|

|

COE Quotas and Prices

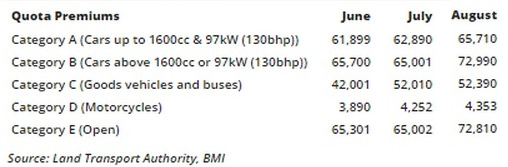

Certificate of Entitlement (COE) quotas are trending upwards in the second half of 2014 given the increasing number of vehicles de-registered in recent months.

Despite that, COE prices for all vehicle categories rise due to strong demand and this may bode well for Vicom.

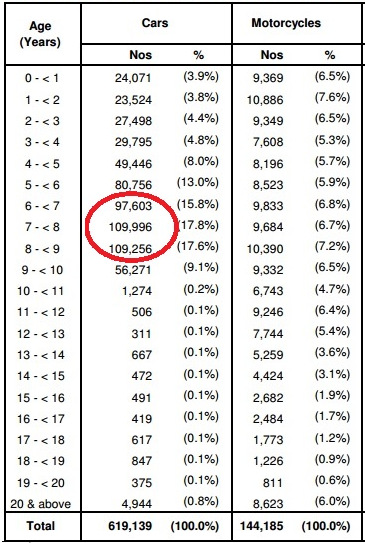

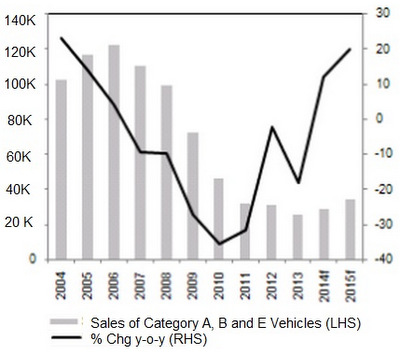

Although COE Quotas have risen and car buyers are looking to replace their old cars, the high COE prices mean that vehicle owners are holding off their deregistration due to the high cost of purchasing a new car, and opting instead to extend their COEs for a further 5 years.  Source: Business Monitor InternationalThis can also be seen from the contracting sales figure of new cars, indicating that car owners are likely to extend the life of their cars rather than buy.

Source: Business Monitor InternationalThis can also be seen from the contracting sales figure of new cars, indicating that car owners are likely to extend the life of their cars rather than buy.

This could very well be what Vicom needs.

Instead of having a huge number of vehicles getting deregistered at the same time like what happened back in 2004-2006, the number of vehicles deregistered could be spread over a couple of years, giving the company time to adjust.

The extension beyond 10 years would also mean that the testing and inspection for the vehicles need to be done annually (after 10 years) instead of biennially (3-10 years), which means that the frequency of vehicles sent to Vicom could increase.

Conclusion

There are certain worries that is evident in the public and private transport in the sense that the company is highly reliant on the policies of what the government and LTA decides. But a number of factors could play out in favor of Vicom at the end of the day depending on how the management works out the strategy. Remember that even during the Global Financial Crisis, the management handled the situation very well and provided good value for shareholders.

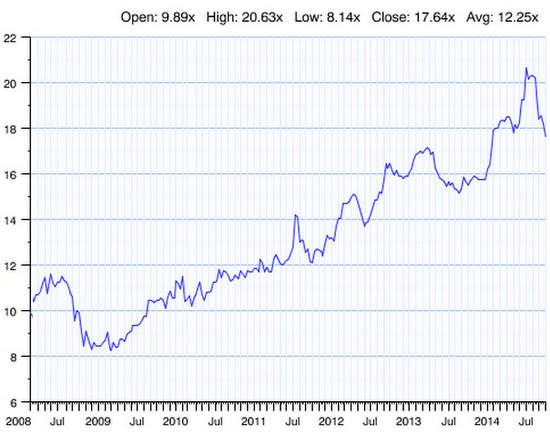

If you are an investor looking to buy the stock, get an idea of how the policies might play out in the next couple of years for Vicom. The share is currently trading at a multiple of 17.6x, which is higher than the historical 10 year average of 12.2x. The current price yields a dividend of 3.8%.

PE chart: Vicom's share is currently trading at a PE multiple of 17.6x, which is higher than the historical 10-year average of 12.2x.

PE chart: Vicom's share is currently trading at a PE multiple of 17.6x, which is higher than the historical 10-year average of 12.2x.

Vested.

What do you think of the company? Are they undervalued/overvalued at current price? Can the dividends be sustained?

In Part 2, the writer discusses the non-vehicle testing services of Vicom.

Recent stories: