Excerpts from CIMB report

Analysts: Kenneth Ng, CFA (left) & The Singapore Research Team

Analysts: Kenneth Ng, CFA (left) & The Singapore Research TeamFor privatisation candidates in Singapore, the areas to look for would be the downtrodden sectors of property, transport and commodities.

CWT has doubled its earnings in the past two years but because the earnings come from ‘difficult-to-predict’ commodities businesses, investors have not accorded the stock the same type of valuations for its old business.

CWT has gravitated to 1.2x P/BV. The Loi family owns 54% of the company and already has a vehicle in Cache Logisitics to recycle assets and recover capital if needed; there might not be a need to keep CWT listed if it falls below 1.0x P/BV.

We think that there may also be deals in the shipyards and transport infrastructure space. ASL Marine and CH Offshore trade at 1x P/BV or below and could go the way of Jaya.

Dyna-Mac is a main subcontractor for Keppel Corp and could be taken private by the latter since there is no clear successor.

Tiger Airways could be taken private by SIA and combined with Scoot to be a single budget brand for SIA.

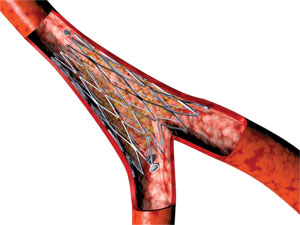

Outside these sectors, Biosensors has a big cash pool to attract PE funds to come for a break-up deal. Sunvic Chemicals trades at a deep discount to asset values.

M&A deals that can happen next:

|

Recent stories:

Credit Suisse says BIOSENSORS may be privatised and re-listed in HK

SUNVIC: "Am positive about its share buyback and factory deal but ...."