Excerpts from analysts' reports

|

Analysts: Jessalynn Chen & Kenneth Ng, CFA  Above: Straco's Shanghai Ocean Aquarium. Photo: http://www.shanghai.gov.cn/ Above: Straco's Shanghai Ocean Aquarium. Photo: http://www.shanghai.gov.cn/Recent story: STRACO: Notional net profit rise was 42% for Q1 |

Analysts: Jessalynn Chen & Kenneth Ng, CFA (left)

Analysts: Jessalynn Chen & Kenneth Ng, CFA (left)1Q14 net profit of S$35.0m beat expectations, at 36% of our FY14 forecast and 31% of consensus.

The results were strong across the board, but the beat was mainly due to higher contributions from the commodity marketing segment.

We raise our FY14-16 EPS by 17-22% to reflect higher trading volumes, and our target price rises to S$1.92, still based on 9.1x CY15 P/E (its mean post-MRI acquisition).

Our Add rating is premised on the growth potential of the core logistics segment given the new warehouses coming on stream in FY14-15, as well as strong momentum in the commodity marketing segment.

NRA Capital maintains 100% upside potential for China Yuanbang Property

Analyst: Jacky Lee

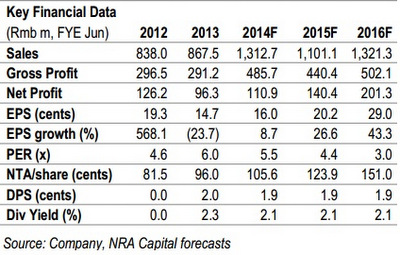

Earnings below expectations. China Yuanbang's 3Q14 net profit of Rmb9.1m (+441% yoy) came in 37% below our expectation due mainly to high-than-expected taxation, other variances included slightly lower-than-expected sales but offset by lower-than-expected operating expenses.

Earnings below expectations. China Yuanbang's 3Q14 net profit of Rmb9.1m (+441% yoy) came in 37% below our expectation due mainly to high-than-expected taxation, other variances included slightly lower-than-expected sales but offset by lower-than-expected operating expenses.

Cut earnings forecasts but maintain fair value. We have lowered our FY14 net profit forecasts by 9% to factor for higher taxation but kept FY15-16 numbers relatively unchanged.

Our fair value remains at S$0.36, still based on 30% discount to RNAV. Despite headwind ahead on China property sector. Maintain Overweight rating for deep discount to our fair value.

Recent story: SWISSCO's market cap to double? CHINA YUANBANG's revenue to hit a high?