Excerpts from latest analyst reports...

OCBC Securities initiates ‘Buy’ on CWT with S$2.08 target price

Analysts: Chia Jiunyang, CFA, and Low Pei Han, CFA CWT CEO Loi Pok Yen. NextInsight file photo.

CWT CEO Loi Pok Yen. NextInsight file photo.

Global logistics player

CWT is a leading provider of logistics solutions for worldwide customers in the commodities, chemical, petrochemical, marine, oil & gas, defense and industrial sectors. A competitive edge is its global logistics network, which connects customers to around 200 direct ports and 1,500 inland destinations. The group controls a number of warehouse facilities in strategic locations in Asia and Europe, serving as key regional distribution hubs and helping facilitate efficient storage, movement and distribution of goods.

Expanding portfolio of warehouse assets

The Group is currently developing two large warehouses in Singapore – the Cold Hub 2 (TOP: 1Q2014) and Toh Guan Road East (TOP: 4Q2013). Upon completion, its owned warehouse space in Singapore would increase by more than 50%, bringing about higher revenue from warehouse rentals and other logistics services. Including the two warehouses under construction, CWT owns more than 6 million square feet of warehouse space, estimated to be worth around S$800 million. Given its track record of monetizing its assets into REITs, future disposal gains cannot be ruled out. CWT Cold Hub offers freezer, chiller, air-conditioned and ambient storage, and is equipped with the best practice cool tunnel in its loading dock facility to ensure that 100% cold chain is maintained throughout loading and unloading operations. Company photo

CWT Cold Hub offers freezer, chiller, air-conditioned and ambient storage, and is equipped with the best practice cool tunnel in its loading dock facility to ensure that 100% cold chain is maintained throughout loading and unloading operations. Company photo

Commodity SCM to drive growth

We also expect the recently acquired Commodity SCM business to scale up quickly, taking advantage of the group’s strong global logistics network and reputation as an established commodity collateral manager. Besides purely arranging logistics services for other companies, it now aims to earn a spread by purchasing physical commodities (e.g. copper and zinc) from the producers (e.g. mines) before selling them to the consumers (e.g. smelters).

Initiate with BUY with S$2.08 fair value

We value CWT using sum-of-the-part methodology. For its logistics and Commodity SCM businesses, we assigned PER multiples of 17x and 12x, in-line with their respective peers. The warehouse portfolio is estimated to be about S$800m. Accordingly, our fair value estimate is S$2.08. Given the ample upside, we initiate coverage with BUY.

Related story: MIDAS, CWT: What Analysts Now Say....

CIMB raises target price for Wilmar to S$3.74

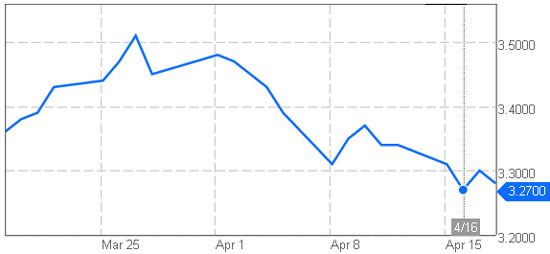

Wilmar's stock price recovered from its recent low of S$3.27 after its announcement of a Morrocan sugar supply deal. Bloomberg data

Analyst: Ivy Ng, CFA

What Happened

Wilmar has acquired a 27.5% stake in Cosumar SA for MAD2.3bn (US$263 million) cash from Societe Nationale d'Investissement (SNI), a large Moroccan holding company. Subsequent to this transaction, another block amounting to 26.5% will be sold by SNI to a consortium of Moroccan institutional investors, which together with Wilmar will own a strategic 54% controlling block in Cosumar. Cosumar is the sole sugar supplier in Morocco and the third largest sugar producer in Africa.

What We Think

We estimate that the acquisition values Cosumar at US$956 million, which represents a historical P/E of 11x (13.6x if we exclude non-operating income). We believe that this valuation is fair as it is below the historical P/E of 14-17x for MSM Malaysia (MSM MK, RM4.90), a leading sugar refiner in Malaysia that resembles Cosumar in some aspects.

This is not a material acquisition for Wilmar as the purchase consideration accounted for only 1.7% of the group's shareholder funds. The group can easily fund the acquisition, which will raise its adjusted net gearing by only 2 percentage points to 38%. We estimate that this acquisition will enhance Wilmar's future earnings by 1% in FY2014, assuming Cosumar can maintain its 2012 earnings performance.

We maintain Outperform with an unchanged SOP-based target price of S$3.74, with key re-rating catalysts coming from improving earnings from its oilseed crushing division in China and higher refining capacities in Indonesia.

Kim Eng maintains ‘Hold’ call on Lian Beng

Lian Beng executive chairman Ong Pang Aik.

Lian Beng executive chairman Ong Pang Aik.

NextInsight file photoAnalyst: Alison Fok

9MFYMay2013 revenue and net profit are up 5.1% and down 24.2% YoY to S$350.7 million and S$30.7 million respectively, due to a lack of property earnings recognition this year.

As we roll over our earnings forecast to FYMay14, we have changed our valuation matrix from P/E to sum-of-the-parts valuation to account for its diversified businesses. We maintain HOLD with a higher target price of S$0.49. We believe the market has already factored in earnings coming from its property development projects.

Four contracts secured year to date

Year to date, Lian Beng has secured a total of four contracts – two residential projects of Skies Miltonia and Bartley Ridge and two construction and engineering contracts for Oxley’s industrial project which add up to S$538 million of contract wins, exceeding our previous estimate of S$300 million for FYMay2013. This brings Lian Beng’s orderbook up to SGD986m. We are estimating S$400 million in contract wins in FYMay2014, sustaining its orderbook at current levels. M-Space @ MandaiMidtown @ Hougang to begin preview

M-Space @ MandaiMidtown @ Hougang to begin preview

We believe that Lian Beng will not be as affected by the recent cooling measures targeting individual retail units as they have submitted plans prior to the measures being announced. Midtown @ Hougang (ex Hougang Plaza) will begin preview this month. In addition, Lian Beng has joined with KSH and Kim Seng to purchase a commercial plot in 160 Changi Road, and intends to redevelop the site. Assuming a 60/40 split - we estimate the commercial and retail average selling price to be at SGD2,000 and SGD2,500psf respectively, and be accretive by 1.3cts to its value per share.

Look out for FYMay2014

Lian Beng will be completing its construction of M-Space @ Mandai in September 2013, while the 1st phase of its workers dormitory will be completed and launched in June 2013. So far, the workers dormitory has achieved a 50% commitment rate, and we expect this to ramp up to over 95% within 6 months of launch due to the overwhelming demand and lack of supply for workers dormitories.

Related story: TIONG SENG, LIAN BENG Clinch Big Property Contracts