Excerpts from analyst's report

|

» 1Q15 net profit of S$ 7.6m (+1% y-o-y) in line with our expectations |

High contribution from Americas. Revenue of S$105m (+13% y-o-y) was supported by higher contribution coming from Americas. Gross margin remained healthy at 28.5%, above 27.5% recorded in 1Q14, helped by higher

contribution from offshore projects. However, net profit growth was subdued due to one-off tax deduction in 1Q14.

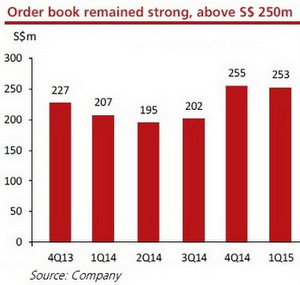

Healthy growth in new order wins. CSE recorded order wins worth S$ 103.1m (+40% y-o-y). This included major orders from the Americas valued at US$33.8m (S$45.3m). In addition, the company won contracts worth S$ 40m through its Middle Eastern and Mexican subsidiaries. As a result, CSE’s order book remained above S$ 250m.

Despite possible headwinds from the oil and gas industry segment, we believe its strong order book and healthy contributions from brownfield projects should meet our FY15F projections.

Upgrade to BUY on improved upside. Applying a 10% discount to its historical average PE of 9.6x, our TP of S$0.65 is based on ex-cash FY15F PE of 8.6x plus net cash of S$23m. At current market price, the stock offers 14% share price upside in addition to a c. 5% yield.

Low oil prices could stifle investments. Low crude oil prices in the world market could result in lower investments in oil & gas exploration. CSE is involved in the production and refinery stages which could see an adverse impact with 6-12 months delay in our view. As a result, we remain vigilant on how it will impact new order wins. However, the oil market has shown a slight recovery over the past few months, which is encouraging for CSE’s prospects.

UOB Kay Hian analyst: Brandon Ng, CFA (left)

UOB Kay Hian analyst: Brandon Ng, CFA (left)

VALUATION

• Maintain BUY with a target price of S$0.84, based on 12.2x 2015F PE. Our target PE is at a 30% discount to sector mean of 17.5x to account for the group’s smaller size and a niche business model.

FINANCIAL HIGHLIGHTS

• CSE Global (CSE) reported 1Q15 net profit of S$7.6m (+1% yoy), driven by higher revenue of S$105.5m (+13.2% yoy) and improved gross margin. Gross profit rose 17.3% yoy to S$30.1m and gross margin added 1.0ppt to 28.5%. However, CSE recorded a higher tax of S$3.1m (1Q14: S$1.3m), mainly attributable to writebacks of deferred tax and non-recurring tax reductions in 1Q14.

• Orderbook sustained into the second quarter

The group received a strong order intake from greenfield and brownfield projects totalling S$103.1m in 1Q15, an increase of 40.4% yoy from 1Q14’s order intake of S$73.4m. As at 31 Mar 15, CSE had an orderbook of S$252.5m (4Q14: S$255.0) of which 51% will be recognised for the rest of the year.

• Balance sheet remained strong, with net cash of S$23m, representing 7.8% of its current market cap.

OUR VIEW

• We are delighted to see CSE continuing to secure contracts despite the challenges. The company recently announced several contract wins in the quarter worth a total of S$85.3m. These contracts are for a telecommunication system and maintenance works in Abu Dhabi, a three-year maintenance contract with a national oil company in Mexico to provide rehabilitation services and technical assistance, and instrumentation and electrical design, fabrication and construction in the American region. This S$85.3m forms part of the S$103.1m of order wins announced in this set of results.

• Looking to acquire. CSE Global would like to enter into the mid-stream and downstream space but without a track record, the easiest route to doing so is to acquire smaller players. According to management, there are currently a lot of candidates but they have yet to find a good fit.

• No change to our 2015 net profit forecast as the current orderbook and the quarterly maintenance contracts should bring CSE’s 2015 net profit marginally higher. We expect the company to record S$35.5m of net profit in 2015 (+0.3% yoy) and pay a dividend of 2.75 S cents.