions of S$12.8mln, net income in FY21 would have stood at S$9.0mln.

With the reopening of the UK/Japan economies on the back of rapidly rising vaccination rates, KSH provided a revaluation gain on hotel properties owned by associate companies of S$6.5mln in FY22.

We see potential for additional impairment reversals in FY23, with KSH’s stake in its 9 hotels located in UK and Japan to benefit from both domestic and international travelers in 2022 and beyond.

Strong financials, net cash position. KSH’s net cash position of S$23.2mln represents 11.9% of its market cap, a rarity amongst its peers whose gearing range between 50-100%. We see further strengthening of its balance sheet over the next year as it collects cash from its JVs after reaching TOP for the Singapore development projects, as well as cash from its construction projects.

We believe the above factors can provide KSH cash inflows of close to S$60mln, lifting its net cash position to 42.8% of current market cap by end-FY23.

Favouring shareholders with dividend payouts. With a good track record of paying dividends, KSH has continued paying dividends of 1.0 S ct even during the circuit breaker financial period of FY21, before doubling it to 2.0 S cts in FY22.

| "...we expect strong profitability in FY23 to boost dividends back to pre-Covid levels of 2.2 S cents." |

Given its history of strong free cash flows as well as the return of the construction upcycle, we expect strong profitability in FY23 to boost dividends back to pre-Covid levels of 2.2 S cts.

We forecast FY23 earnings to grow 21% to S$29.3mln with the resumption of the construction and development projects in Singapore and the expected earnings to be recognized from the JV development project in Gaobeidian, PRC.

Assuming FY23F dividends of 2.2 S cts, this represent a conservative payout of 42% and an attractive dividend yield of 6.4%.