OIL & GAS stocks have been hard hit but the number of companies -- or insiders -- coming out to buy back their shares is not overwhelmingly large.

One of these is Mermaid Maritime, which has just reported a tripling of its FY14 (ended Sept 2014) net profit to US$45 million.

The company is a leading provider of subsea and drilling services to the offshore oil and gas industry.

Its services are applied in the production phase of the oil & gas supply chain, thus it is less exposed to any capex cuts by its customers (the oil producers). Purchases of Mermaid Maritime shares by Soleado Holdings, a wholly-owned subsidiary of Thoresen Thai Agencies.

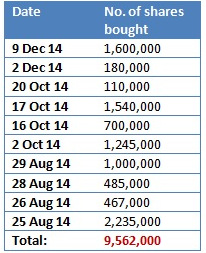

Purchases of Mermaid Maritime shares by Soleado Holdings, a wholly-owned subsidiary of Thoresen Thai Agencies.  Chart: Bloomberg

Chart: Bloomberg

As the table above shows, Mermaid's controlling shareholder, Thoresen Thai Agencies (TTA), through its wholly-owned subsidiary Soleado Holdings has bought 9.562 million shares in the past 4 months.

Mr Mahagitsiri owns 150,461,660 shares directly and has a deemed interest in 967,169,473 shares for an aggregate stake of 68.444% in Mermaid.

TTA is, by the way, also controlled by the Mahagitsiri family and TTA's CEO is also Mr Chalermchai Mahagitsiri.

Mermaid has proposed a final dividend of US 0.47 cent a share, which is equivalent to 15% of the earnings per share for FY2014.

It has said it would declare another dividend (estimated to be US 0.31 cent a share) for the quarter ending 31 Dec 2014. (See press release)

These two dividends will amount to a yield of about 3.5% based on the current stock price of 28 cents.

"Our operations have exposure to mostly shallow water fields and to the production phase of the oil and gas supply chain. Shallow water fields are more defensive and oil price volatility has a lower impact on these fields as break-even points are much lower. "In addition, we also enjoy a presence in cabotage and restricted regions that are benefiting from a concerted local expansion effort." -- Chalermchai Mahagitsiri, 36, Vice-Chairman & CEO of Mermaid Maritime. NextInsight file photo. |

P/S:

» The CEO of Mermaid Maritime's father is Mr Prayudh Mahagitsiri, who has been in the news for spearheading a proposed investment in another Singapore-listed company, Sino Grandness. See: SINO GRANDNESS: Attracts Two Quality Investors From Thailand

» The Mahagitisiri family has been ranked among the richest in Thailand in a Forbes article.

Recent story: MERMAID MARITIME: May gain market share if weaker players fail