Excerpts from analysts' reports

Barclays views Yangzijiang Shipbuilding a likely long-term winner; target price $1.50

Analysts:

Jon Windham, CFA &

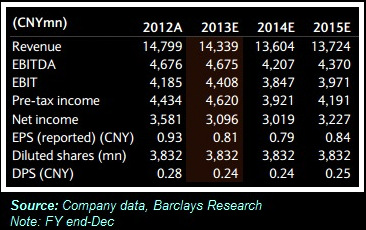

Esme Pau  WE view YZJ as one of the best quality yards in China and its leadership makes it an attractive option. WE view YZJ as one of the best quality yards in China and its leadership makes it an attractive option. Our S$1.50 PT is based on 1.0x current EV-to-orderbook and the assumption that the third-party loan will be “good”. Our PT implies 1.3x 2014E P/B, reasonable, in our view, given the 15-16% expected 2014-15E ROEs. YZJ currently trades at 7.0X 2014 P/E. The existence of the RMB14.1bn loan book makes investors wary of owning YZJ’s shares, in our view. The RMB$14.1bn (US$2.3bn) loans are equal to two-thirds of YZJ’s current market cap. The trust loans contribute RMB1.4bn of pre-tax profit, equal to 30% of YZJ’s FY2013 total pre-tax profit. To give a sense of the market scepticism about these loans, the value implied in the shipyard, after stripping out the loans, is just 2.6X 2013 P/E. We remain comfortable with management’s ability to manage the risk inherent with its individual loan-book in China. While we acknowledge there could be potential downside from systemic China credit risk, our view is that virtually all Chinese stocks have exposure to systemic risk linked to the informal and formal lending market in China. We continue to view YZJ as a core China stock holding, and consider the stock a likely long-term winner in the shipbuilding and off-shore rig market. It trades at a just 6.6X 2013E P/E with a net cash position and is poised to benefit from industry consolidation in China, in our view. |

Recent story: Analysts' Target Prices: STRACO -- 70 C, YANGZIJIANG -- $1.55

OSK-DMG highlights Mencast's strong growth outlook, TP at 76 cents

Analyst: Lee Yue Jer

Loading out of floating, production, storage and offloading (FPSO) mooring table. Photo: OSK-DMGVisiting Mencast’s facilities again for a post results briefing, we saw a number of new machines that are already operational.

Loading out of floating, production, storage and offloading (FPSO) mooring table. Photo: OSK-DMGVisiting Mencast’s facilities again for a post results briefing, we saw a number of new machines that are already operational. Productivity is set to increase with the introduction of robotic welding machines. Staff morale is high, a clear sign that workers are buying into management’s vision.

We see the offshore engineering segment as the largest growth driver for FY14. Maintain BUY with an adjusted SGD0.76 TP.

Temporary work slowdown for new customer audits. Mencast’s core FY13 earnings came in 10% below expectations, as work at its facilities were slowed to cater for qualification audits by new oil & gas (O&G) customers.

Brand-new precision engineering fabrication machine that produces metal parts automatically, with the command input at the visible terminal. Photo: OSK-DMG.Margin compression continued as the increased overheads from the new facilities outweighed the incremental revenues, although we do expect a rebound in FY14.

Brand-new precision engineering fabrication machine that produces metal parts automatically, with the command input at the visible terminal. Photo: OSK-DMG.Margin compression continued as the increased overheads from the new facilities outweighed the incremental revenues, although we do expect a rebound in FY14.

Brand-new precision engineering fabrication machine that produces metal parts automatically, with the command input at the visible terminal. Photo: OSK-DMG.Margin compression continued as the increased overheads from the new facilities outweighed the incremental revenues, although we do expect a rebound in FY14.

Brand-new precision engineering fabrication machine that produces metal parts automatically, with the command input at the visible terminal. Photo: OSK-DMG.Margin compression continued as the increased overheads from the new facilities outweighed the incremental revenues, although we do expect a rebound in FY14.Surprise special dividend. Mencast declared a 3 cent dividend (1 cent ordinary and 2 cents special) that raised yields to about 5%.

We see this as a sign of management’s confidence on the company’s prospects.

We see this as a sign of management’s confidence on the company’s prospects.

While we continue to forecast 1.2 cents of ordinary dividend for FY14-15, we do see potential for more future results-based special dividends.

Maintain BUY with TP adjusted to SGD0.76 (from SGD0.75). We continue to like Mencast for its strong growth outlook and strengthening presence in the O&G services industry in Singapore. Our TP is now based on 12x recurring FY14F P/E and is nudged to SGD0.76.

Recent story: MENCAST HOLDINGS: Our big hairy audacious goals

Recent story: MENCAST HOLDINGS: Our big hairy audacious goals