Loquat juice sales help Garden Fresh achieve gross profit margins of around 40%. Photo: CompanyTHE REPORT by an anonymous person, 'Newman9', casting doubt on various aspects of Sino Grandness' business has led to a selloff of Sino Grandness shares recently.

Loquat juice sales help Garden Fresh achieve gross profit margins of around 40%. Photo: CompanyTHE REPORT by an anonymous person, 'Newman9', casting doubt on various aspects of Sino Grandness' business has led to a selloff of Sino Grandness shares recently.

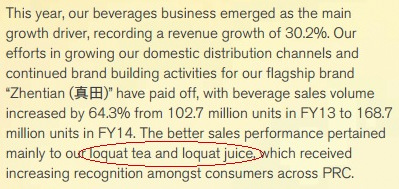

In particular, Newman9 alleged that Sino’s Garden Fresh beverage brand, whose key product is loquat juice, could not have achieved a high gross profit margin (GPM) of around 40%, when Huiyuan, an established beverage maker in China, recorded a lower GPM of 30%.

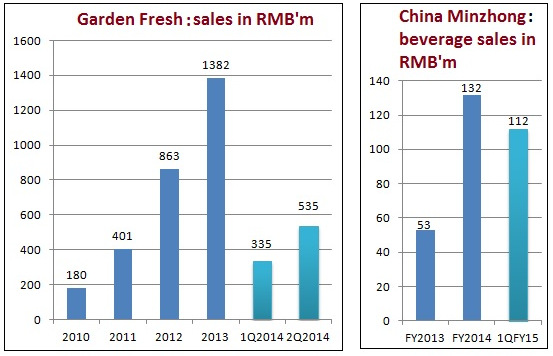

He also believed that Garden Fresh sales figures have been inflated many times.

It would be enlightening to look closely at China Minzhong, which cultivates, produces and sells processed and fresh vegetables. It has been quietly building up its beverage business with loquat juice and loquat tea as its mainstay.

Minzhong has recently announced its 1QFY15 performance and revealed the strong sales of its loquat beverages. Let's compare some historical data of Minzhong and Garden Fresh:

Though not a first mover, Minzhong has been able to replicate Garden Fresh's rapid sales growth of loquat beverages. (Note: Garden Fresh's financial year ends in December while China Minzhong's, June).

Though not a first mover, Minzhong has been able to replicate Garden Fresh's rapid sales growth of loquat beverages. (Note: Garden Fresh's financial year ends in December while China Minzhong's, June).Loquat juice was first introduced in 2010 by Garden Fresh. Despite being a new product, loquat juice was able to gain early entry into well-known international supermarket chains, instead of beig sold from mom & pop shops first to prove consumer acceptance.

After establishing a foothold in the supermarket segment, Garden Fresh managed to get into convenience store chains, such as 7-Eleven, which carry only popular items because of the stores' limited shelf space.

Minzhong’s high beverage revenue growth is not unlike the sales increase reported by Garden Fresh, which many investors have doubted.

Minzhong’s high beverage revenue growth is not unlike the sales increase reported by Garden Fresh, which many investors have doubted.Now compare GPM of the two (see table on the right):

Minzhong was able to achieve higher GPM on much lower sales.

For example, in FY 14 its GPM was 39.4% on RMB 132 m sales, which were only one-tenth of Garden Fresh RMB 1,382m sales in 2013. (Using the same 12-month period as Minzhong's FY14, sales of Garden Fresh were RMB 1,670m, or 12.7 times higher than Minzhong’s).

Interestingly, the beverage division was Minzhong’s only bright spot in recent times, as its core vegetable business has languished.

Minzhong's executive chairman and CEO, Lin Guo Rong, had this to say of the beverage business in the recently-published annual report of Minzhong (see quotation just below):

Screenshot: Minzhong's FY14 annual report.

Screenshot: Minzhong's FY14 annual report. Minzhong's loquat tea.

Minzhong's loquat tea.For some history of the development of Garden Fresh: It started off with OEMs and waited for sales to pick up before building its own beverage factory.

When its 70,00-tonne Sichuan started producing in 2013, heavy reliance was still placed on OEMs. The 100,000-tonne Hubei factory started production only last month.

In-house production should boost Garden Fresh‘ GPM. It is not known whether Minzhong has its own beverage factory.

Given Minzhong's rising sales of loquat drinks, it is clear that the beverage is fast gaining popularity in China, and the profit margin is good -- still good.

Minzhong was the target of short-sellers’ attack a couple of years ago. The Indonesian Salim Group, a substantial shareholder during the crisis, expressed confidence in Minzhong's management. Minzhong is now majority-owned by the Salim Group after a subsequent general offer. There is little reason to now doubt the integrity of Minzhong’s financial reporting.

The next question is whether Garden Fresh is very much larger than Minzhong’s beverage business. A recent survey by Frost & Sullivan shows the following market shares of the 3 top players:

| Garden Fresh | 78.2% |

| Furenyuan | 10.9% |

| Minzhong | 6.6% |

| Total | 95.7% |

Sino Grandness' Chairman Huang Yupeng has mentioned previously that Garden Fresh's successful beverage sales and good profit margin will attract more F&B players into this niche. But he is confident that Garden Fresh will stay well ahead of its peers.

Sino's upcoming 3Q (3 months ended Sep 14) results announcement, due not later than 14 Nov, will be closely watched by the investment community.

You can find your answers here..

http://www.valuebuddies.com/thread-3371-page-28.html