Excerpts from analysts' reports

CIMB raises rating and target price for Super Group

Analyst: Kenneth Ng, CFA

Super's share price peaked at $5.05 in Aug 2013, and now trades at about $3.53.

Super's share price peaked at $5.05 in Aug 2013, and now trades at about $3.53. Chart: BloombergRecent share price weakness has brought Super Group's valuations to more attractive levels.

We took the company on a roadshow, where it shared how it is coping in its core coffee and new markets, and of its move into the premium-end of the non-dairy creamer segment (NDC).

If 2013 was a year of rebranding (for coffee) and market diversification (for NDC), we see 2014 as a year for its new coffee markets to step up, its mainstay coffee markets to stabilise and its NDC to product differentiate – these are its potential price catalysts.

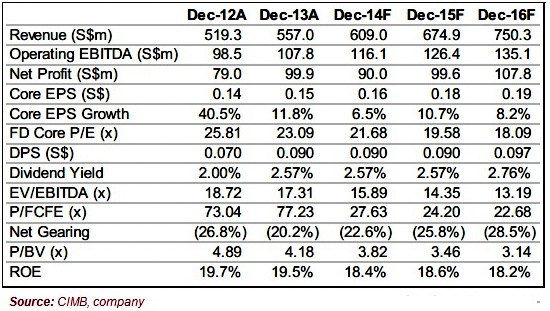

We keep our EPS forecasts and target price (still based on 23.5x CY15 P/E, in line with Nestle Malaysia).

As recent price weakness opens up room for a more positive view, we upgrade our rating from Hold to Add.

Dissecting coffee markets: Super has a mix of mature markets and new growth markets. The diversity helps to even out the impact of challenges in each market at any point in time.

In the consumer division, the Philippines (its 6th largest market) and Myanmar (2nd largest) are the relatively more challenging markets right now, while China (5th largest), Thailand (largest) and Malaysia (3rd largest) look more promising.

Each market requires a slightly different strategy to cater to the local tastes and competitive pressures. Market conditions will also vary but the group's brand legacy and distributor links will ensure that it will have a place among the leaders in 3-in-1 coffee. We explore the issues of each specific market.

Ingredients strategy: In its food ingredients business, competition from large Chinese players has pushed Super Group to adopt strategic initiatives such as increasing its cost efficiency, and product value-add and differentiation. Meanwhile, even as it steps up the execution of these strategies, the booming NDC sales in SE Asia help to offset this competitive concern.

Margin concerns: The main investor concern seems to be whether the rising raw material prices will impinge on margins. According to management, this is not a major worry for now as: 1) raw material prices are nowhere near their 2011 levels, 2) its average selling prices have been raised to compensate for the cost increase in the past and the price hikes remained, 3) it now has greater economies of scale, and 4) it has done some SKU rationalisation.

All in, management believes it can cope with the increased costs and maintain margins.

Previous story: SUPER's 4Q will be better; HALYCON AGRI to have bumper 2014

Maybank Kim Eng raises target price of BreadTalk to $1.54 Analysts: James Koh & Juliana Cai  George Quek, founder and executive chairman of BreadTalk. File photoBreadTalk to focus on China as it continues on its strong growth trajectory after ending FY13 with revenue/net profit (+20%/+13% YoY) at record highs. Reiterate BUY. George Quek, founder and executive chairman of BreadTalk. File photoBreadTalk to focus on China as it continues on its strong growth trajectory after ending FY13 with revenue/net profit (+20%/+13% YoY) at record highs. Reiterate BUY.Management targets to double revenue to SGD1b by FY16E (+23.1% CAGR). Increasing the margins is the priority. The stock remains undervalued. Our SOTP approach to cross-check the replacement value of the firm yields a conservative figure of SGD1.50 per share. What’s Our View: We expect BreadTalk to see EPS grow at a CAGR of 23% over FY14E-16E, driven by top-line growth (+18.1% CAGR) and EBIT margin improvement of 0.1-0.3ppt over FY14E-FY16E (2013: 4.3%). We therefore raise our FY14E-16E earnings by 1.6-4.7% and our TP increases from SGD1.40 to SGD1.54, still pegged to 7x FY14E EV/EBITDA. |