Marc Faber, a world-renowed investor. Screenshot from Youtube videoI CAN PUT together a portfolio of shares with dividend yields of 4% to 5% easily.

Marc Faber, a world-renowed investor. Screenshot from Youtube videoI CAN PUT together a portfolio of shares with dividend yields of 4% to 5% easily. Compared with bond yields and the close to 0% in bank (deposits), a 4% to 5% dividend looks quite ok. I still own Singapore REITS.

I think they are okay. I don't think you will make much money from them. I just buy them for the dividend yields.

I also think some plantation companies are reasonably interesting.

I think Wilmar is not a terribly expensive company at this point. It is not going to make you rich but at this level, it looks okay.

For investment themes in the region, I think Asian tourism is practically a no-brainer.

But how do you capitalise on this? Over the past two years, the way to do that was to own Macau casino stocks. Now they have gone up quite a lot, there is some risk there.

But you can participate in the airline industry, which I still think is a good play on tourism.

I don't like to own airlines but the airline servicing companies like the Singapore-listed SIA Engineering and ST Engineering are good plays on the tourism trade.

Asked "Tell us about your equity plays in China", Marc Faber gave this reply:

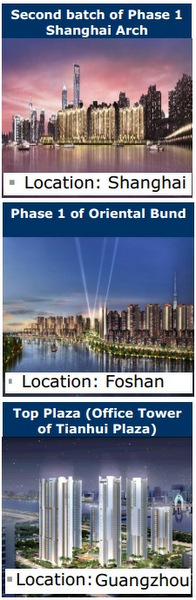

Sun Hung Kai's new projects in China. Images: CompanyThe good companies in China are not cheap.

Sun Hung Kai's new projects in China. Images: CompanyThe good companies in China are not cheap.The bad ones are cheap but you don't want to own them.

I prefer to play China through some Hong Kong companies.

Property companies in Hong Kong are selling at a deep discount to their net asset values.

You can buy Sun Hung Kai Properties, which is probably selling at a 40% discounts to its NAV.

I don't think this stock is terribly cheap but overall, the Hong Kong property developers such as Sinoland, Sun Hung Kai or Cheung Kong, are very well-managed companies.

As China plays, I quite like them

Mark Mobius (right) had this to say in the same article in The Edge Singapore:

We are positive on China. Now that the new administration, you are going to see things happening, with big policies coming into effect, and I think it will be quite exciting.

In China, we do not have much in the banks because we know that the non-performing loans are going to go up.

We are very cautious on the banks. The heyday of property speculation in China is also over. Property companies in China will probably still do well but they are not going to boom like before.

Going forward, areas in China that we are not exposed to yet but want to get more exposure in are healthcare companies.

Education is another area we are looking at. These are two service sectors where the government finds it very difficult to keep up with demand, which is tremendous.

Unfortunately, (many healthcare and education) listed companies are in the A-share market.

Another area in which the Chinese are fast catching up is technology. Companies like Lenovo are becoming more dominant in the area of computers. They are world-class now. Tencent is another one but it is somewhat expensive.

With the pending listing of Alibaba, all the Chinese tech stocks have been pushed up of late so you have to be careful because valuations may be expensive.

For consumer plays, we have been focusing on the ones that are going to win. For instance, the competitiveness of the sportswear companies in China has been tremendous but there are only a few that will survive, in our view.

We have to focus on the winners. It is the same with the jewellery companies. You have to focus on the winners with strong balance sheets and those that can survive.

We definitely want to be exposed to these companies, which are fast growing.