Rex Virtual Drilling had a 85% success rate in predicting whether an oilwell would be dry or would be viable for commercial oil production. Its Rexonic ultrasound technology for oilwell stimulation is expected to enhance oilwell output by 30% to up to 380%. Company photo

Rex Virtual Drilling had a 85% success rate in predicting whether an oilwell would be dry or would be viable for commercial oil production. Its Rexonic ultrasound technology for oilwell stimulation is expected to enhance oilwell output by 30% to up to 380%. Company photo

|

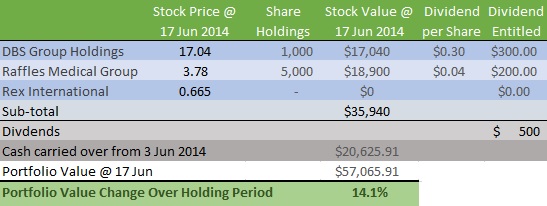

AT THE BEGINNING of this year, NextInsight reader Eagle invested S$50k equally between DBS Group Holdings at S$16.98, Raffles Medical at S$3.10 and Rex International at 58 cents. |

Total cash outflow for purchasing the 3 stocks in early January after offsetting online brokerage fees (at 0.275%) amounted to S$50,017.17.

Total cash outflow for purchasing the 3 stocks in early January after offsetting online brokerage fees (at 0.275%) amounted to S$50,017.17.

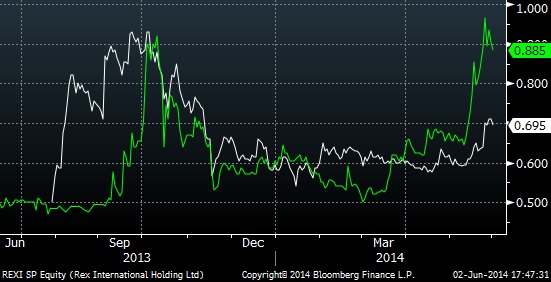

Recently, Rex International's stock price ran up by some 15% over 3 weeks to a high of 71 cents on 29 and 30 May, in tandem to RH Petrogas' price surge.

The market views Rex International and RH Petrogas as proxies to each other, and movements in the stock price of one has mirrored the other since last October.

On 20 May, about two weeks after prices of both stocks started rising, RH Petrogas said that its major shareholder had been approached by investors for a potential buyout.

Does a takeover bid on RH Petrogas imply Rex International will also be taken over?

My personal assessment is the Rex management has such great confidence and pride in their proprietary technology that they are highly unlikely to sell out.

So, I took profit on Rex International at 69 cents on 3 June as I did not consider the recent price surge to be reflective of a material change to its fundamental business in the past 6 months.

As at 29 May, Rex International had exposure to 24 oilfield concessions compared to the 10 it had during its IPO on 31 July last year.

On 4 June, its subsidiary, Lime Petroleum Norway, inked a deal to acquire 5% of another 2 oil exploration and production licenses in Norway (subject to regulatory approval).

Rex International announced in February that it had found oil in Oman, and is targeting to produce first oil by 1Q2015.

Until then, the company has yet to post revenue.

My broker helps me to track this stock, and will remind me to buy back when there is a meaningful price correction.

Stock price of Rex International (white line) and RH Petrogas (green line) track each other. Bloomberg data

Stock price of Rex International (white line) and RH Petrogas (green line) track each other. Bloomberg data

|

Raffles Medical Group up 22% |

DBS Group China growth

Analyst calls on DBS Group Holdings issued from 8 May to 17 June 2014 were positive across the board. Bloomberg data

DBS Group Holdings' presence in Greater China puts it in good stead to ride on a stronger economic wave in China and the internationalisation of the RMB.

Exposure to China and Hong Kong accounted for 36% of its loan book as at 31 March 2014.

On 16 June, the banking group said that it increased its shareholdings in its Hong Kong credit card subsidiary, Hutchison DBS Card Ltd, by another 50%, making its a wholly-owned subsidiary for S$88 million.

Its exposure to China's economy is a double-edged sword. During 1Q2014, the stock was under short-selling pressures due to concerns over non-performing loans in China, as well as depreciation of the RMB.

In March, its stock price fell to about S$16.

There was also concern over the impact of government curbs on property speculation in Singapore and the downward pressure in home prices.

The property curbs could affect mortgage credit quality in banks, as well as growth in home loans, which accounted for close to one third of Singapore banks loans in 1Q2014.

Its stock price has since recovered to about S$17, which is around my entry price, as its mid term investment theme remains intact.

DBS Group Holdings is a long term investment, with stock price gains expected when its revenues are boosted by a rise in interest rates in Singapore, which some analysts expect to happen in mid-2015.

Its 1Q2014 net profit was up 9% year-on-year at S$1.0 billion.

Related story: My Stock Picks: DBS Group, Raffles Medical, REX Int’l