PAX GLOBAL, CHINA UNIONPAY in e-payment tieup

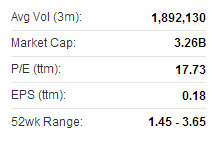

PAX Global Technology Ltd (HK 327), the leading Electronic Funds Transfer Point of Sale (EFT-POS) terminal solutions provider in China and No.4 globally saw China Unionpay Merchant Services (UMS) select PAX as its major supplier for its 2014 POS solutions.

PAX is China's top Electronic Funds Transfer Point of Sale (EFT-POS) terminal solutions firm. Photos: PAX

PAX is China's top Electronic Funds Transfer Point of Sale (EFT-POS) terminal solutions firm. Photos: PAX

“Once again, PAX proves its leading position in the EFT-POS terminal solutions industry in China and our excellent product quality and service is attested by our long-term partner, Union Merchant Services,” said PAX Global CEO Mr. Jack Lu.

PAX will provide UMS with payment devices including the full range of countertop, portable, MIS PIN Pads and mobile/wireless terminals which fully meet the highest international standards of secure payment PCI PTS 3.x, EMV certifications. PAX recently 3.44 hkdUMS is the largest bankcard acquiring and standardized services provider in China.

PAX recently 3.44 hkdUMS is the largest bankcard acquiring and standardized services provider in China.

With over 12 years of accumulated electronic payment industry experience and advantages in cutting edge technology, as well as its excellent quality, PAX has been UMS’ business partner since UMS was established in December 2002.

PAX Global is an electronic funds transfer point-of-sale (EFT-POS) terminal solution services provider and developer. PAX was listed on Hong Kong’s main board on 20 December 2010. The Group currently collaborates with over 35 partners worldwide on EFT-POS solutions. The Company is a leading EFT-POS terminal solutions provider in China.

According to The Nilson Report Oct 2013 Issue, PAX Global ranked #4 globally by shipping volume of EFT-POS terminals in 2012. Sales of its EFT-POS products reached over five million units and are sold to more than 70 countries and regions, including the US, Singapore, Taiwan, Japan, South Korea, New Zealand, EMEA and Central Asia.

Ju Teng is the world's top computer casings maker. Photo: Ju TengJU TENG to pay contractor 490 million yuan for new plant

Ju Teng is the world's top computer casings maker. Photo: Ju TengJU TENG to pay contractor 490 million yuan for new plant

JU TENG International (HK: 3336) announced financial details of its investment in Chongqing Shuangqiao Economic and Technological Development Zone following the acquisition of land use rights in October of a plot in the zone following successful bidding.

The construction of the factory to produce casings with plastic, metal and composite materials for notebook computers, tablet computers and other portable devices in the development zone in Chongqing, China, has a consideration of 490 million yuan.

The Hong Kong-listed firm recently opted to establish a subsidiary in the industrial park and then acquire the land use rights of a parcel of land located in the industrial park with a site area of around 1,019 mu.

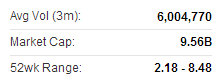

Guoco has ‘Buy’ call on TCL COMMUNICATION

Guoco Capital has assigned a “Buy” recommendation on mobile handset designer and manufacturer TCL Communication (HK: 2618) with a target price of 9.35 hkd (recent share price 8.40).

TCL recently 8.23 hkdThe firm’s Hong Kong-listed shares rose 6.2% on Thursday with “exceptional turnover,” testing the previous peak in early December,” said Guoco.

TCL recently 8.23 hkdThe firm’s Hong Kong-listed shares rose 6.2% on Thursday with “exceptional turnover,” testing the previous peak in early December,” said Guoco.

“Its trend against the Hang Seng Index made a positive breakout.”

Guoco’s cut loss for TCL is 7.24 hkd with a consensus 2014 PER of 11.5 times and a consensus target price of 8.59 hkd.